Binance reinforces solvency claims amidst rising FUD

Binance is at the center of renewed speculation as the specter of insolvency has once again cast a long shadow over the crypto sector.

Over the past weeks, rumors have emerged that the world’s largest cryptocurrency exchange is facing a liquidity crunch, and these rumors have spread across social media platforms, underscoring the fragility of investor sentiment in a post-2022 market landscape.

The narrative gained traction on Feb. 9 when Jacob King, the founder of SwanDesk, issued a stark warning regarding the exchange’s stability.

King claimed that investors were executing a mass exodus from the platform and alleged that Binance was witnessing its largest net outflows on record.

The commentary ignited a firestorm of speculation among traders, who posited that the exchange was grappling with hidden liquidity constraints, while others pointed to long-standing, albeit unproven, suspicions of price manipulation and coordinated selling by large-scale market participants.

However, these alarms did not materialize in a vacuum. They were fueled by data aggregators that appeared to show significant capital flight.

Figures from DeFiLlama were widely interpreted as indicating that Binance experienced over $2 billion in outflows over the preceding month.

This reading, alongside data from CoinGlass, similarly suggested a contraction in the exchange’s reserves.

Binance’s FUD gains traction

The catalyst for this latest bout of fear, uncertainty, and doubt (FUD) appears to be a conflation of technical friction and structural anxiety.

The initial spark was a disruption to withdrawals that the exchange characterized as a routine technical hiccup.

A support notice from Binance confirmed a withdrawal delay occurred on Feb. 3 but stated that the underlying issue had been resolved and that systems had returned to normal operations.

In a traditional equities market, a brief pause in withdrawals might be viewed as a technical nuisance. However, in a crypto sector defined by sharp price swings and a history of catastrophic failures, a momentary halt is sufficient to revive the industry’s most feared label: a bank run.

This dynamic transformed a customer-experience issue into a debate over balance-sheet solvency before the underlying facts could be fully understood.

The velocity at which this narrative traveled is indicative of the current market psychology. The crypto ecosystem retains significant “muscle memory” from the collapse of FTX and other centralized lenders.

Since then, crypto investors have been conditioned to view any friction in the withdrawal process as a first-order risk signal rather than a benign support issue.

This reflex was further amplified by the volatility observed earlier this month. Bitcoin’s sharp plunge toward the $60,000 level, followed by a rapid rebound above $70,000, created a chaotic environment.

In such conditions, market participants are primed to look for hidden stress in the system.

Consequently, even temporary technical disruptions are frequently interpreted as a signal of deeper solvency problems.

Meanwhile, renewed apprehension regarding Binance has developed into a self-sustaining ecosystem.

Periods of heavy asset price declines invariably invite a fresh cycle of viral claims, screenshots, and threads that blur the line between operational maintenance and financial ruin.

As the central node in the global crypto plumbing, Binance remains a recurring target. This is partly due to its sheer size and partly because any rumor regarding its stability is viewed as systemically critical.

Moreover, recent commentary has tied this specific episode to a broader wave of skepticism that has been building since the market drawdowns in October.

Critics have framed the exchange as a potential point of failure, attributing prior market collapses to it.

Others have resurrected a familiar set of anxieties, including opaque liabilities, reliance on third-party wallet trackers, and the belief that a brief halt is merely a precursor to a permanent freeze.

What on-chain data shows about Binance

Despite the fervor on social media, a granular analysis of on-chain data paints a more complex picture that disputes the narrative of a runaway bank run.

Analysis by CryptoSlate suggests that the platform, now led by Richard Teng, is not experiencing the kind of catastrophic drain described by detractors.

CoinMarketCap’s exchange page for Binance currently lists “Total Assets” at approximately $132 billion. Similarly, the Binance CEX page on DeFiLlama shows a comparable scale, listing total assets of approximately $132.3 billion.

These figures present a breakdown by blockchain, with Ethereum and Bitcoin accounting for the largest share of the reserve base.

It is crucial to note that these numbers do not constitute a full financial audit. They do not inform the market of Binance’s outstanding obligations to creditors, nor do they map every off-chain obligation or replace standard financial statements.

However, they remain relevant to the counter-narrative. A genuine bank run is defined not merely by a high volume of withdrawals but by a sustained drain that overwhelms liquid reserves and forces new restrictions on capital movement.

So, a platform that continues to hold roughly $132 billion in observable assets presents a fundamentally different risk profile than a venue that is visibly being emptied of all liquidity.

Moreover, much of the current fear was driven by a chart showing a decline in total asset value. DeFiLlama data indicated that Binance’s total assets peaked at more than $178 billion earlier this year before declining by approximately $40 billion to the current $132 billion level.

While a $40 billion drop is substantial, dollar-denominated totals can be misleading during periods of market correction.

This is because a decline in token prices reduces the dollar value of reserves even if the underlying token balances remain stable.

So, Bitcoin’s brief trade below $60,000 created exactly this type of mechanical reduction in asset value, independent of customer withdrawals.

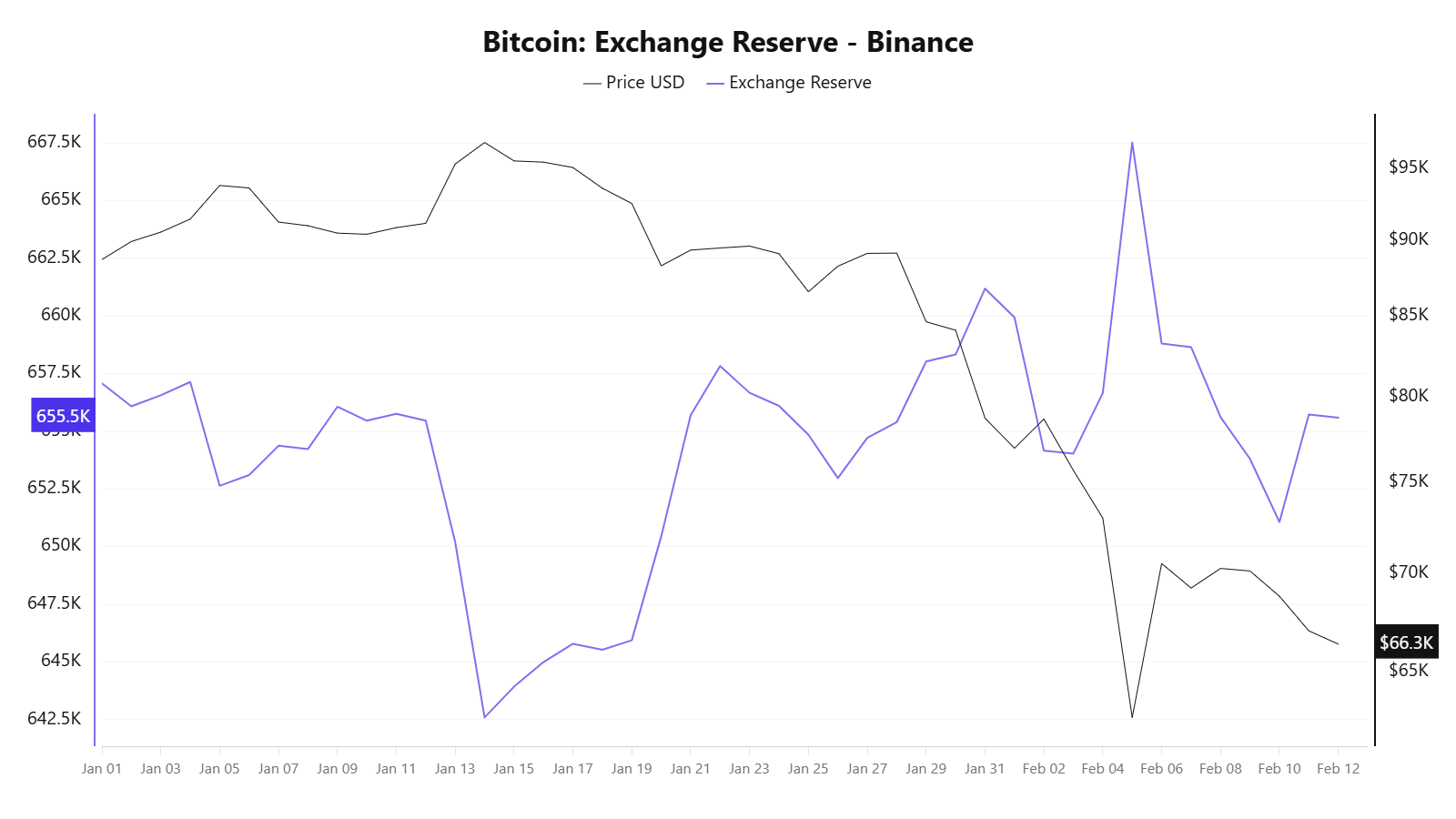

Moreover, data from CryptoQuant supports the view that the underlying collateral remains intact.

Their metrics indicate that Binance’s Bitcoin reserves have actually increased to more than 655,000 BTC, rebounding from a decline to roughly 642,000 BTC in January.

Binance stands firm against FUD

In response to circulating rumors, Binance has adopted an aggressive transparency strategy to clearly distinguish operational disruptions from solvency concerns.

Earlier this month, Binance co-founder He Yi characterized the surge in chatter as a deliberate “withdrawal campaign.”

She argued that on-chain activity on Binance-linked addresses suggested that assets actually increased during the period in question. This implies that, despite the optical noise, deposits exceeded withdrawals as the panic subsided.

