Why Bitcoin ETFs bleed billions while Gold makes 53 new all-time highs with $559B in demand

Gold demand reached a record $555 billion in 2025, driven by an 84% surge in investment flows and $89 billion in inflows into physically backed ETFs.

The World Gold Council reports ETF holdings climbed 801 tons to an all-time high of 4,025 tons, with assets under management doubling to $559 billion. US gold ETFs alone absorbed 437 tons, bringing domestic holdings to 2,019 tons, valued at $280 billion.

This indicated institutional repositioning.

Bitcoin, meanwhile, spent the first two months of 2026 shedding holders. US spot Bitcoin ETFs recorded net outflows of over $1.9 billion in January.

As of Feb. 9, spot Bitcoin ETFs globally held 1.41 million BTC valued at $100 billion, roughly 6% of Bitcoin’s fixed supply. Yet, the tape suggests capital is moving out, not in.

The gold rally validates the debasement thesis, raising the question of whether Bitcoin captures any of the next wave of flows or whether allocators have already assigned it to a different risk bucket entirely.

What actually changed

Investment demand for gold reached 2,175 tons in 2025, an 84% jump year-over-year.

Using the World Gold Council’s average price of roughly $3,431 per ounce, that translates to approximately $240 billion in notional investment demand. This figure is driven by ETF adoption, central bank buying, and concerns about currency stability rather than cyclical growth fears.

China’s People’s Bank bought gold for a 15th consecutive month, holding 74.19 million ounces valued at $369.6 billion as of January 2026.

The IMF notes global debt remains above 235% of world GDP, a backdrop that makes hard collateral appealing regardless of growth expectations.

Gold’s 2025 run, which resulted in 53 all-time highs, wasn’t a trade. It was a repricing of the role of strategic reserves amid persistent sovereign deficits and weakening confidence in the stability of fiat currencies.

Bitcoin’s proponents argue it serves the same function: a non-liability asset immune to debasement. However, the ETF tape tells a different story.

While gold funds doubled assets under management, Bitcoin ETFs hemorrhaged capital. If allocators viewed the two as substitutes, the flows would track each other. They don’t.

| Metric | 2025 / Jan–Feb 2026 value | Direction | Interpretation |

|---|---|---|---|

| Gold: Total demand (value) | $555B (2025) | ↑ | Record-scale demand value = “strategic collateral” repricing, not just cyclical buying |

| Gold: Investment demand | 2,175t (2025) | ↑ | Investment-led bid (allocation behavior), consistent with macro/sovereignty hedging |

| Gold: Physically backed ETF inflows | $89B (2025) | ↑ | Institutional channel doing the work; ETF wrapper is the transmission mechanism |

| Gold: ETF holdings change | +801t (2025) | ↑ | Holdings accumulation (not just price) → persistent positioning, not a quick trade |

| Gold: End-year ETF holdings | 4,025t (all-time high, 2025) | ↑ | New “inventory” peak reinforces the idea of a structural allocation shift |

| Gold: Gold ETF AUM | $559B (2025) | ↑ | AUM doubling signals scale-up in institutional exposure and mandate adoption |

| Gold: US gold ETFs absorbed | +437t (2025) | ↑ | US institutions participated materially; not just EM/central-bank narrative |

| Gold: US gold ETF holdings | 2,019t (2025) | ↑ | Deepened domestic stockpile supports “gold re-rating” / reserve-like framing |

| Gold: US gold ETF AUM | $280B (2025) | ↑ | Concentrated capital base: US ETF complex is a major driver of the gold bid |

| Bitcoin ETFs: Net flow (US spot ETFs) | –$1.9B (Jan 2026) | ↓ | De-risking / liquidation pressure; “tape” contradicts pure debasement narrative |

| Bitcoin ETFs: Global holdings (spot ETFs) | 1.41M BTC (Feb 9, 2026) | — | Large installed base remains, but flows are the marginal signal (and they’re negative) |

| Bitcoin ETFs: Value of holdings | ~$100B (Feb 9, 2026) | — | Size is meaningful, yet capital is leaking rather than compounding |

| Bitcoin ETFs: Share of BTC supply | ~6% (Feb 9, 2026) | — | Concentrated “wrapper ownership” is large enough that flows can matter at the margin |

