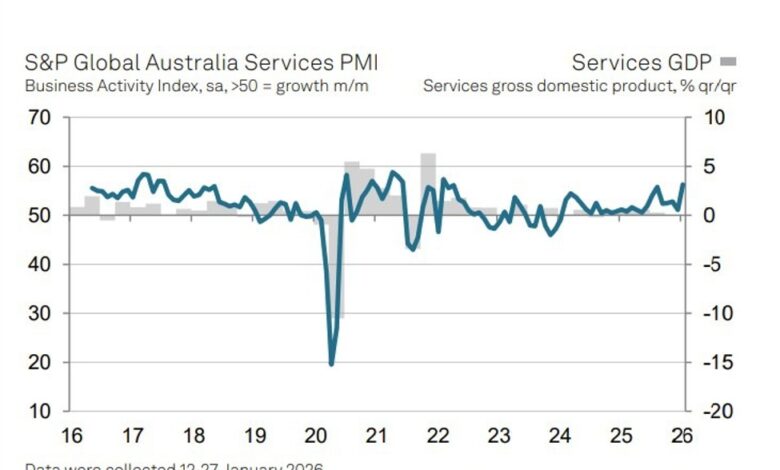

Australia services PMI hits near four-year high as demand surges in January

2026-02-03 22:11:00

Australia’s services sector surged to a near four-year growth high in January, but softer confidence signals caution beneath the strong activity rebound.

Summary:

-

Australia’s services sector posted its strongest growth in nearly four years in January

-

New business rose at the fastest pace since April 2022, including stronger export demand

-

Hiring accelerated for a second straight month, though labour constraints remain

-

Input and output price pressures eased, signalling cooling inflation dynamics

-

Business confidence slipped despite stronger activity, reflecting global growth concerns

Australia’s services sector began 2026 on a strong footing, recording its fastest expansion in activity in almost four years, as a sharp rise in new business lifted output and prompted firms to step up hiring. The latest PMI data showed services activity accelerating well above the 50-mark that separates growth from contraction, extending the sector’s expansionary run to two years and marking the strongest reading since early 2022.

The pickup in activity was driven primarily by a surge in new business, with order growth accelerating for a third consecutive month to its fastest pace since April 2022. Firms reported that successful business development initiatives and broader customer reach helped underpin demand, while external conditions also improved. Export-related orders increased as service providers gained traction in overseas markets, adding another layer of support to overall activity.

Rising workloads flowed through to employment, with service firms lifting staffing levels at the fastest pace since September. Hiring growth has now accelerated for a second straight month, reflecting efforts to keep pace with expanding order books. Even so, labour constraints remained evident, and combined with strong demand, contributed to a further build-up in outstanding work.

Encouragingly, price pressures showed signs of easing. While input costs continued to rise, largely due to wages and supply-related expenses, the pace of cost inflation slowed to a 14-month low. Output price inflation also moderated, easing to its softest rate in two months, suggesting that disinflationary forces are gradually gaining traction within the sector.

At the broader economy level, the Composite Output Index also strengthened sharply, pointing to the fastest expansion in private-sector activity in nearly four years, with both services and manufacturing contributing to the improvement. New orders across the economy similarly rose at the quickest pace since April 2022, reinforcing the sense of a strong start to the year.

Despite these positives, business confidence weakened in January, falling to its lowest level since October 2024. Firms cited heightened competition and uncertainty around the global economic outlook as key headwinds, leaving the near-term growth picture mixed despite the strong momentum in current activity.

Earlier: