How Bitcoin miners’ woes might set stage for BTC price rebound

Bitcoin just got ~15% harder to mine as hashrate falls—pushing miner revenue back into the $30 stress zone

Bitcoin’s mining economy has tightened again, but its undertones could pave the way for a price recovery in the top crypto.

Over the past weeks, the network difficulty jumped, while the hashrate has shown signs of softening. At the same time, BTC miner margins have come under increased pressure as their revenue slipped back toward stress levels.

That combination has repeatedly materialized near major inflection points in previous market cycles.

While market analysts caution that this is not a magic buy signal for investors, the structural setup matters deeply because it has the potential to flip miner behavior from a desperate need to sell in order to survive into a scenario where they sell less of their accumulated holdings.

This subtle shift in behavior can effectively turn what is normally a steady, predictable source of incoming market supply into a significantly lighter headwind for Bitcoin’s price.

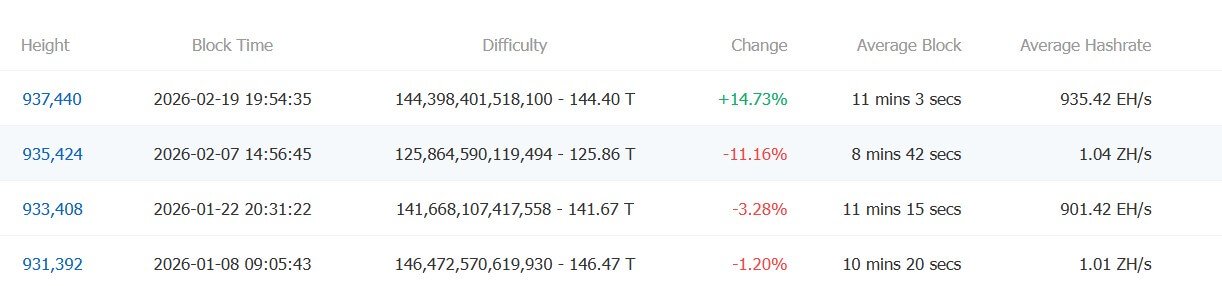

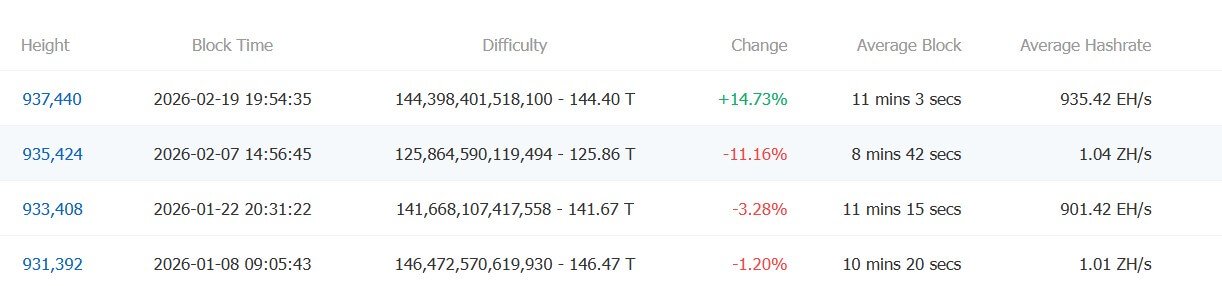

A lagged difficulty jump landed after the rebound

Bitcoin’s difficulty adjusts every 2,016 blocks, roughly every two weeks, meaning the metric is always reacting to events that have already occurred on the network.

That timing explains the apparent contradiction in the latest move.

After a storm and curtailment period knocked machines offline, the network saw a difficulty cut of about 11.16% to about 125.86T on Feb. 7.

As miners came back online and block production normalized, the next adjustment moved in the opposite direction. On Feb. 19, difficulty rose about 14.73% to about 144.40T.

The key point is simple. The network became harder to mine because earlier hashrate recovered, not because miner economics improved in real time.

That distinction is important for interpreting miner behavior. A rising difficulty print can look bullish on the surface because it signals network strength.

However, it can also be a margin squeeze if that increase arrives after a temporary recovery, when fees are weak, and BTC’s price is not doing enough to offset higher mining costs.

A short-term recovery in hashrate is masking a broader decline

Short-term measures of BTC network hashrate did indeed show notable improvement heading into the middle of February.