Small percentages and big numbers

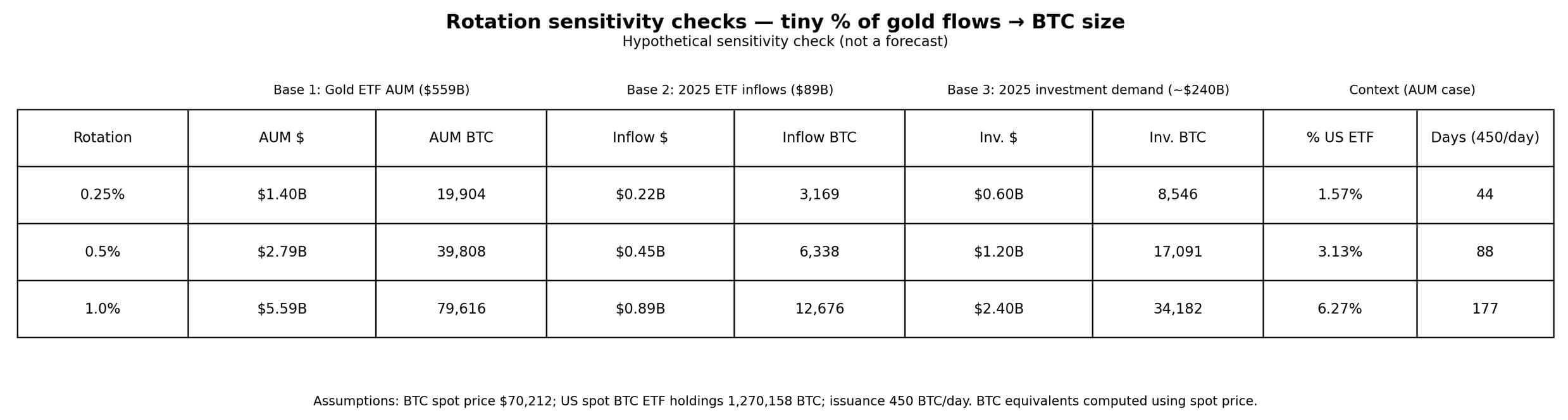

The hypothetical exercise is important because it quantifies the implications of small reallocations for Bitcoin’s marginal bid.

Starting with global gold ETF assets under management of $559 billion, a 0.25% rotation would represent $1.4 billion, or roughly 19,900 BTC, at current prices of approximately $70,212. At 0.5%, doubling yields $2.8 billion and 39,800 BTC.

A full percentage point translates to $5.6 billion, enough to purchase approximately 79,600 BTC, equal to 6.3% of existing US spot ETF holdings or about 177 days of post-halving issuance at 450 BTC per day.

Using 2025 gold ETF inflows of $89 billion as an alternative base, the same exercise yields smaller but still meaningful figures. A 0.25% reallocation amounts to $222 million, or approximately 3,170 BTC, while a 0.5% reallocation amounts to $445 million and 6,340 BTC.

At 1%, the figure rises to $890 million and approximately 12,700 BTC.

A third base is based on the derived $240 billion in gold investment demand from 2025. Quarter-percent, half-percent, and one-percent reallocations translate to $600 million (8,550 BTC), $1.2 billion (17,100 BTC), and $2.4 billion (34,200 BTC), respectively.

These aren’t forecasts. They’re sensitivity checks. But they clarify the stakes: even a 0.5% allocation of gold ETF assets would represent an order-of-magnitude capital comparable to Bitcoin’s worst monthly outflow in recent memory.

The problem is there’s no mechanism forcing that rotation, and current behavior suggests allocators treat the two assets as complements in different portfolios rather than substitutes within the same mandate.

Jan. 30 tells you what Bitcoin is

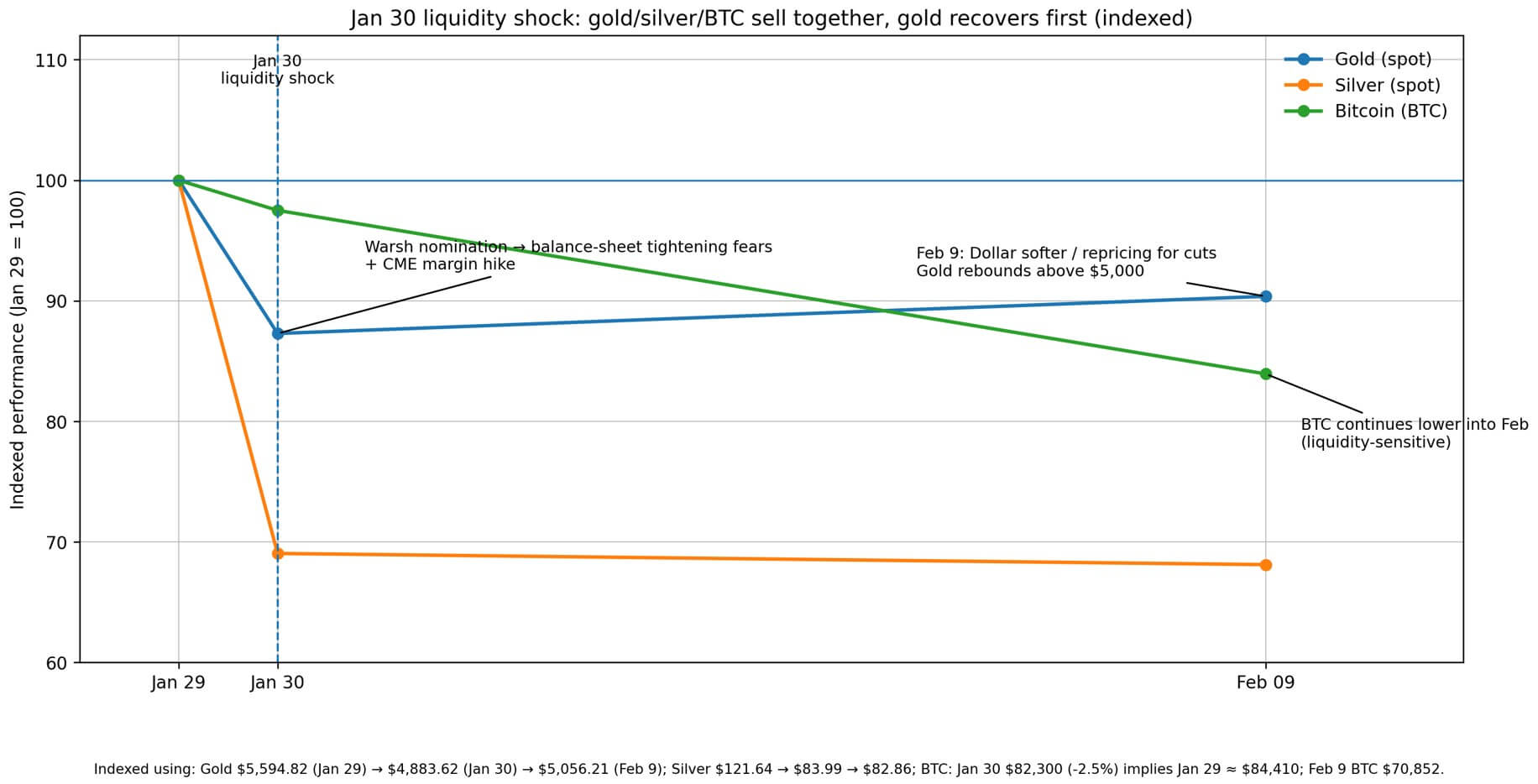

On Jan. 30, gold dropped nearly 10%, its steepest single-day decline since 1983, after Kevin Warsh’s nomination as Treasury Secretary triggered concerns about balance sheet tightening and the CME raised margin requirements.

Silver collapsed 27% the same day. Bitcoin fell 2.5% to around $82,300, explicitly tied by Reuters to liquidity fears stemming from the potential for a smaller Federal Reserve balance sheet.

