Bitcoin mining profit crisis hits as difficulty to drop by 14% this weekend while block time spikes to 20 minutes

While price action has always been volatile and, arguably, exciting, the Bitcoin network itself is built to feel boring. Ten minutes per block, tick tock, rinse and repeat, a metronome you can set your watch to.

Then every so often, it gets very human again.

Early this morning, block production slowed enough that the average block time briefly spiked to 19.33 minutes. On the surface, it appears to be a technical issue. Below, it reads like a real-time pulse check of an industry that operates on thin margins, loud fans, cheap power, and a lot of stress.

When miners shut down their machines, the network does not immediately adjust. Bitcoin’s difficulty only updates every 2,016 blocks, so if the hashrate drops quickly, blocks come in slower until the next retarget. That gap between reality and the protocol’s response is where you get the weird mornings, the longer waits, the uneasy posts in mining chats, the quiet “something’s off” feeling.

Right now, “off” looks a lot like miners backing away.

The network is telling you miners are stepping back

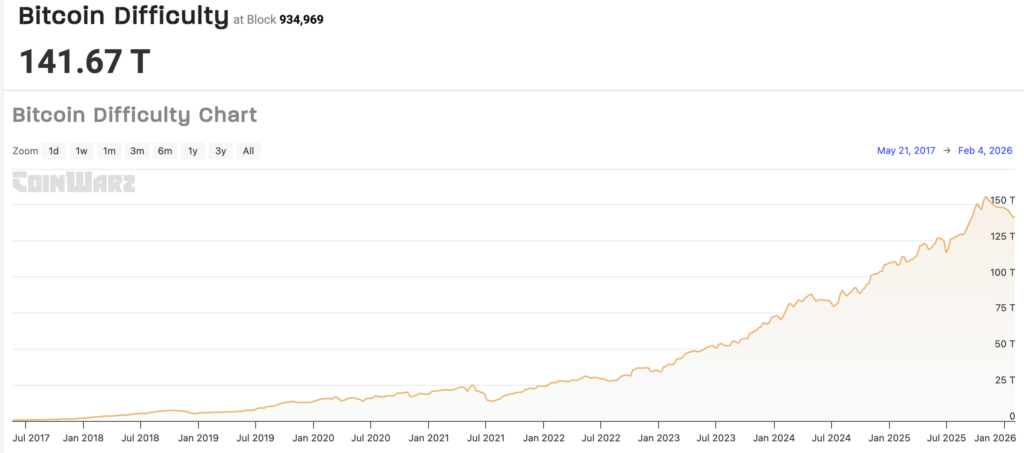

Over the last stretch of difficulty adjustments, more of them have been negative, and that matters because difficulty is Bitcoin’s way of matching the workload to the number of machines competing to solve blocks.

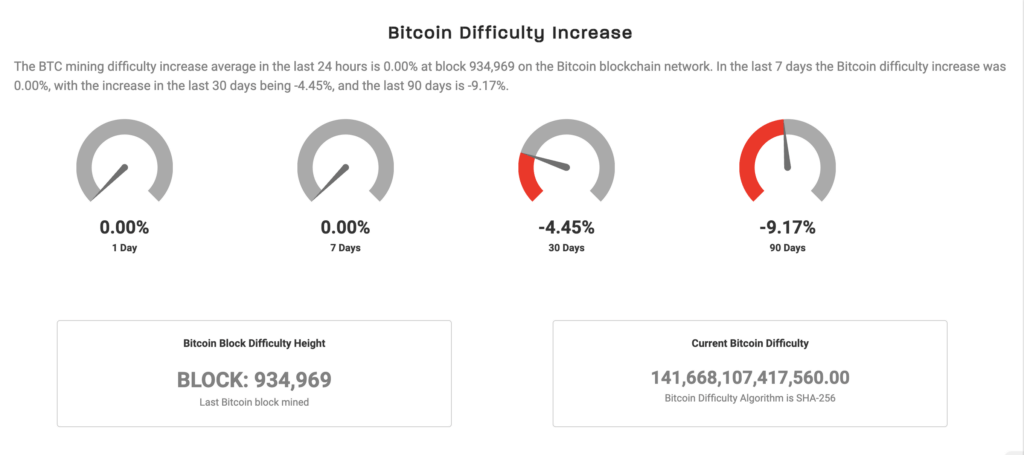

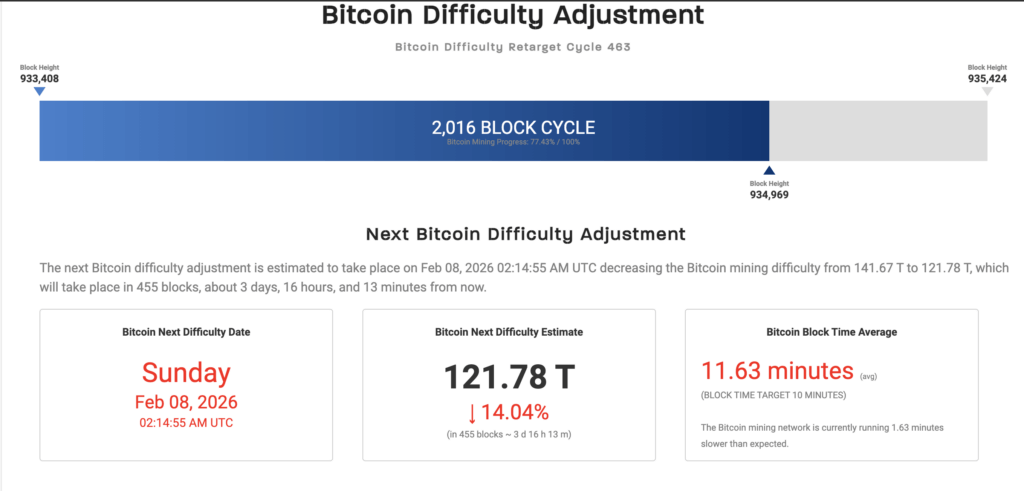

Hashrate Index’s latest weekly roundup noted the most recent difficulty adjustment on Jan. 22 came in at a -3.28% cut, bringing difficulty to about 141.67T, and it flagged an early estimate for another large negative adjustment in the next cycle, around the Feb. 8 window, with early-epoch projections bouncing near the mid-teens percentage range, while cautioning those estimates can change as the epoch develops.

Other trackers are landing in the same neighborhood. On mempool, the estimated next adjustment is a decline near 15%, and the site’s dashboard has average block time running around the 11 to 12 minute range in the current stretch.

That is slower than the ten-minute target, and it matches the story the charts are trying to tell, miners pulled back, the network is slogging along, the protocol is waiting for the next recalibration.

CoinWarz puts the next difficulty estimate at 121.78T, down about 14.04%, with the average block time around 11.63 minutes, and the retarget date pointing to Feb. 8.

The next adjustment is, therefore, set to be the sharpest drawdown since the post-China-ban era. A block-time spike is a symptom. A run of negative difficulty adjustments is a diagnosis.

Why a 14 to 18% difficulty cut would be a big deal

A double-digit difficulty cut is the protocol admitting the mining economy has changed fast enough that the previous setting no longer fits. For people outside mining, it’s background noise. For miners, it is the difference between a fleet that limps along and a fleet that has to shut the lights off.

If the next adjustment lands around 14 to 18%, it would be large enough to put a marker down, especially coming after multiple negative adjustments in recent months. It would also be a reminder that Bitcoin’s difficulty algorithm is a shock absorber, not a crystal ball.

A move that size has happened before, and bigger ones have too.

The largest single downward difficulty adjustment on record came in early July 2021, when difficulty fell about 28% after China’s mining crackdown forced a massive chunk of the global hashrate offline.

So a 14 to 18% cut has precedent, and the network has seen much worse, the context is different though, the China era was a sudden geopolitical shock, today’s pressure looks like a slower squeeze, price, power, and profitability grinding against each other.

The impact for traders is the margin call

Mining is a business where the product is math and the input is electricity, which means the industry lives and dies by spreads.

When Bitcoin’s price falls, miners earn fewer dollars for the same amount of Bitcoin. When power costs rise, or when a region tightens supply during weather events, their input costs climb. When both happen together, older machines and higher-cost sites get pushed out first.

That is why the story keeps snapping back to “who can stay online.”

