Financial & Forex Market Recap: Feb. 16, 2026

Markets traded in a subdued, range-bound fashion on Monday as the United States observed the Presidents’ Day holiday and mainland China remained closed for Lunar New Year celebrations, with thin trading volumes producing modest moves across most asset classes despite lingering concerns about artificial intelligence disruption still rippling through equity markets.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Last Saturday, the European Central Bank unveiled its plans to widen access to its euro liquidity backstop, making it globally available and permanent

- New Zealand Services PSI for January 2026: 50.9 (51.9 forecast; 51.5 previous)

- New Zealand Electronic Retail Card Spending for January 2026:0.4% y/y (-0.4% y/y forecast; -1.0% y/y previous)

-

Japan GDP Growth Rate Prel for December 31, 2025: 0.1% q/q (0.5% q/q forecast; -0.6% q/q previous); 0.2% y/y (2.0% y/y forecast; -2.3% y/y previous)

- Japan GDP Price Index Prel for December 31, 2025: 3.4% y/y (3.5% y/y forecast; 3.4% y/y previous)

- Japan Industrial Production Final for December 2025: -0.1% m/m (-0.1% m/m forecast; -2.7% m/m previous); 2.6% y/y (2.6% y/y forecast; -2.2% y/y previous)

- Euro area Industrial Production for December 2025: -1.4% m/m (-1.2% m/m forecast; 0.7% m/m previous); 1.2% y/y (1.5% y/y forecast; 2.5% y/y previous)

- Canada Housing Starts for January 2026: 238.0k (275.0k forecast; 282.4k previous)

- Canada Manufacturing Sales Final for December 2025: 0.6% m/m (0.5% m/m forecast; -1.2% m/m previous)

Promotion: Use TradeZella’s AI Powered trade journal to deep-dive into your execution and see exactly how you performed during today’s trading session. Click here to get the TradeZella Edge and use code PIPS20 to save 20% on your subscription!

Disclosure: We may earn a commission from our partners if you sign up through our links, at no extra cost to you.

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay – Chart Faster With TradingView

Monday’s trading session reflected the muted, cautious tone typical of holiday-shortened weeks, as reduced liquidity and the absence of major US economic catalysts limited volatility across asset classes despite ongoing concerns about AI-driven disruption that have pressured equity markets in recent weeks.

WTI crude oil emerged as the session’s standout performer, rallying 1.73% to close around $63.60 per barrel. The commodity strengthened steadily through the Asian and European sessions before accelerating higher during US hours, possibly reflecting expectations of tighter supply conditions following recent reports of intensifying US-Iran negotiations and geopolitical tensions in oil-producing regions. With limited trading activity and no specific oil-market catalysts announced Monday, the move likely reflected positioning adjustments and technical buying.

The S&P 500 traded with minimal volatility, edging higher by just 0.07% to close near 6,835. The index opened the session around 6,830 during Asian hours and remained largely range-bound throughout the day, with the modest gain possibly reflecting relief that AI disruption concerns that hammered equities last week appeared to have temporarily stabilized.

Treasury yields edged higher by 0.05%, with the 10-year note closing around 4.041%. Yields traded mostly sideways through the truncated session with low volatility, holding near the lowest levels since December touched on Friday. The modest uptick likely reflected technical positioning adjustments rather than any specific catalyst, as bond markets remained closed in the US for the holiday.

Gold declined 1.01% to settle near $4,992 per ounce, dipping below the psychologically significant $5,000 level. The precious metal traded lower throughout the session, with the move possibly reflecting profit-taking following recent strength and reduced safe-haven demand as equity markets stabilized.

Bitcoin fell 0.53% to trade around $68,491. The cryptocurrency experienced choppy trading throughout the session, posting its fourth consecutive weekly loss according to market reports. Bitcoin struggled to find clear direction as a weekend rally fizzled, with the decline possibly correlating with ongoing concerns about AI disruption affecting risk appetite in speculative assets.

Promoted: Smart trading is about more than just reading fundies and price action; it’s about having a platform that can handle high-volatility events like Friday’s US CPI release. Whether you’re hedging against a “Risk-Off” selloff or riding a “Goldilocks” rally, Crypto.com provides a seamless interface for both beginners and seasoned pros. Learn more here at Crypto.com!

Disclosure: We may earn a commission from our partners if you sign up through our links, at no extra cost to you.

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Majors – Chart Faster With TradingView

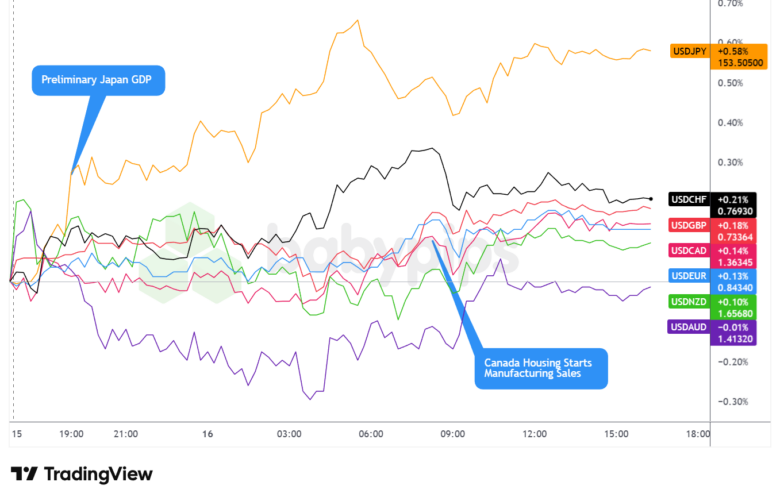

The US dollar traded with a net bullish bias throughout Monday’s holiday-shortened session, posting gains against most major currencies as thin liquidity conditions and reduced market participation amplified modest directional moves.

