RBA February minutes to detail case for rate hike, set to reinforce tightening bias

2026-02-16 21:29:00

The RBA’s February minutes are expected to reinforce the case for its return to tightening, highlighting persistent inflation, firm demand and ongoing capacity pressures, without signalling any major shift from the guidance already provided.

Summary:

-

RBA to publish minutes from February meeting that lifted the cash rate to 3.85%.

-

Due at 11.30am Sydney time, which is 0030 GMT / 1930 US Eastern time.

-

Hike was widely expected after inflation moved back above the 2–3% target band.

-

Minutes unlikely to contain major surprises after extensive commentary from Governor Michele Bullock.

-

Focus will be on language around persistence of inflation, demand strength and capacity pressures.

-

Tone may reinforce that further tightening remains possible if inflation fails to moderate.

The rationale behind the Reserve Bank of Australia’s first rate increase in more than two years will be laid out in detail when the minutes of the February monetary policy meeting are released.

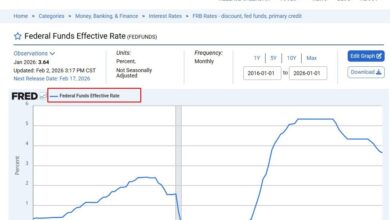

At that meeting, the board lifted the official cash rate by 25 basis points to 3.85%, marking the first hike since November 2023. The move followed a renewed lift in inflation, which pushed price growth back above the Bank’s 2–3% target range and signalled that disinflation had stalled.

Markets were not caught off guard. The rate rise had been broadly anticipated after data through late 2025 showed inflation pressures picking up and proving more persistent than previously expected. Since the decision, Governor Michele Bullock has addressed the reasoning behind the move at a press conference and in parliamentary testimony, meaning the minutes are unlikely to deliver dramatic new revelations.

Instead, the focus will be on nuance. Investors will scrutinise how strongly the board emphasised demand strength, labour market tightness and broader capacity constraints in the economy. Previous communication indicated that private demand had been running ahead of earlier forecasts and that supply capacity remained limited, adding to price pressures.

The board has also flagged that inflation accelerated in the second half of 2025 and may remain elevated through 2026. While some of the rise has been attributed to temporary influences, policymakers have acknowledged that underlying momentum in consumer spending and business investment surprised to the upside.

The minutes may reinforce that policy remains data dependent but retains a tightening bias. If demand growth outpaces supply and inflation fails to ease convincingly, further rate increases remain a live possibility.