Tether Makes $100M Equity Investment in Anchorage Digital

Tether has made a $100 million strategic equity investment in Anchorage Digital, formalizing an existing relationship between the stablecoin issuer and the federally regulated US crypto bank.

According to a post by Tether on Thursday, the investment builds on the companies’ prior collaboration, which includes Anchorage Digital’s role as the issuer of USAt, which launched on Jan. 27.

USAt is dollar–pegged stablecoin designed to operate in the United States under the federal payment stablecoin framework established by the GENIUS Act in July 2025.

Anchorage Digital Bank, founded in 2017 in San Francisco, is the first federally chartered digital asset bank in the United States, providing custody, settlement, staking and stablecoin issuance services to institutional clients.

The investment was made by Tether Investments, the stablecoin issuer’s El Salvador–based investment arm, and comes after Anchorage Digital was recently reported to be exploring a capital raise of $200 million to $400 million ahead of a potential initial public offering next year.

Tether is the issuer of USDt (USDT), the world’s largest stablecoin by market capitalization, with about $185 billion in circulation, or about 60% of the total stablecoin market, according to DefiLlama data.

Related: Anchorage Digital deepens RIA market push by acquiring unit of Securitize

Tether invests on the back of huge profit margins

Tether reported more than $10 billion in net profit for 2025 and $6.3 billion in excess reserves, according to its fourth-quarter attestation released in January. The results highlight the scale of Tether’s balance sheet and help explain its recent acquisitions and investments.

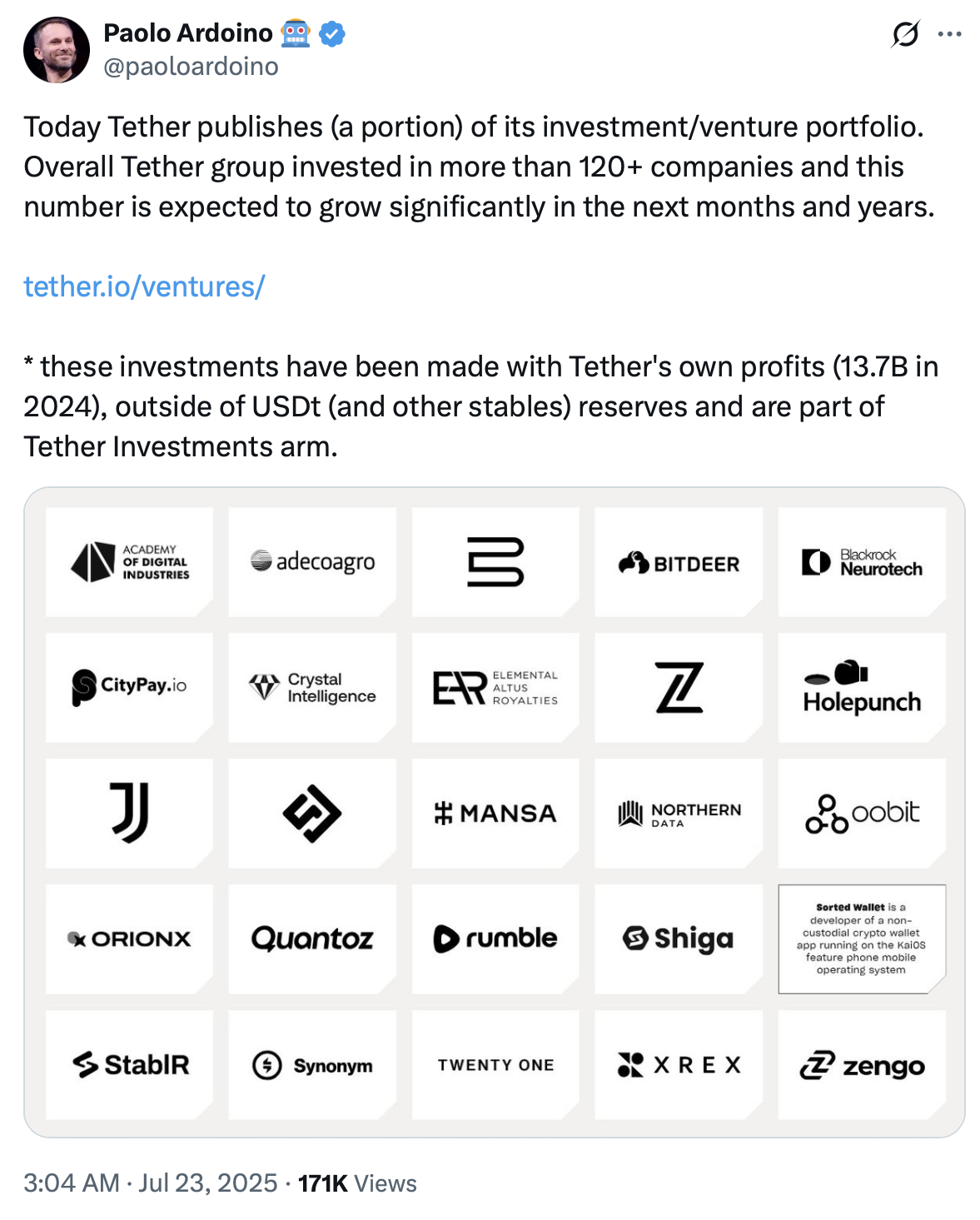

In July, CEO Paolo Ardoino said that Tether had invested in more than 120 companies using its own profits, adding that the portfolio was expected to grow further in the months and years ahead.

In November, Tether invested in Ledn, a platform that offers consumer loans backed by Bitcoin (BTC). The investment followed reports that Tether was also weighing a $1.15 billion investment in German robotics company Neura.

A month later, the company led an $8 million investment round in Speed, a Bitcoin payments company focused on enabling enterprise stablecoin transactions over the Lightning Network.

Tether has also been building up its Bitcoin reserves. On Jan. 1, it disclosed that it had added 8,888 Bitcoin at the end of 2025, bringing its total holdings to more than 96,000 BTC, according to Ardoino.

Although Tether is privately held, it would rank as the second-largest corporate holder of Bitcoin if it were a public company, according to data from BitcoinTreasuries.NET.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi