ICYMI, gold bulls galore: JPMorgan $8,000 decade-end gold scenario

2026-02-10 22:42:00

JPMorgan sketched out an $8,000 decade-end gold scenario in a late January note as big banks lift targets and WGC data show record 2025 demand.

Summary:

-

JPMorgan mapped out a decade-end US$8,000 scenario

-

Upside hinges on private allocation rise

-

Goldman lifted its end-2026 target to US$5,400

-

WGC flags record 2025 demand 5,002t

-

Macro hedging bid still supports gold

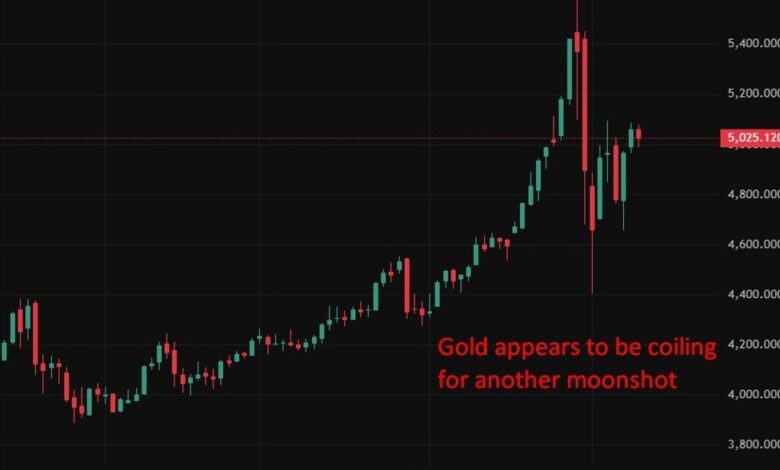

Gold’s surge through fresh record highs has sparked a wave of bullish scenario work from Wall Street, with JPMorgan arguing the metal could ultimately extend well beyond current levels if private investors continue to increase allocations over coming years.

Gold has rallied sharply in early 2026, supported by a familiar mix of drivers: elevated safe-haven demand amid geopolitical uncertainty, persistent official-sector buying, and a broader rethink of long-duration bond exposure. The move has also been framed by renewed debate around the U.S. dollar’s longer-run role in portfolios, with some investors favouring hard-asset hedges.

In a research note, ICYMI, JPMorgan strategists outlined an upside path in which gold could reach around US$8,000/oz by the end of the decade, contingent on a sustained rise in private-sector demand. The bank’s scenario assumes investors lift portfolio allocations to gold to roughly 4.6% from about 3%, a shift that would represent a significant reweighting toward the metal and implies substantial upside from recent prices.

JPMorgan’s framing aligns with a broader trend among major banks lifting targets as gold’s momentum persists. Goldman Sachs recently raised its end-2026 gold forecast to US$5,400/oz (from US$4,900), citing continued diversification demand from private investors alongside ongoing emerging-market central bank purchases.

Underlying fundamentals have also been reinforced by new industry data. The World Gold Council reported global gold demand rose to a record 5,002 tonnes in 2025, with investment demand surging even as high prices weighed on some traditional segments such as jewellery.

For markets, the key question is whether investment flows can remain strong enough to offset sensitivity to shifts in real yields, the dollar, and risk sentiment — variables that can still drive sharp volatility even inside a structurally bullish trend.