Financial & Forex Market Recap: Feb. 17, 2026

Wall Street whipsawed on Tuesday as lingering concerns about artificial intelligence disruption collided with a broadly risk-off tone across asset classes, sending gold and oil sharply lower while the S&P 500 briefly tested a key technical level before staging a late-session partial recovery. Multiple Federal Reserve officials weighed in on the policy outlook, delivering a split message that kept rate expectations in check and contributed to a mixed finish for the U.S. dollar. Meanwhile, weaker-than-expected U.K. labor market data and a softer-than-forecast Canadian CPI print rippled through currency markets, reinforcing the session’s theme of diverging central bank trajectories across major economies.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- New Zealand Food Price Index for January 2026: 4.6% y/y (4.2% y/y forecast; 4.0% y/y previous)

- Australia RBA Meeting Minutes: The RBA’s February minutes show a unanimous 25 bp hike as the Board judged that policy had become too loose, financial conditions had eased, and demand was outpacing supply, warranting tighter monetary policy to realign conditions with their objectives. Inflation risks were assessed as having “shifted materially” to the upside, with underlying inflation expected to stay above the 2–3% target band for an extended period, so future rate moves are left data‑dependent with no preset path but a clear hawkish tilt.

- Japan Tertiary Industry Activity Index for December 2025: -0.5% (-0.1% forecast; -0.2% previous)

- Germany CPI Growth Rate Final for January 2026: 0.1% m/m (0.1% m/m forecast; 0.0% m/m previous); 2.1% y/y (2.1% y/y forecast; 1.8% y/y previous)

- U.K. Employment Change for December 2025: 52.0k (-40.0k forecast; 82.0k previous)

- U.K. Unemployment Rate for December 2025: 5.2% (5.1% forecast; 5.1% previous)

- U.K. Claimant Count Change for January 2026: 28.6k (22.0k forecast; 17.9k previous)

- Germany ZEW Economic Sentiment Index for February 2026: 58.3 (61.0 forecast; 59.6 previous)

- U.S. ADP Employment Change Weekly for January 31, 2026: 10.25k (6.5k previous)

- Canada Wholesale Sales Final for December 2025: 2.0% m/m (2.1% m/m forecast; -1.8% m/m previous)

-

Canada CPI Growth Rate for January 2026: 0.0% m/m (0.2% m/m forecast; -0.2% m/m previous); 2.3% y/y (2.5% y/y forecast; 2.4% y/y previous)

- Canada Core CPI Growth Rate for January 2026: 0.2% m/m (0.4% m/m forecast; -0.4% m/m previous); 2.6% y/y (2.8% y/y forecast; 2.8% y/y previous)

- NY Empire State Manufacturing Index for February 2026: 7.1 (3.0 forecast; 7.7 previous)

- NAHB Housing Market Index for February 2026: 36.0 (41.0 forecast; 37.0 previous)

- New Zealand Global Dairy Trade Price Index for February 17, 2026: 3.6% (6.7% previous)

- Fed member Michael Barr noted on Tuesday that it will “likely be appropriate to hold rates steady for some time” while the Fed evaluates incoming data, the evolving outlook, and the balance of risks.

- Fed member Goolsbee said on Tuesday that “several more” interest rate cuts in 2026 are possible if the Fed can show inflation is on a clear path back to the 2% target.

Promotion: Use TradeZella’s AI Powered trade journal to deep-dive into your execution and see exactly how you performed during today’s trading session. Click here to get the TradeZella Edge and use code PIPS20 to save 20% on your subscription!

Disclosure: We may earn a commission from our partners if you sign up through our links, at no extra cost to you.

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay – Chart Faster With TradingView

Tuesday’s session delivered an unusual correlation picture, with gold and oil absorbing the session’s steepest losses, but equities managed to claw back from intraday lows. AI disruption anxiety dominated the narrative, pulling capital away from precious metals and speculative assets while leaving equities in a volatile, whipsaw state.

The S&P 500 traded in a wide intraday range, briefly breaking below its 100-day moving average before recovering to close near 6,843, up approximately 0.11% on the day. The index opened sharply lower in the early U.S. session, plunging close to 1% and tagging the 6,775 area before buyers stepped in. A strong recovery through the midday session pushed the index toward 6,867, but sellers returned into the afternoon and the index faded into the close. Over 250 S&P 500 constituents declined on the day, with software-related names among the harder hit areas.

Gold was the session’s worst performer on a percentage basis among the tracked assets, declining approximately 2.31% to close near $4,878 per ounce. The precious metal opened near $4,990 before selling pressure accelerated sharply, dropping to a low around $4,860 before stabilizing and partially recovering through the early London session. Then came the US selloff, which likely reflected a combination of thin Asian liquidity due to Lunar New Year holidays across much of the region — which typically reduces physical demand support — and US dollar strength.

Bitcoin (BTC/USD) declined approximately 1.21% to trade near $67,660, in line with the broader risk-off tone. Bitcoin had opened the Asian session near $68,850 and drifted lower through the overnight hours, eventually breaking below the $67,625 support area during the early U.S. session before finding buyers and stabilizing in a choppy range between roughly $67,600 and $68,200 through the afternoon. The move appeared to correlate with the broader risk sentiment rather than any crypto-specific catalyst.

WTI crude oil fell approximately 2.17% to settle near $62.20 per barrel, giving back a notable intraday gain. Oil had actually rallied sharply during the London session, climbing from around $62.80 to a high near $63.95 in early European hours, possibly reflecting initial optimism around U.S.-Iran nuclear talks. However, the gains reversed sharply at the U.S. session open, with oil selling off aggressively through mid-morning to a low near $61.75 before consolidating around $62.00 to $62.50 for the remainder of the day. Reports that the U.S. and Iran had made progress in nuclear talks were cited as a headwind for crude, as a potential deal could bring additional Iranian supply back to global markets.

U.S. 10-year Treasury yields edged higher by approximately 0.35%, settling near 4.055%. Yields had trended lower during the late Monday session through the early hours of Tuesday, dipping to a low near 4.020% around the London open before reversing higher. Yields climbed steadily through the U.S. session, briefly touching 4.060% near midday before stabilizing. The modest uptick appeared inconsistent with the risk-off tone in equities and likely reflected the Fed speakers reinforcing the “hold for longer” message rather than any meaningful shift in rate expectations.

Promoted: Protecting your trading capital starts with securing your access. Don’t let a weak password be the single point of failure for your brokerage or exchange accounts. LastPass simplifies your digital life by generating and storing complex, encrypted passwords for every site you use. Secure Your Accounts with LastPass Today!

Disclosure: We may earn a commission from our partners if you sign up through our links, at no extra cost to you.

FX Market Behavior: U.S. Dollar vs. Majors

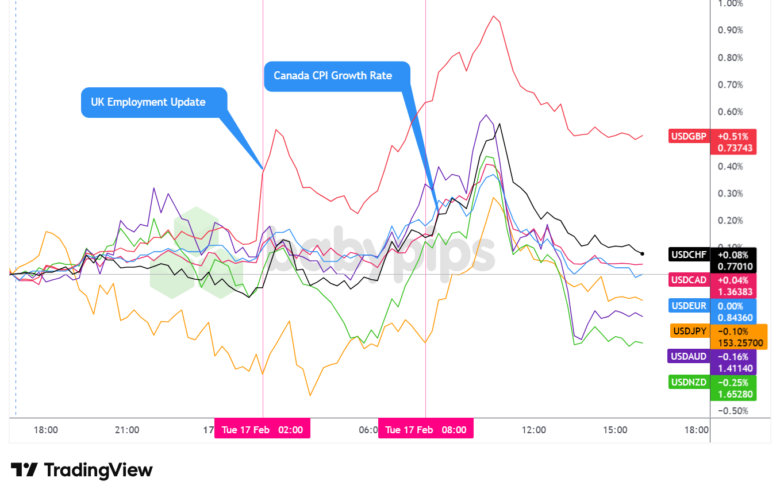

Overlay of USD vs. Majors – Chart Faster With TradingView

The U.S. dollar traded in an intraday range on Tuesday, ultimately closing mixed against major currencies with an arguably net bearish lean overall. The session featured two distinct macro catalysts — the U.K. labor market report in the London session and the Canada CPI in the U.S. session — each of which drove notable but ultimately transient moves for the dollar’s key counterparts.

During the Asian session, the U.S. dollar saw relatively low volatility and traded mostly sideways with an arguably net bullish lean against the majors. Liquidity was thinned by Lunar New Year holidays across mainland China, Hong Kong, Singapore, South Korea, and Taiwan, which limited directional follow-through. The session’s notable development was a sharp drop in USD/JPY, which correlated with report cited former Bank of Japan board member Seiji Adachi, flagging April as the most likely timing for the next BOJ rate hike. The move reinforced expectations that Japan’s policy normalization cycle remains ongoing, with further tightening toward 1.25% considered possible over the medium term. Elsewhere, RBA minutes confirmed a unanimous decision to hike 25 basis points in February, with the board acknowledging that inflation risks had “shifted materially” to the upside — a hawkish tone that provided relatively little support to the Australian dollar.

The London session brought the day’s first major FX catalyst. At the open, the USD briefly bounced then pulled back, eventually finding support mid-morning London before rallying into the U.S. session open. The dominant driver was likely the U.K. labor market report, which came in softer than expected across the board. The unemployment rate rose to 5.2%, its highest level since February 2021, exceeding the 5.1% forecast. The Claimant Count Change also surprised to the upside at 28.6k versus the 22.0k expected. The softer data firmed up market pricing for a 25 basis point Bank of England rate cut at the next meeting, with implied probability rising to around 75%. Sterling came under notable selling pressure following the release, with USD/GBP posting the session’s largest gain among dollar pairs. Separately, Germany’s ZEW Economic Sentiment Index for February printed at 58.3, missing the 61.0 forecast slightly, generating only a muted market reaction.

