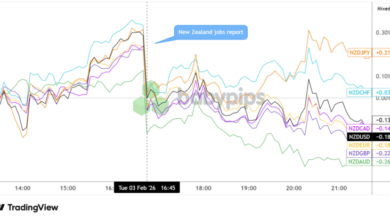

China services PMI rises to three-month high as demand and hiring improve

2026-02-04 02:02:00

China’s services sector started 2026 on firmer footing, though confidence remains cautious despite easing cost pressures.

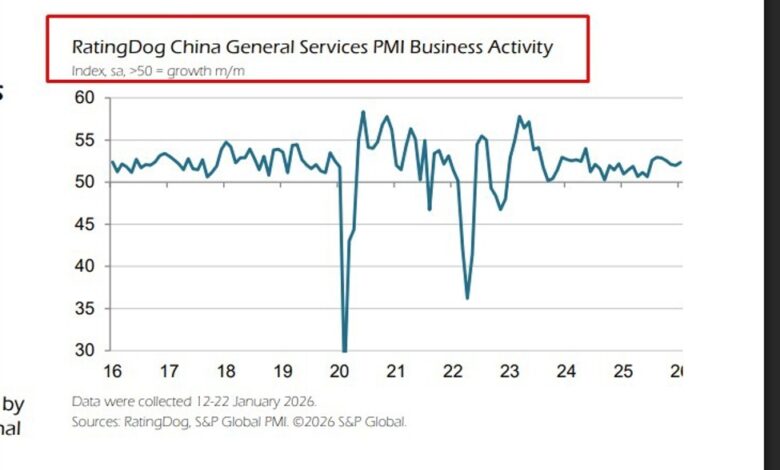

Via private survey RatingDog / S&P Global.

Summary:

-

China’s services sector accelerated to a three-month growth high in January

-

New business and export orders strengthened at the start of 2026

-

Employment rose for the first time in six months

-

Cost pressures eased, while selling prices stabilised

-

Business confidence softened despite improved activity

China’s services sector gained momentum at the start of 2026, with business activity expanding at its fastest pace in three months as demand conditions improved both domestically and overseas. The latest PMI data showed a modest but broad-based acceleration, underpinned by stronger new orders and a return to growth in export-related business.

The Services Business Activity Index edged higher to 52.3 in January from 52.0 in December, remaining firmly above the 50 threshold that separates expansion from contraction. This extended the current run of growth in China’s services sector to just over three years and signalled a stable start to the year.

The improvement was driven primarily by faster growth in new business, with firms citing successful promotions, stronger client interest and new product launches as key supports. External demand also improved, with new export orders returning to expansion after contracting late last year, marking the second rise in overseas demand in the past three months.

Stronger inflows of new work fed through to employment. Service-sector staffing levels rose for the first time since July, although the increase was modest and marked only the fourth instance of employment growth over the past year. The rise in labour supply helped prevent a sharper build-up in backlogs, with outstanding business continuing to increase only marginally despite quicker order growth.

Price dynamics were more favourable. Input costs continued to rise, driven mainly by higher fuel and purchased item prices, but the pace of cost inflation eased to a five-month low. At the same time, output prices were broadly unchanged, suggesting some relief in downstream pricing pressures and limited ability or willingness among firms to pass costs on to customers.

At the broader economy level, the Composite Output Index rose to 51.6 from 51.3, pointing to a modest acceleration in overall business activity across both services and manufacturing. New orders at the composite level strengthened, supported again by improved export demand, while staffing levels increased to help work through outstanding business. Notably, composite output prices rose for the first time in more than a year, reflecting stabilising margins amid easing cost pressures.

Despite firmer activity, business sentiment softened. While firms remain broadly optimistic about growth over the coming year, confidence dipped below its 2025 average as concerns about the global economic outlook weighed on expectations. Looking ahead, seasonal support from the extended Spring Festival holiday may lift consumer-facing services, though producer services could see a temporary lull, leaving the recovery dependent on sustained domestic demand.