Westpac sees lift in NZ inflation expectations ahead of February RBNZ meeting

2026-02-12 21:47:00

Westpac: near-term NZ inflation expectations likely to rise in Q1 RBNZ survey

Summary:

-

Westpac expects a lift in near-term inflation expectations in the Q1 RBNZ survey.

-

Two-year-ahead expectations last stood at 2.28%.

-

Recent inflation surprises and firmer activity data cited as drivers.

-

Focus on whether longer-term expectations edge higher.

-

Survey will be key ahead of the 18 February RBNZ meeting.

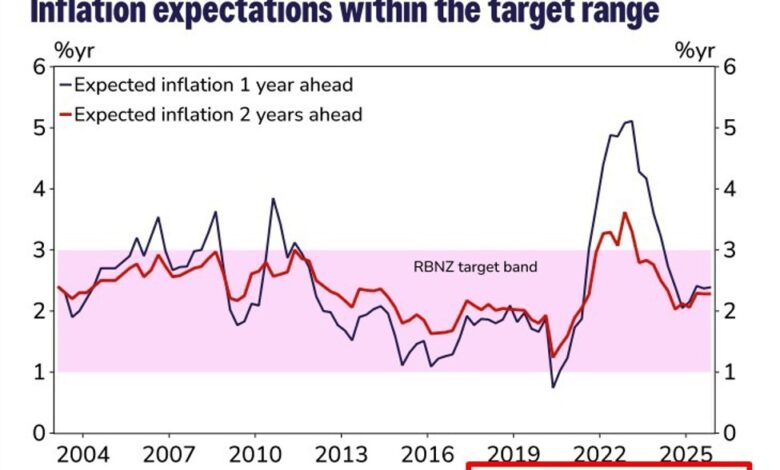

New Zealand’s inflation outlook is likely to show renewed firmness in the Reserve Bank’s latest Survey of Expectations, according to Westpac, with the near-term measures particularly at risk of moving higher.

The Q1 survey, due 13 February, 0200 GMT (2100 US Eastern time on February 12) previously showed inflation expectations two years ahead at 2.28%. Westpac believes recent developments point to at least a modest rise at shorter horizons, reflecting upside inflation surprises over recent months and accumulating signs that economic activity is stabilising.

Stronger-than-anticipated price data have altered the narrative somewhat from late 2025, when disinflation appeared more entrenched. At the same time, improving business sentiment and firmer indicators of domestic demand suggest price pressures may prove more persistent than earlier assumed.

Westpac argues that the trajectory of longer-term expectations will be especially important for policymakers. While a lift in short-term measures may be understandable given recent data, any meaningful increase in two-year or longer horizons would likely attract closer scrutiny from the Reserve Bank.

The survey lands just days before the RBNZ’s 18 February policy meeting, making it a timely input into the Monetary Policy Committee’s deliberations. Recent economic data have already indicated that inflation could track stronger than the central bank previously projected, raising questions about how quickly policymakers can shift toward a more accommodative stance.

For markets, a rise in expectations — particularly at the two-year horizon — could reinforce a cautious policy outlook and temper expectations of near-term easing. Conversely, stable longer-term readings would help reassure officials that inflation remains anchored close to the 2% midpoint of the target range.