During times of stress, people desperately search for validation

2026-02-06 19:09:00

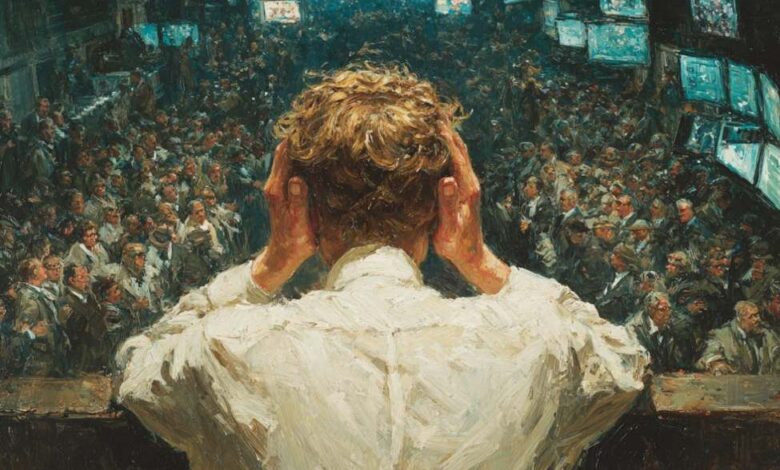

There’s a moment in every drawdown, every flash crash,

every this time is different panic where something shifts inside you.

It’s not just fear — it’s the desperate need for someone, anyone, to tell you

what’s going to happen next. Every trader wants certainty in a world that just reminded

you it offers none.

I’ve watched this pattern play out across decades of

markets and it never changes. When the VIX spikes, when carry trades unwind,

when central banks surprise (and this week when software stocks, silver and bitcoin plunge) — the first thing traders do isn’t analyze. It’s

search. They scroll Twitter. They refresh their favorite commentary sites — including investingLive. They

look for the person who sounds the most confident and they grab onto that voice

like a lifeline.

It’s natural and it’s one of the most dangerous things you can do with

your money.

The Confidence Trap

In calm markets, you barely notice the commentators. You

have your own thesis, your own positioning, your own process. You might read

someone’s analysis and think, hm, interesting point, and move on. But

when your P&L is deep red and the headlines are screaming, suddenly the

person with the firmest voice becomes magnetic like a life raft.

It’s hardwired.

Psychologists have long documented that uncertainty triggers a deep need for something called cognitive closure — the brain wants the open loop closed. In markets, that

manifests as a desperate search for someone who seems to know the answer. And

the cruelest irony is that the people who sound most certain during a crisis

are almost always the least reliable. Certainty is easy to project when you have no

skin in the game or when your business model rewards boldness over accuracy.

Think about who rises to prominence in a crash. It’s

rarely the measured analyst saying well, it depends on a number of factors.

It’s the person pounding the table. This is the bottom. Buy everything.

Or: This is 2008 all over again. Get out now. Extreme conviction finds a

ready audience in extreme fear.

You Can’t Borrow Conviction

Here’s the core problem: even if the confident voice

turns out to be right, you still lose. Because you can’t borrow conviction.

“The stock market demands conviction as surely as it victimizes the unconvinced. – Peter Lynch

This is the part that newer traders miss entirely.

Suppose you’re panicking during a sell-off and you find a commentator who’s

screaming buy. You buy. The market drops another 3%. What do you do? You don’t

have the analytical foundation beneath the trade. You don’t understand the

thesis at a cellular level. So you sell at the worst possible time — right

before the bounce — because the conviction you were borrowing wasn’t yours to

spend.

I’ve seen this happen thousands of times. A trader

follows someone into a position and then bails out at the exact moment they

needed to hold, because they never truly understood why they were in the trade.

The guru holds because they did the work. The follower folds because they

didn’t.

Recognizing the Pattern in Yourself

The first step is awareness, and it’s simpler than you

think. Ask yourself this question the next time you feel compelled by someone’s

market take: Am I reading this to learn, or am I reading this to feel

better?