According to her:

“Although the number of assets in Binance addresses has increased after the campaign was launched, I believe that regularly initiating withdrawals from all trading platforms is a very effective stress test.”

Additionally, the co-founder cautioned users regarding the mechanics of blockchain transfers.

She warned that errors in transfer protocols are permanent once confirmed and directed users toward self-custody options. This includes the Binance Wallet and Trust Wallet, as well as hardware wallet alternatives for those seeking sovereignty over their keys.

This advice is consistent with a platform confident in its reserves, as insolvent entities typically discourage self-custody to retain capital.

In a separate Feb. 11 message, Binance also disputed the data integrity of certain third-party service providers.

The firm stated that figures cited from external sources often rely on incomplete wallet tagging. The statement noted that DeFiLlama had previously identified discrepancies and added that it could take 24 to 48 hours for third-party data to reconcile with internal records.

In light of this, Binance directed users to its own proof-of-reserves page and to the flow dashboards of other analytics providers, such as OKLink. They endorsed regular withdrawal tests across all platforms and issued a blunt operational warning to users to verify addresses before moving funds.

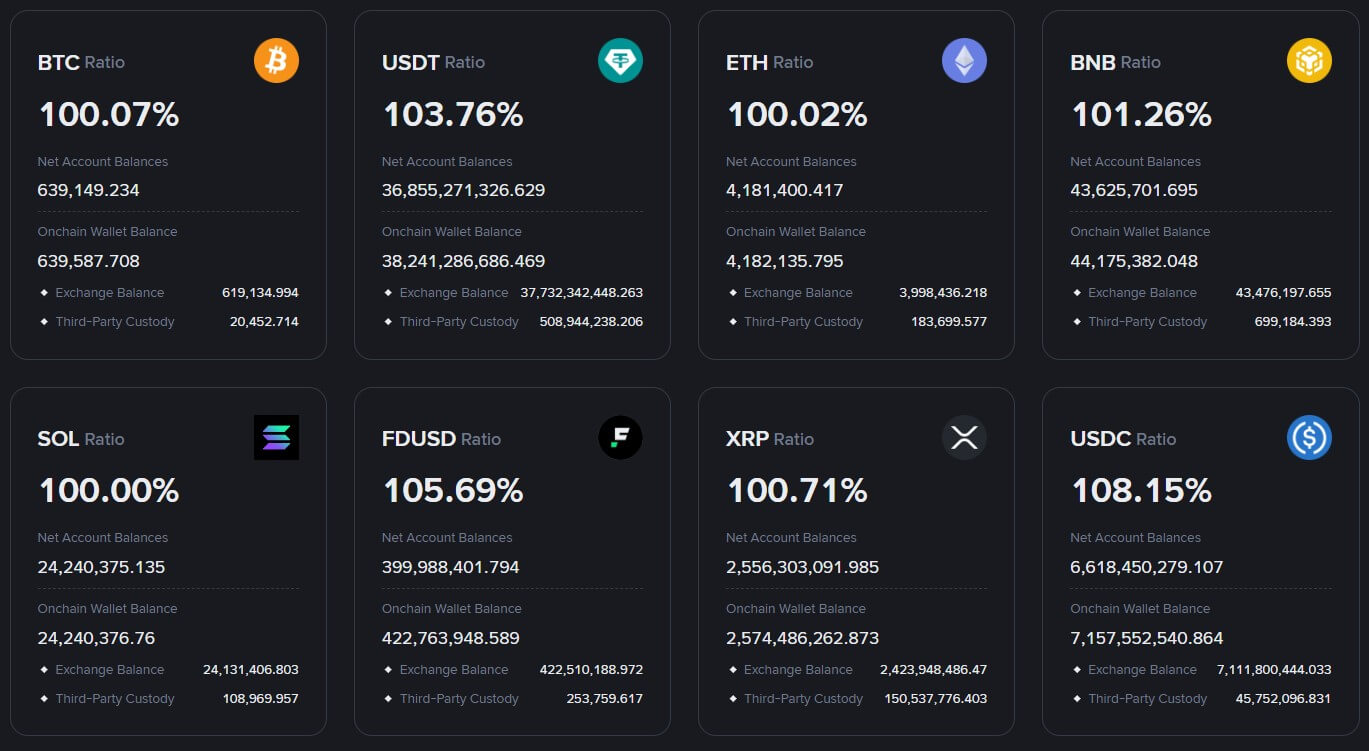

At the same time, exchange supporters have cited Binance’s reserve ratios as evidence that the firm maintains more than $1 in reserve for every $1 a user holds on the platform.

This “over-collateralization” narrative is central to the exchange’s survival strategy. By emphasizing that it maintains a ratio greater than 1:1, Binance seeks to distance itself from fractional reserve banking models that dominate traditional finance.