Bitcoin stalls amid $18.5B Fed repo and $4B ETF outflows

Bitcoin, the largest cryptocurrency by market capitalization, continued its price struggles as traders weighed two stress-tinged signals from the US financial ecosystem.

This week, there was a sudden $18.5 billion Federal Reserve overnight repo operation, and Blue Owl Capital has decided to permanently halt redemptions from a retail-focused private credit fund.

In another era, either headline might have been enough to spark a reflexive “money printer” narrative.

Taken together, they can read like an early warning that something is tightening in the plumbing of US markets.

Yet Bitcoin has stayed heavy, even as it remains marketed as a hedge against the traditional system.

The Fed’s $18.5 billion headline is narrower than it sounds

The $18.5 billion figure that grabbed attention came from the New York Fed’s overnight Treasury repurchase agreements on Feb. 17. Financial commentary platform Barchart said this is the fourth-largest liquidity injection since COVID and surpasses even the peak of the Dot Com Bubble.

However, data tracked on the St. Louis Fed’s FRED database show that the same series printed just $0.002 billion on Feb. 18 and $0.024 billion on Feb. 19.

That sequence matters. It characterizes the $18.5 billion as a one-day spike rather than a sustained weekly infusion.

The reverse repo side of the plumbing was also quiet. Usage of the Fed’s overnight reverse repo (ON RRP) facility remained small at $0.441 billion on Feb. 17 and $0.856 billion on Feb. 18.

If traders were looking for a sign of abundant cash sloshing around, the numbers did not deliver it.

Repo operations are designed to keep short-term rates behaving, not to deliver the kind of balance-sheet expansion that crypto markets often label as stimulus.

The New York Fed reports that it conducts repo and reverse repo operations daily to help keep the federal funds rate within the range set by the Federal Open Market Committee (FOMC).

The FOMC held the target range at 3.50% to 3.75% at its Jan. 27 to Jan. 28 meeting and instructed the Desk to conduct open market operations as needed to maintain that range.

The distinction is why a repo spike is not automatically bullish for Bitcoin.

A one-off operation can reflect technical frictions such as settlement timing, Treasury cash movements, or balance-sheet constraints at dealers. It can also reverse quickly, as the Feb. 18 and Feb. 19 prints suggest.

That is not the same thing as a durable change in the path of monetary policy.

At the same time, the macroeconomic backdrop has not become clearly supportive of speculative assets.

Minutes from the January meeting showed officials were divided on next steps, with some open to additional cuts if inflation cools and others willing to consider hikes if progress stalls, according to Reuters.

Even without an immediate change in rates, that mix can revive “higher for longer” anxiety, a tone that tends to tighten financial conditions for risk assets before the Fed moves a single lever.

Blue Owl’s gate is about liquidity terms, not an instant credit crash

Blue Owl’s decision to permanently stop redemptions at Blue Owl Capital Corp II (OBDC II) has a different message.

It is less about a sudden wave of losses and more about the product structure that promises periodic liquidity while holding assets that do not trade like stocks.

The Financial Times reported this week that Blue Owl will permanently cease redemptions at OBDC II and return capital on an episodic basis as assets are sold. Reuters reported that the firm is selling $1.4 billion of loans across three funds to pension and insurance investors at about 99.7% of par value.

The sales are designed to enable OBDC II to return approximately 30% of net asset value while also paying down debt.

Those details cut both ways for a “stress” narrative.

A fund halting redemptions is a headline that reads like a gate coming down. But the ability to sell loans near par reinforces the idea that credit markets are strained in places, not freezing across the board.

For Bitcoin, that nuance matters because the asset has behaved less like an insulated hedge and more like a component of a broader risk complex.

If the financial system were sliding toward a disorderly funding event, Bitcoin could still fall first, as investors hoard cash and reduce leverage.

So, a gate in private credit is not proof of a funding crisis. It is proof that liquidity premia have a price, and the price is rising for certain retail-facing vehicles.

Bitcoin is still trading on flows, and the flows remain a headwind

The clearest explanation for Bitcoin’s muted response is that a major channel of demand remains outward.

