investingLive Americas market news: Bitcoin cut in half in four months, down 13% today

2026-02-05 21:12:00

Markets:

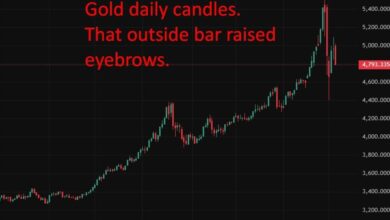

- Gold down $151 to $4811

- US 10-year yields down 8.2 bps to 4.19%

- WTI crude oil down $1.92 to $63.21

- S&P 500 down 1.2%

- USD leads, GBP lags

It was another ugly one as the rout in software and tech shares expanded to just about everything else. There were few places to hide as all the major US indexes finished down by more than 1% and the Russell 2000 down nearly 2%.

After hours, Amazon reported and missed on the bottom line while also reporting capex at $200 billion for this year compared to $146 billion expected. That further weighed on equity futures.

As bad as it is in tech, it’s worse in crypto. Bitcoin fell 12% today and is now down 50% since the October 6 record high. That’s a bad sign for risk assets in general and ugly all around. I tend to think it’s spilling over into everything else and creating a risk-off dynamic.

Worse yet, all the US employment data this week has been poor. ADP and ISM services earlier in the week along with JOLTS (really weak), initial jobless claims and Challenge job cuts today. The bond market had been mostly an observer in the latest turmoil but today we got yields down 7-10 bps across the curve, led by the front end.

Despite that, the US dollar led the way today. Again, that’s probably more of a classic risk-off move as Fed fund futures now price just over 50 bps in easing this year. In FX, the bigger story was a dovish signal form the Bank of England as Bailey highlighted falling inflation trends. The market is now pricing a 45% chance of a cut in March. That pushed cable down by 116 bps to 1.3533.