XRP finds new life in lending and regulated markets amid BTC stall

XRP is attracting institutional money and a burst of bullish positioning, even as much of the crypto industry remains stuck in a risk-off tape.

According to a CoinShares report, XRP is the best-performing crypto token this year, attracting around $150 million in fresh capital, while Bitcoin and Ethereum have registered cumulative outflows of around $1.5 billion.

The simplest takeaway is not “XRP is bullish.” It is that investors are actively rotating into assets other than BTC and ETH at a time when the broader tape remains unstable.

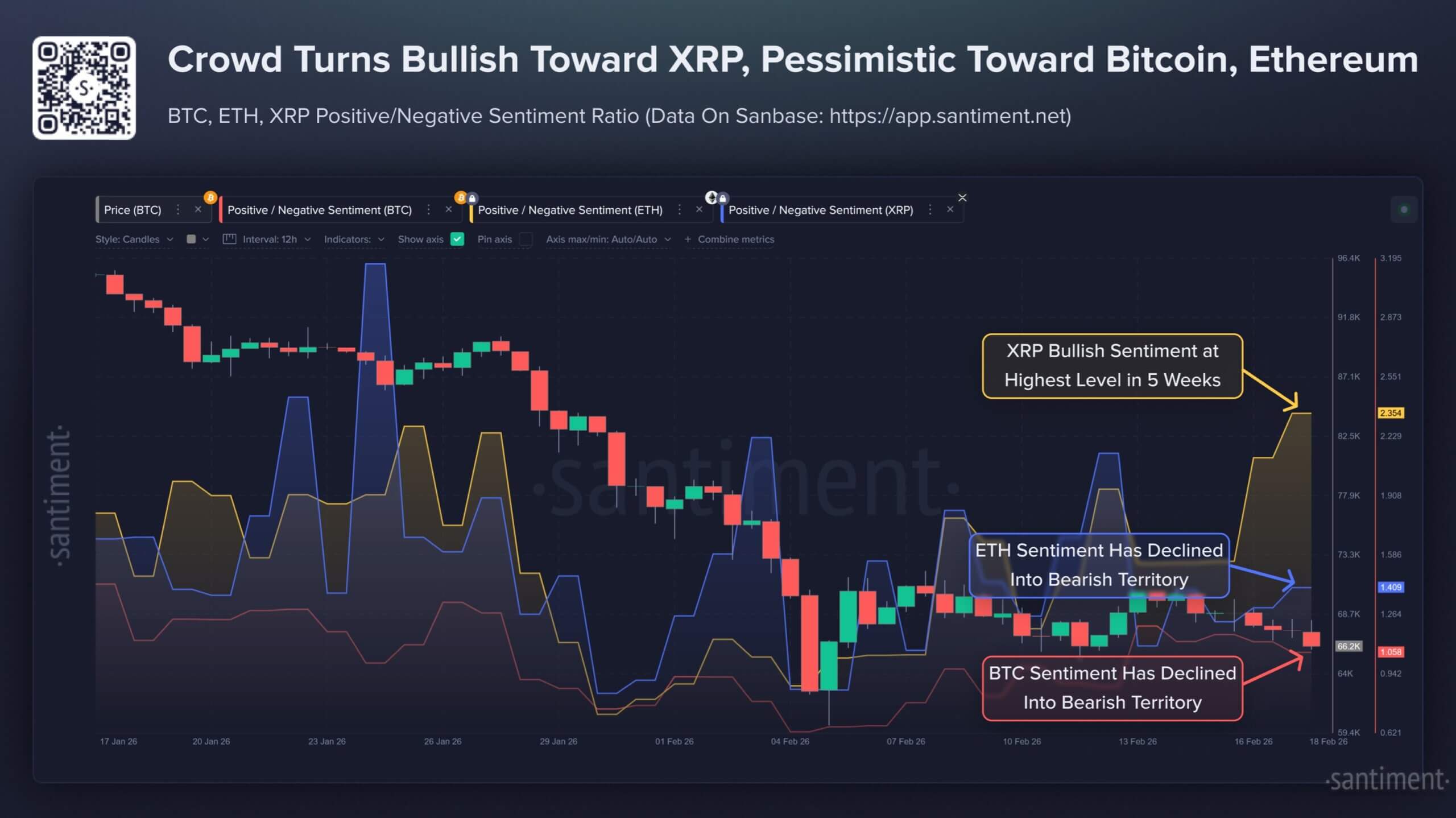

That divergence is showing up in market sentiment, too.

On Feb. 18, blockchain analytics platform Santiment said XRP sentiment hit a five-week high in bullish commentary, while chatter around Bitcoin and Ethereum cooled.

However, the broader crypto market backdrop is not doing XRP any favors, and not everyone is convinced the catalysts are large enough to matter in the near term.

For context, Standard Chartered recently cut its end-2026 XRP target to $2.80 from $8.00 in a note circulated after February’s selloff, with the bank’s digital-assets research team warning of “further declines” across the asset class.

Still, industry experts believe that the new catalysts for XRP usage, especially in collateral and regulated trading infrastructure, could become large enough to matter and help the token register a strong year.

Coinbase lending expands XRP’s role from trade to collateral

One of the clearest catalysts is tied to XRP’s use in the rapidly expanding crypto lending space.

On Feb. 18, Coinbase, the largest US-based crypto exchange, added support for XRP (alongside DOGE, ADA, and LTC) as eligible collateral for up to $100,000 USDC loans.

A Coinbase spokesperson told CryptoSlate that:

“These assets were chosen due to a number of factors, including our ability to bring these tokens onto Base and the Morpho protocol, as well as the amount of these tokens our customers hold on Coinbase.”

The detail matters because collateral eligibility changes the set of reasons to hold an asset.

Payment use can be high-volume and high-velocity. Tokens move quickly, balances do not necessarily sit in wallets for long, and the market does not always need to warehouse large inventories.

However, asset collateral behaves differently. When a token becomes borrowable collateral, some holders stop viewing it as something they must sell to access liquidity. They can post it, borrow against it, and maintain the position.

That can create stickier demand. Borrowers who want to keep loans open often need to maintain collateral, and during volatility, they may add more collateral to avoid liquidation.

Meanwhile, the same mechanism cuts both ways. If markets gap lower and collateral values fall quickly, forced liquidations can amplify downside.

Permissioned Domains and a gated DEX aim to bring regulated liquidity on-ledger

A second catalyst is showing up in XRPL’s infrastructure rather than in partnership headlines.

In recent weeks, the XRPL has been shipping features such as Permissioned Domains and a credential-gated DEX, alongside tools like token escrow, to make it easier for regulated firms to transact on-chain within defined access and compliance boundaries.

That is a different pitch from the open-access model associated with networks like Ethereum.

The premise is straightforward: institutions want blockchain settlement and tokenized rails, but they also need guardrails that map to real-world compliance, counterparty policies, and internal controls.

A permissioned trading environment, where participation is limited by credentials, resembles how traditional markets already segment access across venues, products, and participant types.

For institutions, that structure can make on-ledger trading feel less like a leap into public DeFi and more like an extension of familiar market plumbing.

The features themselves are not the endpoint. The real test is whether they get used.

If permissioned domains and the gated DEX become a venue layer institutions actually rely on, the evidence should appear in the mechanics: more permissioned domains launched, steady credential activity, and order-book liquidity that holds up beyond pilot phases.

If that adoption materializes, it can strengthen XRP’s longer-term case, less about “a new DEX” and more about market structure.

This is because these upgrades can attract market makers, keep inventory on the ledger, and sustain tradable depth, which is what matters when institutions decide whether a venue can handle size.

Ripple’s institutional buildout

Over the past year, Ripple has expanded beyond a single cross-border payments product into a broader institutional stack that looks closer to a full-service digital-asset platform than a pure crypto payments firm.

At the center is a lineup that now spans Ripple Payments for settlement, Ripple Custody for safeguarding assets, and Ripple Prime, its institutional brokerage offering.

Ripple is also pushing deeper into treasury operations through GTreasury, while positioning RLUSD, its dollar-backed stablecoin, as a settlement and collateral asset across that ecosystem.

The strategic logic is straightforward: if payments, custody, brokerage, and treasury tooling all sit inside one network, Ripple can keep more of the transaction lifecycle on its rails, with activity flowing through the XRPL and adjacent infrastructure.

In that model, XRP can benefit as liquidity moves across corridors and institutions look for efficient ways to source and rebalance value, while RLUSD can serve as the regulated, cash-like unit for settlement and collateral management.

Meanwhile, Ripple has also pursued a more “regulated perimeter” posture. The company has ended its long-running SEC dispute, while securing a national bank charter from the US Office of the Comptroller of the Currency (OCC).

These developments are happening alongside broader regulatory developments in the UK and the European Union.

In light of this, what matters for XRP is whether this institutional stack converts into sustained real-world volume.

Notably, early signals point to growing experimentation by large financial players, including Société Générale’s SG-FORGE, which has expanded its stablecoin efforts to the XRPL with EUR CoinVertible (EURCV).

This deployment is supported by Ripple Custody and is framed around broader use cases, including collateral and integration into institutional workflows.

If these integrations scale, they do more than validate Ripple’s product roadmap.

They increase the odds that XRP becomes part of the “plumbing” behind institutional crypto payments and treasury movements, where adoption is measured less by headlines and more by recurring settlement flow.

How XRP wins in 2026

XRP’s success this year is unlikely to hinge on a single headline. Instead, it will depend on usage that persists across major points.

Given this, three watchpoints stand out.

First, collateral share in mainstream lending. If Coinbase’s borrowing product shows sustained growth with XRP as a meaningful collateral asset, the case for productive demand strengthens. It does not need to become dominant overnight, but it needs to become repeat behavior.

Second, permissioned liquidity that persists. If permissioned DEX domains host durable liquidity, rather than launch-week noise, it supports the idea that regulated on-chain markets can develop on XRPL in a way institutions can actually use.

Third, relative flows. If flow data continues to show interest in XRP while majors struggle, it can keep a rotation tailwind, even in a choppy macro tape.

Those points translate into a scenario range that traders can pressure-test.

In a bull case, risk appetite improves, XRP becomes a commonly used collateral asset in US lending wrappers, and permissioned markets attract early institutional liquidity. Flows follow, and the narrative shift becomes self-reinforcing.

In a base case, XRP benefits from episodic catalysts, including lending additions and infrastructure milestones, but broader crypto liquidity stays uneven. XRP outperforms in bursts without a straight-line trend.

In a bear case, macro stays tight, leverage unwinds, and new rails do not translate into meaningful usage. XRP remains headline-driven and vulnerable to the same liquidity downdrafts that likely shaped Standard Chartered’s cut.