After the U.S. session open, the USD continued to move higher before finding a top around the London close, then fell back lower through the remainder of the session. The day’s second major FX catalyst came with the Canada CPI release for January, which printed meaningfully below expectations across the board. Headline CPI came in flat on a monthly basis (0.0% m/m versus +0.2% forecast) and slowed to 2.3% year-over-year, undershooting the 2.5% consensus. Core CPI also disappointed at 0.2% m/m versus 0.4% expected. The data sparked a broad-based CAD softening.

Multiple Fed speakers crossed the wires during the U.S. afternoon, arguably delivering a directional influence on the dollar. Chicago Fed President Goolsbee maintained that several more rate cuts in 2026 remain possible if inflation continues its descent toward 2%, while Governor Barr struck a more cautious tone, calling for steady rates while the Fed assesses incoming data. The mixed Fed messaging likely contributed to the dollar’s drift lower into the close.

Promotion: Tired of “demo-only” prop firms? Lux Trading Firm funds with real capital (up to $10M in buying power) and refunds evaluation fee 100% after Stage 1. Get a certified track record, no time limits and a focus on institutional-grade execution. It’s designed for those looking for a career, not a contest.

Learn More at Lux Trading Firm

Disclosure: To help support our free daily content, we may earn a commission from our partners if you sign up through our links, at no extra cost to you.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand PPI for December 31, 2025 at 9:45 pm GMT

- Japan Balance of Trade for January 2026 at 11:50 pm GMT

- Australia Wage Price Index for December 31, 2025 at 12:30 am GMT

- RBNZ Interest Rate Decision for February 18, 2026 at 1:00 am GMT

- RBNZ Press Conference at 2:00 am GMT

- U.K. Inflation Updates for January 2026 at 7:00 am GMT

- Euro area ECB Cipollone Speech at 9:00 am GMT

- U.S. MBA Mortgage Applications for February 13, 2026 at 12:00 pm GMT

- U.S. MBA 30-Year Mortgage Rate for February 13, 2026 at 12:00 pm GMT

- U.S. Housing Starts for December 2025 at 1:30 pm GMT

- U.S. Building Permits Prel for December 2025 at 1:30 pm GMT

- U.S. Durable Goods Orders for December 2025 at 1:30 pm GMT

- U.S. NY Fed Services Activity Index for February 2026 at 1:30 pm GMT

- U.S. Manufacturing & Industrial Production for January 2026 at 2:15 pm GMT

- Euro area ECB Schnabel Speech at 5:00 pm GMT

- U.S. Fed Bowman Speech at 6:00 pm GMT

- U.S. FOMC Minutes at 7:00 pm GMT

Wednesday’s action likely starts with the Reserve Bank of New Zealand policy decision (Check out our Event Guide here), where the RBNZ is widely expected to hold rates steady. Markets will be closely watching the policy statement and forward guidance for any signals about the potential for renewed tightening later in 2026, particularly given Tuesday’s higher-than-expected New Zealand food price inflation reading for January and broader global inflation concerns.

Due in the morning London session, the U.K. CPI report for January will attract elevated attention following Tuesday’s deteriorating labor market data, which pushed Bank of England rate cut expectations to around 75% for the next meeting. A softer-than-expected inflation print could reinforce the case for near-term BoE easing and extend sterling’s weakness, while a surprise to the upside would likely prompt traders to reassess the aggressive rate cut pricing that sent the pound sliding on Tuesday.

Wednesday’s U.S. calendar is headlined by three potential U.S. updates. January Housing Starts and Building Permits, which will be watched for any signs of improvement following Tuesday’s weak NAHB Housing Market Index print of 36 — well below the 41 forecast and pointing to continued pessimism among homebuilders. The December Durable Goods Orders advance report rounds out the U.S. data slate. Markets will focus particularly on the core reading — non-defense capital goods orders excluding aircraft — as a gauge of business investment appetite heading into 2026.

The FOMC meeting minutes from the January 27-28 policy decision are due Wednesday afternoon and represents the most significant potential USD catalysts. Markets will be parsing the minutes for the depth of internal debate around the decision to hold rates steady, including the dissent from Governors Waller and Miran who argued for an immediate cut. Any language around the threshold for resuming easing, or the committee’s interpretation of tariff-driven price pressures as transitory versus persistent, could generate notable moves in Treasuries and the dollar.

Stay frosty out there, forex friends!

The Daily Recap is Only Half the Story!

Understanding market moves are essential, but having a strategy to capitalize on it is what builds an edge. BabyPips Premium bridges the gap between market awareness and high quality analysis! Our Premium toolkit includes: tactical Event Guides, Watchlists, Weekly Prep & Recaps, & partner perks!

[Learn more & Get the Premium Edge!]