Data compiled from Luxor’s Hashrate Index demonstrated the 7-day SMA rising from ~1,003 EH/s to ~1,054 EH/s during the immediate storm recovery phase.

However, if one zooms out a bit to view the broader trend, the picture becomes noticeably less comfortable for the industry.

VanEck’s latest ChainCheck report describes a ~14% decline in hashrate over the past 90 days, a metric that is notable because sustained drawdowns of this magnitude are uncommon in the mature phases of the Bitcoin network.

Furthermore, day-to-day estimates consistently show meaningful volatility, a factor that complicates any single-point narrative pushed by market observers.

In light of this, the broader trend shows sustained pressure on hashrate over the last several months. A sharp increase in mining difficulty layered on top of that pressure can intensify margin stress at a particularly fragile point for the industry.

Hashprice is the real pressure point, and it has tightened again

Difficulty and hashrate describe the network. Hashprice describes the business.

Miners pay expenses in fiat and fund those costs through BTC production and, in some cases, sales of the flagship digital asset. That is why hash price, typically quoted in dollars per petahash per day, is a more practical measure of stress.

Following the Feb. 19 difficulty increase, BTC hashprice dropped back below about $30/PH/day. That level is widely viewed as a stress zone, depending on machine efficiency, debt obligations, and power costs.

This is because some operators can withstand it, while several marginal operators often cannot.

Fees are not offering much relief. Hashrate Index data for the same period showed that transaction fees accounted for only about 0.48% of block rewards, indicating miners rely almost entirely on the subsidy and Bitcoin’s spot price.

The result is a familiar compression. Difficulty moved higher, fee support remained thin, and hash price weakened.

That is the combination that tends to shut off older rigs first and push higher-cost miners closer to forced selling.

In practice, this is how a network that looks technically strong can produce economic stress in the mining sector. The protocol is doing what it is supposed to do. The problem is timing.

Why miner stress can become a bullish setup over 90 days

The bullish argument surrounding this phenomenon centers on structural shifts within the mining industry and their impact on supply dynamics.

The mechanism at play is structural, rooted in how sustained miner pressure reshapes issuance, balance sheets, and market liquidity.

Difficulty acts as a lagging squeeze on the market. When the network actively hikes difficulty after a brief operational rebound, it can easily overshoot what the miners can actually sustain at the current price and fee levels.

Hashrate then adjusts in real time as operators react to the new economic reality. Marginal rigs are forced to power down almost immediately when their daily profitability drops below the break-even point.

If that persistent weakness carries over into the next epoch, the protocol’s built-in relief valve kicks in, and the difficulty inherently falls.

A decline in difficulty mechanically improves the underlying economics for the surviving miners.

If the difficulty drops 10% to 12% and the price of Bitcoin remains entirely flat, the miner revenue per hash rises by a very similar mathematical magnitude.

While that adjustment does not guarantee a massive market rally, it can significantly reduce the overall probability of aggressive, forced selling from financially stressed miners.

That mechanism forms the absolute heart of the capitulation-then-recovery thesis popularized by various miner-cycle frameworks (such as traditional Hash Ribbons-style analysis).