There’s a world of difference between those two

motivations. Learning is when you encounter an argument that makes you

reconsider your assumptions or fills a gap in your understanding. Seeking

validation is when you keep scrolling past the analyses that disagree with you

and stop on the one that tells you what you want to hear. If you find yourself

clicking on seven different commentators until you find one who agrees with

your existing position — or one who sounds confident enough to replace your

missing confidence — that’s validation-seeking. And it’s a red flag.

Another signal: notice when you’re consuming more

commentary than usual. In normal markets, maybe you check two or three sources

in the morning and you’re done. During stress, you might find yourself checking

twenty. That increase in consumption isn’t giving you twenty times more

information. It’s anxiety dressed up as research.

The Pitfalls Run Deep

The damage from borrowed conviction goes beyond

individual trades. It corrupts your entire development as a trader.

First, it destroys your feedback loop. If you’re making

decisions based on other people’s calls, you never learn whether your own

process works. You can’t improve a system you’re not running. Every time you

outsource a decision to someone else’s confidence, you’re stealing from your

future self — the version of you who might have developed genuine market

intuition through the painful but necessary work of being wrong on your own

terms.

Second, it creates a dependency. Once you find a voice

that was right during one crisis, you’ll return to them during the next one.

But markets don’t repeat in neat patterns, and the person who nailed the COVID

bottom might completely misread the next dislocation. As the old trader’s adage

goes: the market is designed to humiliate the largest number of people

possible. That includes the gurus.

Third, and this is subtle — it allows you to avoid

responsibility. If someone else made the call and it went wrong, that’s their

fault, not yours. This feels protective in the moment but it’s poison for

growth. The best traders I know own every single decision, even the ones

informed by others.

Bitcoin – this kind of volatility isn’t easy

How to Correct Your Thinking

Start by building your framework in calm markets, not

stressed ones. You will never build a house during a hurricane, so stop trying

to build a trading process during a panic. Do the work when the VIX is at 14

and your P&L is flat and everything feels boring. Write down your rules.

Define what you believe about how markets function. Determine in advance what

signals would make you change your mind.

“The

time to figure out what you believe is when there’s nothing at stake. The time

to act on what you believe is when everything is.”

When stress arrives — and it will — refer to what you

wrote down. Trust your process, not someone else’s confidence. If your process

says to cut the position, cut it. If your process says to add, add. If your

process has no answer for the current situation, the correct move is to reduce

risk and watch, not to go hunting for someone who will tell you what to do.

Read widely but weight nothing by how confidently it’s

presented. A tentative analysis backed by strong reasoning is worth infinitely

more than a table-pounding call backed by charisma. Train yourself to be

suspicious of certainty. In a complex adaptive system like markets, the

appropriate emotional tone is almost always humble but prepared. Anyone

performing certainty is either selling something or fooling themselves.

Keep a decision journal. Before you enter a trade, write

down why. After you exit, write down what happened. Over time, this journal

becomes something no commentator can ever give you: evidence of what you

actually know. It’s the slow, unsexy path to genuine conviction. There are no

shortcuts.

The Uncomfortable Truth

Markets will always be uncertain, and there will always

be people willing to sell you the feeling of certainty. The entire financial

media ecosystem is built on this exchange. You supply the attention; they

supply the confidence. It’s a transaction that benefits them far more than it

benefits you.

Another shortcut is using LLMs like ChatGPT or Gemini or Anthropic, who says its latest Opus 4.6 model is better for financial analysis. You can question things and harden your conviction with these. Be careful not to let them act like a sycophant and push back on their assumptions. There’s real value there, particularly in analysing obscure companies.

The traders who survive long enough to thrive are the

ones who learn to live in deep discomfort. I think it’s a muscle that needs to be strengthened over time. Good traders accept that they don’t know what’s

going to happen tomorrow and they trade anyway, sized appropriately, with a

plan for being wrong. They don’t need a confident voice on the internet to tell

them it’s going to be okay. They’ve built something better: the quiet, internal

conviction that comes from doing the work yourself.

The next time fear grips the market and you catch

yourself desperately seeking that one reassuring voice, pause. Close the tab.

Open your journal. Trust the process you built when you were thinking clearly.

Because at the end of the day, the only conviction that

will hold when the market tests you is the conviction you earned yourself. This was one of those weeks.

What did you learn? What’s your conviction for next week?