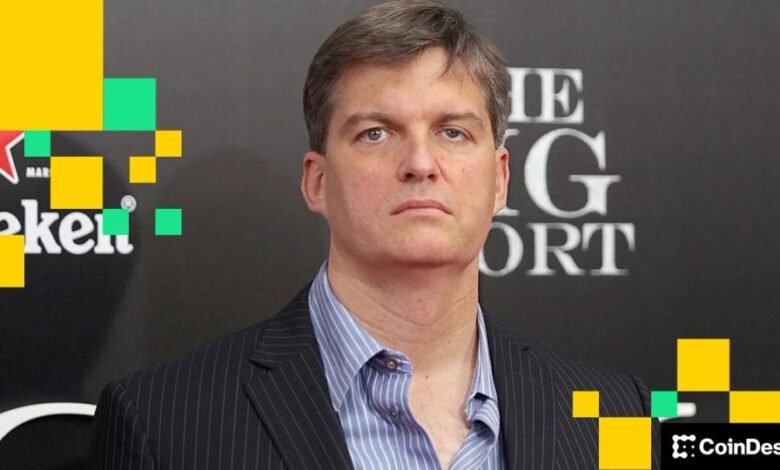

‘Big Short’ Michael Burry flags bitcoin pattern that predicts drop to low $50,000s

تكنلوجيا اليوم

2026-02-05 11:44:00

Perma-bears, much like their hyper bullish counterparts, love shoehorning patterns into the chaos to prop up their gloom.

Take Michael Burry, the “Big Short” oracle famed for doomsday calls, who’s now comparing bitcoin’s ongoing bear market with the 2022 brutal plunge , ominously hinting this crash has legs to run much deeper.

In a post on X in early Asian hours Thursday, Burry highlighted similarities between BTC’s drop from the October high of $126,000 to $70,000 and Bitcoin’s late 2021 and 2022 plunge, claiming in a chart that patterns match perfectly so far.

The previous bear market saw bitcoin fall from around $35,000 to below $20,000 before stabilizing — a move that, when mapped onto today’s price levels, implies risk toward the low $50,000s.

Burry did not spell out a target, but the visual comparison was enough to reignite debate over whether bitcoin is repeating an old script or whether the analogy is being stretched too far.

Analysts and traders questioned whether a single historical instance qualifies as a meaningful pattern at all.

“Is it a pattern if it happened once?” asked trading firm GSR, capturing a broader skepticism toward analog-driven market calls.

The critique goes beyond semantics, however, bitcoin’s 2021–22 collapse unfolded under very different conditions, marked by aggressive Federal Reserve tightening, collapsing crypto-native leverage and heavy retail participation.

On the other hand, today’s market is shaped by spot bitcoin ETFs, deeper institutional liquidity and a macro backdrop dominated less by rate hikes and more by cross-asset volatility tied to equities, commodities and artificial intelligence spending fears.

Still, Burry’s comments have landed at a sensitive moment.

Bitcoin has been whipsawing sharply this week, dropping below $71,000 before rebounding and then slipping again as global risk appetite deteriorated.

Burry’s history adds weight to the discussion, even when his calls prove controversial. His approach often centers on shifts in positioning and market psychology rather than precise forecasts.

In that sense, the chart functions less as a prediction and more as a warning about failed rebounds and dimmed conviction.