Standard Chartered slashes XRP price target by 65% as whales send millions of tokens to Binance

XRP is sliding even as the XRP Ledger (XRPL) rolls out features that supporters have long framed as a bridge to institutional adoption.

According to CryptoSlate’s data, the token has been trading around $1.47, while a mix of fresh supply signals, cooling marginal demand, and broader risk-off behavior continues to pressure the price.

At the same time, banking giant Standard Chartered reportedly cut its end-2026 XRP target by 65% to $2.80 from $8.00 as part of broader reductions to major crypto forecasts.

The disconnect is familiar in crypto, as blockchain networks can deliver meaningful upgrades, activity can rise, and prices can still fall if the market is focused on near-term liquidity.

That is what XRP holders are confronting now. On one side are infrastructure changes such as Permissioned Domains and Token Escrow, tools designed to make a public ledger more usable for regulated participants.

On the other hand, there are indicators that often matter more in the short run, including large holders moving coins to exchanges, exchange-traded fund flows becoming uneven, and derivatives positioning suggesting that traders are leaning defensive.

The result is a market that treats XRP less as a single-asset technology story and more as a high-beta trade that responds quickly to shifts in supply and demand.

Whales are back on Binance, and the market reads it as supply

One of the clearest near-term signals is coming from on-chain flows into Binance.

CryptoQuant’s Whale Transfer Flow to Binance, tracked as a 30-day moving average, has risen to approximately 82.1 million XRP. This is the highest reading since last December and shows a re-acceleration after a quieter stretch.

Notably, that metric is not a verdict that whales are selling.

However, it is a reminder that coins entering an exchange are ones that can be sold quickly, and the market tends to treat this as a supply overhang until proven otherwise.

The numbers make the intuition concrete. At approximately $1.47, 82.1 million XRP represents roughly $120.7 million of notional supply appearing on a major venue over a 30-day window.

When demand is strong, such availability can be absorbed without significant damage, and prices can even rise as buyers compete for liquidity.

However, when demand is weak or inconsistent, it often requires lower prices to identify the next segment of buyers.

This is why exchange inflow signals matter most when they coincide with a wobble in marginal demand.

If the market believes there is a steady bid that reliably steps in, supply transfers become background noise. If that belief breaks, the same transfers become price-moving.

The ETF bid turned choppy, and that changed the absorption test

This increased supply comes as the demand side has been less consistent in the ETF wrapper. XRP spot ETF flow data indicate notable outflows following an initial period of uninterrupted inflows.

Data from SoSo Value indicate that the four XRP ETF products have experienced net outflows totaling more than $46 million over the past four weeks.

This contrasts significantly with the fund’s early performance, which drew in fresh capital of over $1 billion during a 35-day inflow streak.

Those numbers matter because ETF flows can act like a steady bid, until they do not. Even if outflows later stabilize, the message traders take from a streak ending is immediate.

The market becomes less willing to assume that a structural buyer is showing up every day. That shift makes XRP more sensitive to supply signals, including the whale-to-exchange transfers now showing up on Binance.

In practice, traders begin conducting an absorption test. When ETF flows are consistently positive, large deposits to exchanges can be soaked up and price can hold.

However, when the ETF tape turns uncertain, the same deposits become harder to digest, and the market tends to reprice lower until it finds buyers willing to step in without the comfort of a steady ETF bid.

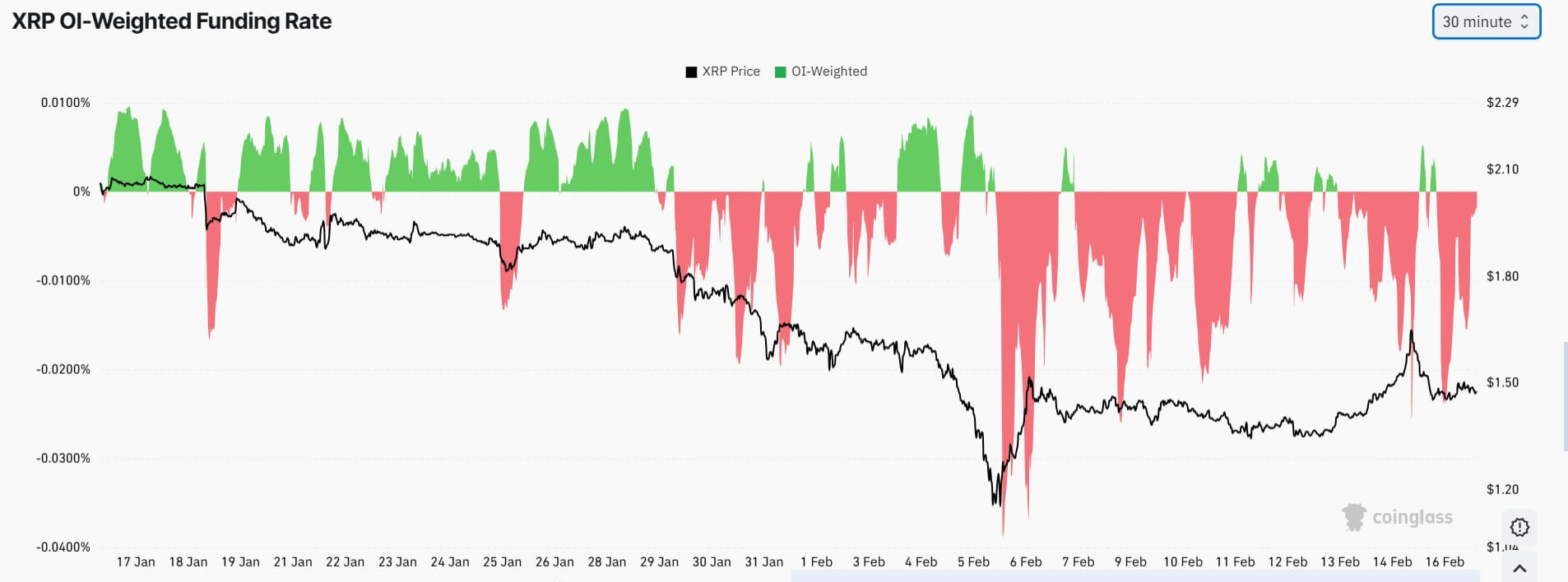

Derivatives are crowded bearish, which increases downside risk and upside sensitivity

Meanwhile, derivatives are adding another layer to the setup.

Data from CoinGlass indicate that XRP funding rates have turned negative over the past few weeks, with repeated spikes above -0.02%.

Negative funding typically means shorts are paying to hold positions, a sign that bearish positioning is crowded.

Crowded bearish positioning is a double-edged signal. If spot demand stays soft and supply continues to hit exchanges, the market can grind lower because shorts feel comfortable pressing, and longs are reluctant to step in.

In this case, token liquidity thins out, upward bounces are sold, and the price can continue to decline even without a fresh catalyst.

At the same time, heavy short positioning makes the market more sensitive to upside surprises. If any demand catalyst shows up, a renewed ETF inflow streak, a macro relief rally, or a clear rollover in exchange inflows, the move can accelerate quickly as shorts cover.

That is why a weak tape can coexist with sudden, sharp rebounds in crypto.

For now, the derivatives signal is aligned with the other near-term indicators. The market is positioned defensively, which makes it harder for positive news on the protocol side to translate into immediate price strength.

The upgrades are real, but they are not instant XRP-buy mechanisms

The contrast with XRP Ledger development makes this moment frustrating for long-term holders. The chain has shipped upgrades that speak directly to the institutional narrative.

Permissioned Domains (XLS-80) went live on Feb. 4 with 91% validator approval. The feature is designed to create credential-gated zones on a public ledger, a framework that can support regulated participation without turning the network into a private chain.

Token Escrow (XLS-85) activated on Feb. 12, extending XRPL’s native escrow functionality beyond XRP to Trustline-based tokens and multi-purpose token structures.

At the same time, Permissioned DEX would launch on Feb. 17. This builds on other features and allows institutions to participate in compliant on-chain activity while keeping sensitive user data off the ledger.

These additions strengthen the pitch that XRPL wants to be an institutional settlement layer, with tools that make compliance and conditional settlement more practical.

However, upgrades such as these are not immediate demand drivers for XRP itself, as their adoption takes time, and integrations have to be built.

For context, Token Escrow may increase the amount of XRP locked up as reserves, but the effect is likely to be modest at this stage.

XRPL ties certain on-ledger objects to owner reserves held in XRP. Even so, the incremental demand generated by Token Escrow may be small relative to the supply forces currently driving price movements.

Using the reserve math of assuming 0.2 XRP per object, 100,000 new escrow objects would require approximately 20,000 XRP in additional reserves. Even at 1 million escrow objects, the reserve requirement rises to roughly 200,000 XRP.

In other words, Token Escrow strengthens the network’s settlement plumbing, but the near-term XRP reserve demand it creates remains minor relative to the volumes implied by the large exchange inflows of over $120 million.

That does not mean the network is stagnant. XRPL usage indicators have been improving.

XRPL DEX activity has surged, with a 14-day moving average of DEX transaction counts reaching about 1.014 million, a 13-month high, based on CryptoQuant data.

At the same time, Ripple’s stablecoin footprint is expanding, with RLUSD’s market capitalization estimated at approximately $1.52 billion.

This is the paradox of the moment. Usage indicators can improve while price falls if the new activity does not translate into incremental XRP demand at the same pace as the supply and risk dynamics driving the market.

What investors are watching next, and the scenarios being traded

Over the next 4 to 12 weeks, XRP’s path is likely to hinge on whether supply signals cool faster than demand returns. The market is already pricing a set of scenarios, even if traders describe them differently.

One scenario is bear continuation, which would result in the token trading at approximately $1.10 to $1.35. In that path, whale-to-exchange flows stay elevated, and ETF flows remain inconsistent, keeping spot demand too soft to absorb supply.

Another is base-building, and XRP would oscillate between $1.35 to $1.80. In that version, exchange inflows plateau, and ETF flows stabilize into small net-positive weeks, allowing the price to form a floor even without a macroeconomic tailwind.

The third is a reflexive rebound, $1.80 to $2.40. This outcome would likely require a short streak of stronger ETF inflows or macro relief that collides with crowded bearish derivatives positioning, forcing cover and accelerating upside.

The core point is not the exact range. It is the mechanism. XRPL’s roadmap may strengthen the long-term case, but in the near term, XRP is still priced by the marginal buyer and seller.

Currently, the marginal signals are more supply arriving on exchanges, weaker ETF flow support, and a market mood that rewards caution.

If those inputs flip, even modestly, the same market that is ignoring institutional-grade upgrades today can reprice them quickly.