India shares seen higher on trade deal optimism, IT stocks in focus

2026-02-05 02:38:00

Indian shares are poised for a firmer open on trade deal optimism, though IT sector weakness and earnings risk may temper gains.

Summary:

-

Indian equities seen opening modestly higher on trade deal optimism

-

Recent US–India agreement lifts hopes of renewed foreign inflows

-

IT stocks remain a key downside risk after global tech sell-off

-

RBI decision on Friday expected to keep policy unchanged

-

Heavy earnings slate keeps single-stock volatility elevated

Indian equity markets are set to open slightly firmer on Thursday, supported by improving sentiment around foreign inflows after a recent trade deal with the United States, even as investors remain cautious amid global weakness in technology stocks and a busy earnings calendar.

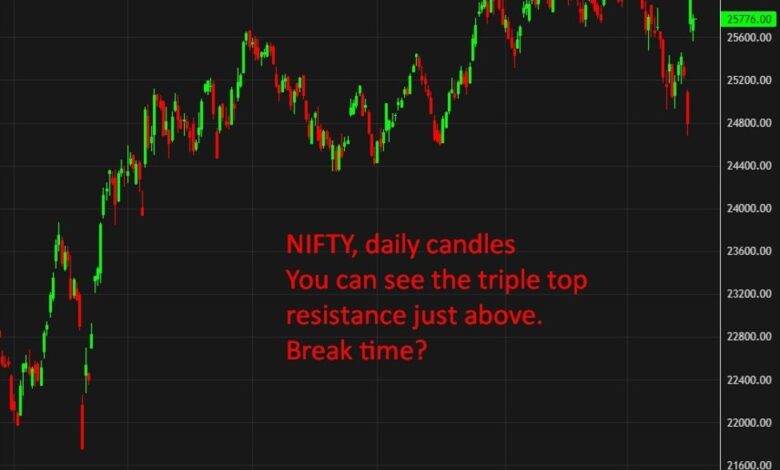

Early indicators pointed to a positive start, with Gift Nifty futures suggesting the benchmark Nifty 50 would open above its previous close. The upbeat tone follows a strong three-session rally across domestic equities, with both the Nifty 50 and the Sensex gaining close to 4% over the period.

The recent advance has been partly underpinned by optimism around a US–India trade agreement that reduced tariffs on Indian exports, reinforcing expectations that foreign portfolio investors could return after an extended period of heavy selling. Provisional data showed overseas investors were modest net buyers on Wednesday, marking a second consecutive session of inflows following a record sell-off through much of 2025 and into January.

Despite the improved tone, risks remain. Global equity markets have been rattled by a sharp sell-off in software and data services stocks, driven by concerns that rapid advances in artificial intelligence could disrupt traditional business models. Those worries spilled into Indian markets on Wednesday, when the Nifty IT Index slumped around 6% in its steepest one-day decline in nearly six years.

The weakness in IT shares has injected a note of caution into an otherwise improving market backdrop, with investors wary that further downside in global tech could weigh on sentiment. As a result, traders are likely to remain selective, favouring sectors tied to domestic demand while closely monitoring technology names.

Attention is also turning to monetary policy, with the Reserve Bank of India set to announce its policy decision on Friday. The central bank is widely expected to leave interest rates unchanged, keeping the focus on guidance around inflation and growth rather than immediate policy action.

Earnings will remain a major driver of stock-specific moves, with several high-profile companies due to report results, including Bharti Airtel, Hero MotoCorp, Tata Motors’ passenger vehicle unit, Life Insurance Corporation of India, and Nykaa.

(via Reuters, summarised)