More on CME raises margins on COMEX gold and silver futures after extreme volatility

2026-02-05 21:42:00

CME’s margin hike is the latest sign volatility is still driving the metals tape, lifting the cost of leverage just as positioning is being forced lighter.

Summary:

-

CME has lifted initial margin requirements again for key precious metals contracts, raising the cash required to hold positions.

-

COMEX 100 gold futures initial margin is set to rise to 9% from 8%

-

COMEX 5000 silver futures initial margin is set to rise to 18% from 15%

-

The move follows extreme, fast price swings in recent sessions, with forced deleveraging a key theme in metals.

-

Higher margins typically cool speculative positioning near-term, but they can also amplify selling pressure if traders must cut positions to meet calls.

CME Group has raised initial margin requirements for two flagship precious metals futures contracts, increasing the amount of collateral traders must post to open and maintain positions.

Under the changes, initial margin on Comex 100 gold futures is set to rise to 9% from 8%, while initial margin on Comex 5000 silver futures is set to rise to 18% from 15% (per the margin update you shared). The adjustment comes as the precious metals complex digests a period of extraordinary volatility, where sharp, intraday swings have triggered position reductions and liquidation across leveraged products.

Margin is a risk-control lever used by clearing houses to ensure adequate collateral coverage when price moves widen. CME has framed recent margin actions as part of routine risk management reviews tied to market volatility, and recent reporting has highlighted that margin hikes have compounded pressure during the latest sell-off.

For markets, the immediate impact is usually mechanical: higher margins increase the cost of carrying exposure, which can reduce speculative participation and prompt some holders to trim positions. That dynamic can be destabilising in the very short term if traders are forced to sell to meet higher collateral requirements, particularly in thin liquidity conditions.

The broader backdrop is that precious metals had been pushed to elevated levels before the abrupt reversal, leaving positioning vulnerable once volatility spiked and the dollar firmed. With margin requirements now higher, traders will be watching whether liquidation risks fade as leverage is wrung out — or whether the higher funding burden keeps the complex heavy until volatility normalises.

****

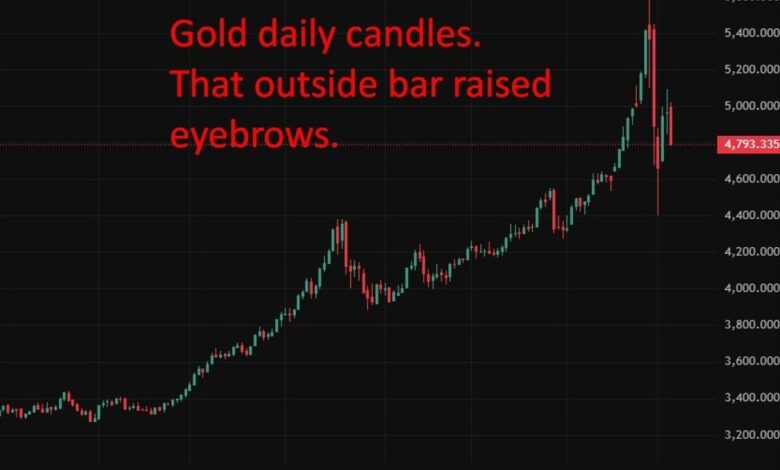

Just for laughs, here is the chart I posted on the day of that outside reversal bar noted in the chart above.

By all means read the guys that post a bazillion words in hindsight on why a market moved. But, for your own sake, spare some time to read us here where the rubber hits the road posting just a few words in real time on what to watch out for. 😉