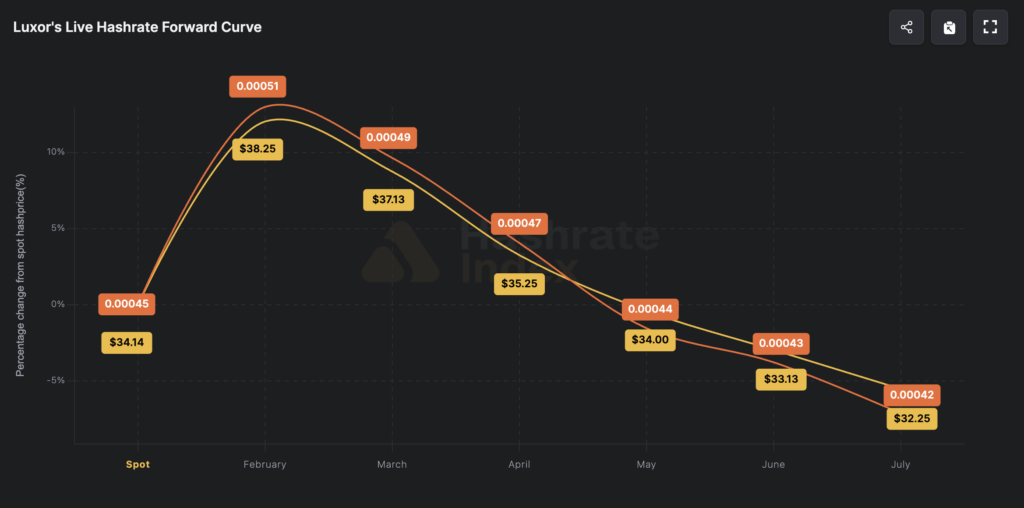

Hashrate Index’s roundup pegged USD hashprice around $39.22 per PH per day in its snapshot, which is one of the clearest shorthand metrics for miner revenue, and it noted that the forward market was pricing an average hashprice around $39.50 over the next six months.

However, the sharp price drop over the last week has since brought the 6-month forward market pricing down to $32.25.

That little detail is easy to skim past, and it might be the most useful forecasting anchor in the whole dataset. The fact that it repriced lower so quickly suggests the market is settling into a tighter, weaker profitability band rather than betting on a fast recovery.

If you talk to miners when hashprice compresses, the language gets less theoretical. It turns into power contracts, curtailment programs, lenders, machine loans, and the constant question of whether to keep plugging in gear that earns pennies over power, or to shut down and wait for difficulty to come to you.

That is what negative adjustments do, they act like relief.

When difficulty drops, every miner who stays online earns a bit more Bitcoin per unit of hashrate, all else equal. Some of the machines that were pushed out can come back. Some operators get to breathe again.

It is one of Bitcoin’s strange balancing acts, the protocol is indifferent, but the outcome is deeply personal for the people running warehouses of hardware.

What happens next, three paths to watch

The cleanest narrative from here is a difficulty relief bounce.

Difficulty cut

If the network cuts difficulty by something like 14 to 18%, block times should drift back closer to ten minutes, and profitability for online miners improves immediately.

That tends to slow the bleeding, and it can even bring some hashrate back, especially if the underlying issue was marginal economics rather than an external shock. The mempool dashboard on mempool gives a real-time view of whether block times are mean-reverting.

Difficulty cut and price decline

A tougher path is a prolonged squeeze.

Difficulty can fall, and miners can still struggle if Bitcoin’s price keeps sliding, or if energy costs stay elevated, or if credit conditions tighten further for mining firms that rely on financing.

In that world, you can see a loop, hashrate declines, difficulty adjusts down, revenue relief arrives, price pressure returns, and weaker operators get tapped out anyway.

Difficulty cut, price decline, and miner pivot

A third path is quieter, and it is about structural change.

Mining has been drifting toward flexible, power-aware operations for years, the miners that can curtail during peak prices and ramp up when the grid is cheap tend to survive longer.

The industry is leaning harder into that model, along with a shift toward AI. As certain regions face recurring curtailment and more power is diverted to AI, the hashrate line may stay lower for longer, and difficulty adapts to a new equilibrium.

Beyond the immediate operational changes, the shift signals how miners are being forced to adapt to tighter margins, evolving regulatory pressures, and increasing competition for energy resources.

As the industry matures, these adjustments could reshape the balance of power among mining firms, accelerate consolidation, and influence Bitcoin’s long-term network security and decentralization.

What this means for everyone else

For ordinary Bitcoin users, a slower block cadence mostly shows up as waiting, and sometimes as higher fees when demand stacks up. It is not usually catastrophic. It is more like traffic.

For miners, it is the entire business.

For the broader market, it is one of the few times you can see the invisible infrastructure wobble in public, the base layer showing its seams. Bitcoin’s security model is tied to miner revenue in dollar terms, and when that revenue compresses, the conversation about network health gets louder.

The thing is, Bitcoin is designed to keep going through this. Difficulty adjusts. Blocks keep arriving. The metronome finds the beat again.

The interesting part is the story inside that adjustment, the people on the other end of the machines, the operators doing the math at 3 a.m., deciding what stays on and what goes dark, and the network quietly recording those choices in the only language it knows, time between blocks.

If the next retarget lands anywhere near the mid-teens, it will read as a clear signal that miners are stepping back in a meaningful way, and it will also be a reminder that the protocol is still doing what it has always done, absorbing the shock, resetting the difficulty, and letting the system move forward, one block at a time.