Gold and silver didn’t behave like stable insurance. They gapped down amid a hawkish liquidity shock and a wave of leverage unwinds. Bitcoin joined them.

By Feb. 9, gold had recovered to around $5,064 as the dollar weakened and markets repriced for rate cuts. However, the Jan. 30 tape revealed something critical: in 2026, Bitcoin still trades as a liquidity barometer during policy-tightening shocks, not as insurance against fiat debasement.

This distinction matters for the rotation thesis. If the primary catalyst driving capital into gold is sovereignty concerns and debt sustainability, Bitcoin theoretically benefits.

However, if the transmission mechanism involves tighter policy or margin calls, Bitcoin behaves more like risk-on leverage than like collateral.

Street forecasts remain bullish on gold. UBS targets above $6,200 per ounce later in 2026, JPMorgan $6,300, and Deutsche Bank $6,000. But those projections assume gold benefits from both debasement fears and safe-haven demand during stress.

Bitcoin has demonstrated the former but not the latter.

When the debasement trade could favor Bitcoin

The regime that supports Bitcoin is one in which markets expect easier policy, balance sheet expansion, and a weaker dollar. These conditions lift assets that benefit from abundant liquidity.

Reuters commentary explicitly links Bitcoin and gold to balance sheet expansion hedging, and the World Gold Council notes that falling yields, a weakening dollar, safe-haven demand, and momentum supported 2025 ETF inflows.

For Bitcoin to win rather than merely tag along, two conditions must hold: sustained spot ETF inflows rather than reflex bounces, and reduced leverage reflexivity that can amplify sell-offs during liquidity shocks.

Recent months show the opposite. Outflows have been persistent, and Bitcoin’s correlation with risk assets remains high during stress.

A clean hypothetical illustrates the stakes: if Bitcoin captured 1% of global gold ETF assets under management in a debasement-driven regime, that would represent roughly $5.6 billion in incremental buying, about 80,000 BTC at $70,000, equal to 6% of current US spot ETF holdings.

That’s not a small number. But it requires a catalyst strong enough to shift allocator behavior, not just to align narratives.

What to watch

The dollar and real-rate expectations will drive the next leg. DXY direction, explicit signals about balance sheet policy, and the speed of any Fed rate cuts will determine whether the environment favors hard assets broadly or just those with established safe-haven credibility.

The Jan. 30 shock demonstrated sensitivity to liquidity conditions. A reversal toward easier policy could flip the script.

ETF flows provide the clearest indication of allocator intent. Comparing weekly inflows into gold ETFs with daily flows into US spot Bitcoin ETFs will indicate whether capital treats Bitcoin as an alternative store of value or as a high-beta macro trade.

China’s continued gold accumulation, spanning 15 consecutive months of central bank buying, supports its sovereignty bid for hard collateral and sets a baseline for how nation-states are positioning themselves.

Gold forecasts clustering around $6,000 to $6,300 per ounce create a testable scenario: if gold consolidates and then re-accelerates toward those targets, does Bitcoin follow or diverge?

The answer will reveal whether the debasement thesis translates into Bitcoin demand or whether institutional flows remain anchored to traditional hard assets with deeper liquidity and regulatory clarity.

The underlying question

Gold’s $555 billion demand year wasn’t about traders front-running inflation prints. It concerned central banks, sovereign wealth funds, and institutional allocators repositioning for a world in which debt levels, currency stability, and geopolitical fragmentation matter more than short-term growth cycles.

Bitcoin’s case rests on the same macro logic, but its behavior during the Jan. 30 shock and the months of ETF outflows that preceded it suggests allocators still view it as a liquidity-sensitive asset rather than a liability-free reserve.

The rotation math shows what’s possible if that perception shifts.

A 1% reallocation from gold ETF assets could move markets. However, possibility isn’t probability, and current flows in the opposite direction.

Bitcoin doesn’t need gold to fail. It needs a catalyst that convinces the same institutions driving gold’s record year that Bitcoin belongs in the strategic collateral bucket, not the speculative beta sleeve. So far, that catalyst hasn’t arrived.