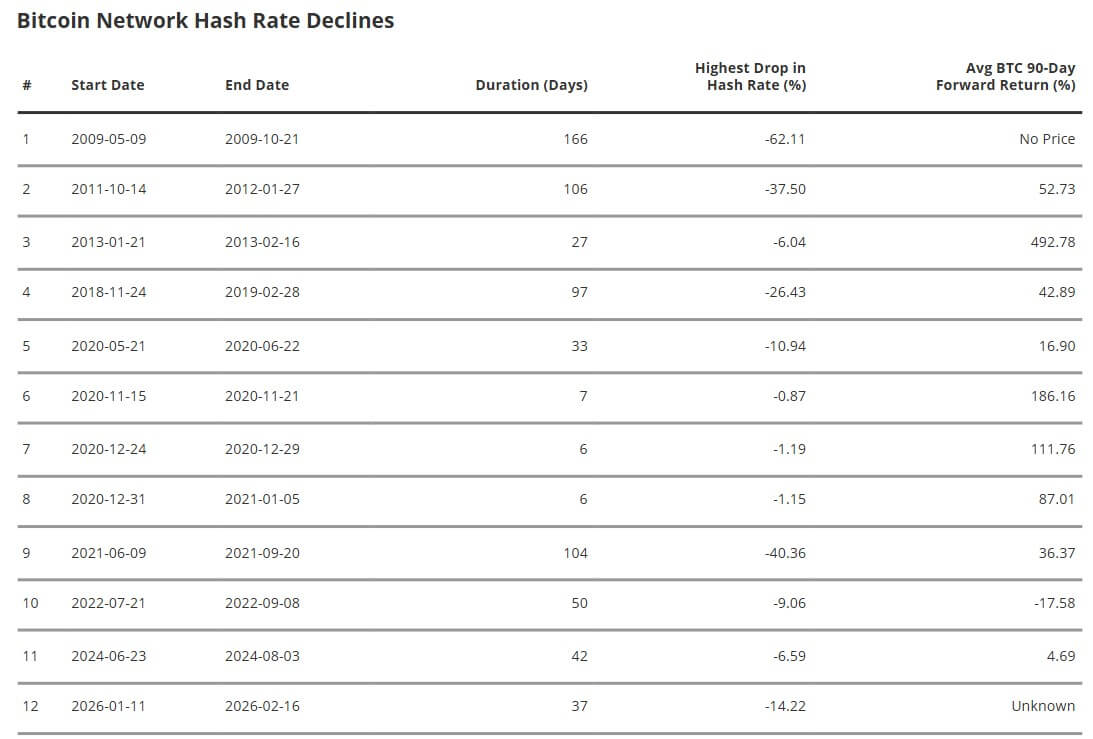

VanEck adds a compelling quantitative hook to this theory. In a published table tracking 12 notable hashrate contraction periods, the financial firm notes that extended hashrate declines have often been followed by remarkably strong 90-day forward returns for Bitcoin.

Excluding the very early history of the network, which lacked a defined price, and the current, still-unresolved episode, VanEck’s listed periods skewed highly positive, delivering a median forward return around the high-40% range and a heavily skewed mean.

The ultimate takeaway for traders centers on the broader signal rather than the specific percentage gain.

Peak miner stress often signals late-stage supply pressure, and once the underlying protocol resets the difficulty or the asset price stabilizes, that supply pressure can fade quickly.

The next catalyst is the next difficulty print, but ETFs and macro still set the tone

The most immediate variable is already on the calendar. Forecasting tools are pointing to another double-digit decrease in difficulty, around 11%, in early March if current block timing holds.

If that estimate is directionally right, the effect is straightforward. Hashprice would improve without requiring BTC to rally first, which could ease sell-to-fund operations pressure across weaker miners.

That is why the current snapshot, difficulty up and hashrate slipping, can sometimes be read as peak tightness rather than a fresh warning. In prior periods, that has been the point just before network conditions loosened.

Still, miner signals do not operate in a vacuum, and the post-ETF market has made that even more obvious.

In early February, US spot BTC ETFs posted wide swings in daily flows, including a net inflow of about $562 million on Feb. 3 and a net outflow of around $545 million on Feb. 5.

Later in the month, daily moves remained choppy, with one day at about $166 million in outflows and another $88 million in inflows.

When ETF buyers are active, miner sell pressure matters less. When ETF demand weakens or turns negative, miner stress can add to downside momentum.

Meanwhile, macro positioning also remains a major filter for the market.

Reuters reported heavy put interest around the $50,000 to $60,000 strike levels during the same period, a sign of hedging demand and caution toward risk assets.

If risk sentiment worsens or liquidity tightens, Bitcoin can still trade like a high-beta macro asset, even if mining conditions improve.

Three paths for Bitcoin over the next 90 days

The most constructive scenario is a mining reset with steadier demand. In that path, hashrate stays soft enough to support a meaningful difficulty cut, hashprice improves, and ETF flows stop swinging sharply negative.

Under those conditions, BTC has room for a 10% to 35% move higher over 90 days as miner-related supply pressure eases.

A middle path is what could be called a capitulation-lite outcome. Hashprice stays near breakeven, hashrate continues to bleed gradually, and difficulty adjusts lower in steps, but spot price remains choppy.

That kind of setup could leave BTC in a range of -5% to 20% over 90 days, with miner stress hurting near-term sentiment before the protocol reset starts to help.

The bearish path is a signal failure, where demand and macro dominate. In that case, ETF outflows persist, risk-off positioning deepens, and even a lower level of difficulty is not enough to offset weak demand.

Here, the digital asset could see returns of up to -30% over the next 90 days as BTC revisits major downside zones and miners are forced to sell into a falling market.