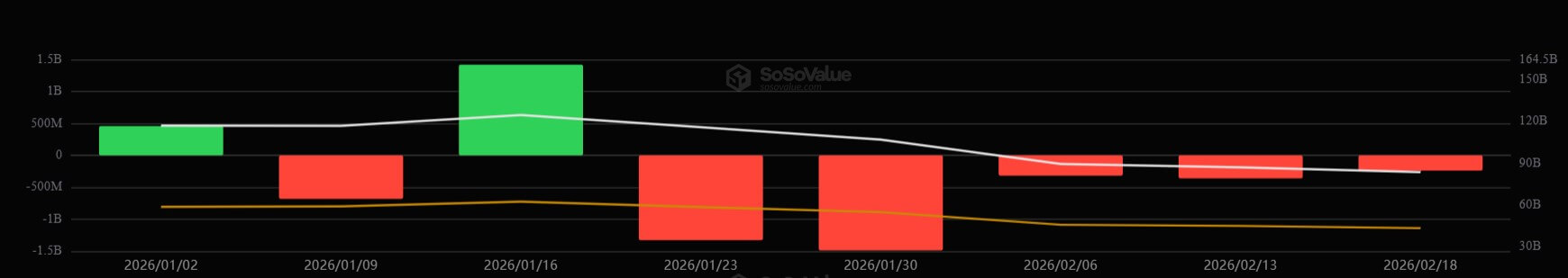

For context, US spot Bitcoin ETFs are experiencing significant drawdowns, with five consecutive weeks of outflows. During this period, the 12 funds have seen net outflows of nearly $4 billion, according to SoSo Value data.

That is a large reversal for a wrapper that was once treated as a one-way bridge for institutional inflows. It also reframes the “Wall Street adoption” story.

The same channel that can create persistent demand can also become a consistent source of supply when investors exit.

In that context, stress headlines do not automatically translate into a Bitcoin rally. If the marginal buyer is stepping back, the market needs something else to offset that vacuum.

So far, it has not gotten it.

This is also why the Fed repo print did not land as bullish. Even traders inclined to interpret liquidity through a crypto lens can see that the numbers describe a one-day operation, not a regime change.

At the same time, the ETF flow tape is a running tally of positioning, and it has been negative.

In the first phase of stress, Bitcoin often behaves like a high-beta stock

Another reason Bitcoin has remained heavy is behavioral, and it is evident in cross-asset correlations.

CME Group research published this month reported a persistently positive correlation between crypto assets and the Nasdaq 100 since 2020. In 2025 and early 2026, the correlation has sometimes been in the range of +0.35 to +0.6.

That relationship helps explain why Bitcoin may fail to rally in response to “stress” headlines. In the first phase of a risk-off move, investors tend to reduce exposure across volatile assets and allocate cash to the safest instruments.

In that phase, Bitcoin often trades as a levered proxy for risk sentiment.

Only later, if policy shifts and net liquidity improves, does the hedge narrative tend to reassert itself.

That is the second phase, when the market starts pricing easier money, a lower cost of capital, or a more durable backstop.

The credit market is not yet exhibiting the kind of extremes that typically trigger the second phase.

The ICE BofA U.S. High Yield Index option-adjusted spread stood at 2.94% on Feb. 17, according to FRED. That is not the sort of blowout usually associated with an imminent funding crisis.

Blue Owl’s loan sales are near 99.7% of par value, in the same direction, with stress and repricing in pockets, but not a wholesale liquidation.

What would make Bitcoin care about these headlines

The forward-looking risk is not that one private-credit fund changed its redemption terms or that the Federal Reserve conducted a single large overnight repo.

Private credit has grown into a roughly $3 trillion market and has attracted scrutiny over transparency, leverage, and valuation practices.

If more funds shift from scheduled redemptions to episodic returns, liquidity premia could rise, and credit availability could tighten for borrowers. That is a slow-burning drag, and it can pressure risk assets broadly.

Already, Arthur Hayes, BitMEX’s co-founder, said Blue Owl’s move to pause retail redemptions is a sign that liquidity stress is building across markets.

According to him, this could prompt the Federal Reserve to increase money creation sooner than expected.

On the money market side, the key indicator for crypto traders is whether this week’s repo spike becomes a pattern.

If repo operations remain sporadic and the Fed stays on hold, Bitcoin is likely to be driven by ETF flows and risk sentiment, and persistent outflows are a headwind.

However, if funding stress becomes persistent and necessitates a more durable policy response (rate cuts or balance-sheet support), Bitcoin’s historical playbook suggests it may dip first, followed by a rally as net liquidity improves.