During the Asian session, the dollar traded mostly sideways with low volatility, though displaying an arguably net bullish lean. The moves were choppy and mixed across currency pairs, with Japan’s disappointing preliminary GDP data showing only 0.1% q/q growth versus 0.5% expected possibly providing some marginal support to the dollar against the yen. USD/JPY gained 0.58% on the day, making it the dollar’s strongest performance among major pairs. New Zealand data came in mixed, with weaker-than-expected retail spending possibly weighing on the kiwi, though USD/NZD gained only 0.10% as the pair remained relatively stable.

The London session brought the dollar’s continued net bullish momentum despite the absence of significant economic catalysts. Euro area industrial production disappointed, falling 1.4% m/m versus 1.2% expected, though the dollar’s strength appeared driven more by technical positioning than European weakness. Sterling showed relative resilience, with USD/GBP gaining only 0.18% as the pound held firm ahead of Tuesday’s UK employment data. The Swiss franc was the session’s second weakest currency, with USD/CHF advancing 0.21% despite Switzerland reporting GDP growth that met expectations at 0.2% q/q.

The US session saw the dollar maintain its choppy but arguably net bullish trajectory through the rest of the day despite the domestic market holiday limiting participation. Canada’s disappointing housing starts data, which came in at 238k versus 275k expected, potentially provided some support for USD/CAD, which gained 0.14%. The euro struggled against the greenback, with USD/EUR rising 0.13%, possibly reflecting the earlier weak European industrial production data and Saturday’s ECB announcement about expanding its euro liquidity backstop globally. The Australian dollar emerged as the only major currency to post a net gain against the dollar, with USD/AUD declining 0.01%, though the move was minimal and likely reflected technical factors rather than fundamental drivers.

Promotion: Tired of “demo-only” prop firms? Lux Trading Firm funds with real capital (up to $10M in buying power) and refunds evaluation fee 100% after Stage 1. Get a certified track record, no time limits and a focus on institutional-grade execution. It’s designed for those looking for a career, not a contest.

Learn More at Lux Trading Firm

Disclosure: To help support our free daily content, we may earn a commission from our partners if you sign up through our links, at no extra cost to you.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Food Price Index for January 2026 at 9:45 pm GMT

- Australia RBA Meeting Minutes at 12:30 am GMT

- Japan Tertiary Industry Activity Index for December 2025 at 4:30 am GMT

- Germany Inflation Rate Final for January 2026 at 7:00 am GMT

- U.K. Employment Situation Update for December 2025 at 7:00 am GMT

- Euro area ZEW Economic Sentiment Index for February 2026 at 10:00 am GMT

- New Zealand Global Dairy Trade Price Index for February 17, 2026

- U.S. ADP Employment Change Weekly for January 31, 2026 at 1:15 pm GMT

- Canada Wholesale Sales Final for December 2025 at 1:30 pm GMT

- Canada CPI Growth Rate for January 2026 at 1:30 pm GMT

- U.S. NY Empire State Manufacturing Index for February 2026 at 1:30 pm GMT

- U.S. NAHB Housing Market Index for February 2026 at 3:00 pm GMT

- U.S. Fed Barr Speech at 5:45 pm GMT

- U.S. Fed Daly Speech at 7:30 pm GMT

Tuesday’s calendar features elevated potential for volatility as markets return to full participation following the US holiday. The UK employment situation update at 7:00 am GMT could spark sterling moves, particularly after recent softer inflation data raised expectations for Bank of England rate cuts. Germany’s final January inflation reading will provide insight into eurozone price pressures following Saturday’s ECB announcement of expanded global euro liquidity access.

During the North American session, Canada’s January CPI report at 1:30 pm GMT stands out as a major catalyst, with the Bank of Canada having already delivered multiple rate cuts and markets closely monitoring inflation trends. The simultaneous release of US ADP employment data and the NY Empire State Manufacturing Index will offer early reads on labor market conditions and regional economic activity ahead of Friday’s crucial nonfarm payrolls report.

Federal Reserve speeches from Vice Chair for Supervision Barr at 5:45 pm GMT and San Francisco Fed President Daly at 7:30 pm GMT will be closely watched for signals on the policy outlook following Friday’s softer-than-expected inflation data. Markets are now fully pricing a Fed rate cut in July with approximately 50% odds assigned to a June move, and any dovish signals from officials could reinforce these expectations and pressure the dollar despite Monday’s resilient performance.

Stay frosty out there, forex friends!

The Daily Recap is Only Half the Story!

Understanding market moves are essential, but having a strategy to capitalize on it is what builds an edge. BabyPips Premium bridges the gap between market awareness and high quality analysis! Our Premium toolkit includes: tactical Event Guides, Watchlists, Weekly Prep & Recaps, & partner perks!

[Learn more & Get the Premium Edge!]