Bitcoin’s Next Step May Depend On US Credit And Debt Conditions

Bitcoin (BTC) scratched new lows below $73,000 on Tuesday as data shows troubling macroeconomic challenges bubbling below increasingly volatile markets. New data highlights tightening credit conditions, even as the US debt and borrowing costs stay elevated, and one analyst says this gap between credit pricing and credit market stress may define Bitcoin’s price trajectory for the upcoming months.

Key takeaways:

The ICE BofA US Corporate Option-Adjusted Spread is at 0.75, its lowest level since 1998.

US debt stands at $38.5 trillion, while the 10-year Treasury yield is 4.28%.

Bitcoin whale inflows to exchanges have risen, but the pace of onchain profit-taking is easing.

Tight credit spreads contrast with rising economic strain

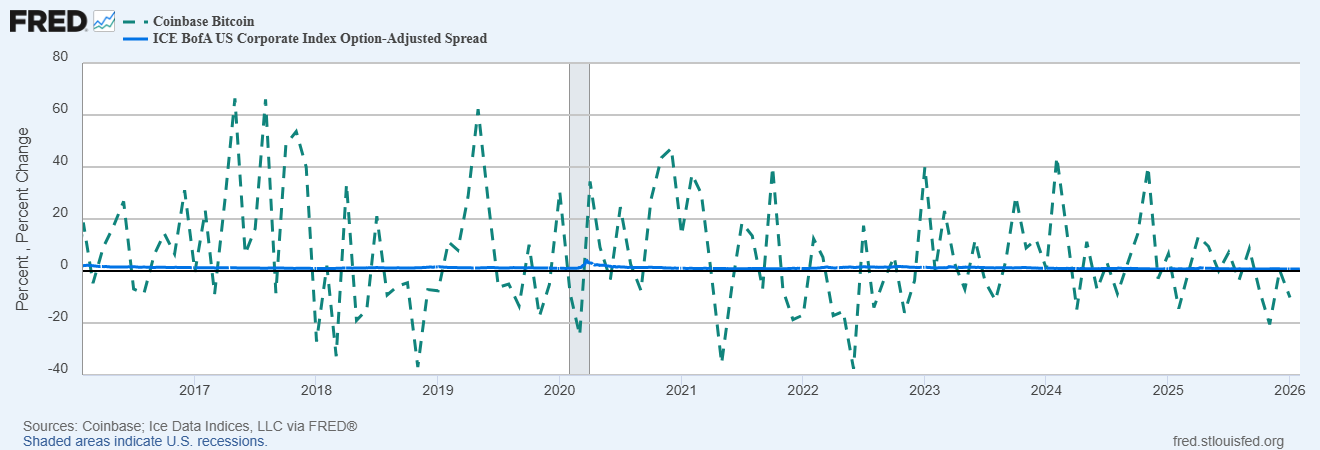

The ICE BofA Corporate Option-Adjusted Spread may act as a key macroeconomic signal for Bitcoin. The metric tracks the extra yield investors demand for holding the corporate bonds over US Treasurys. When spreads widen, it usually reflects stress in the credit markets.

Currently, the spreads are compressed, suggesting the risk is still underpriced. This is notable given the current market. US government debt reached $38.5 trillion at the end of January, and the 10-year Treasury yield, after briefly falling below 4% in October, has climbed back to 4.28%, which is keeping the present financial conditions tight.

In previous Bitcoin market cycles, including 2018, 2020, and 2022, BTC formed a local bottom only after the credit spreads began to widen. That process played out within a three-to-six-month delay, rather than an immediate effect.

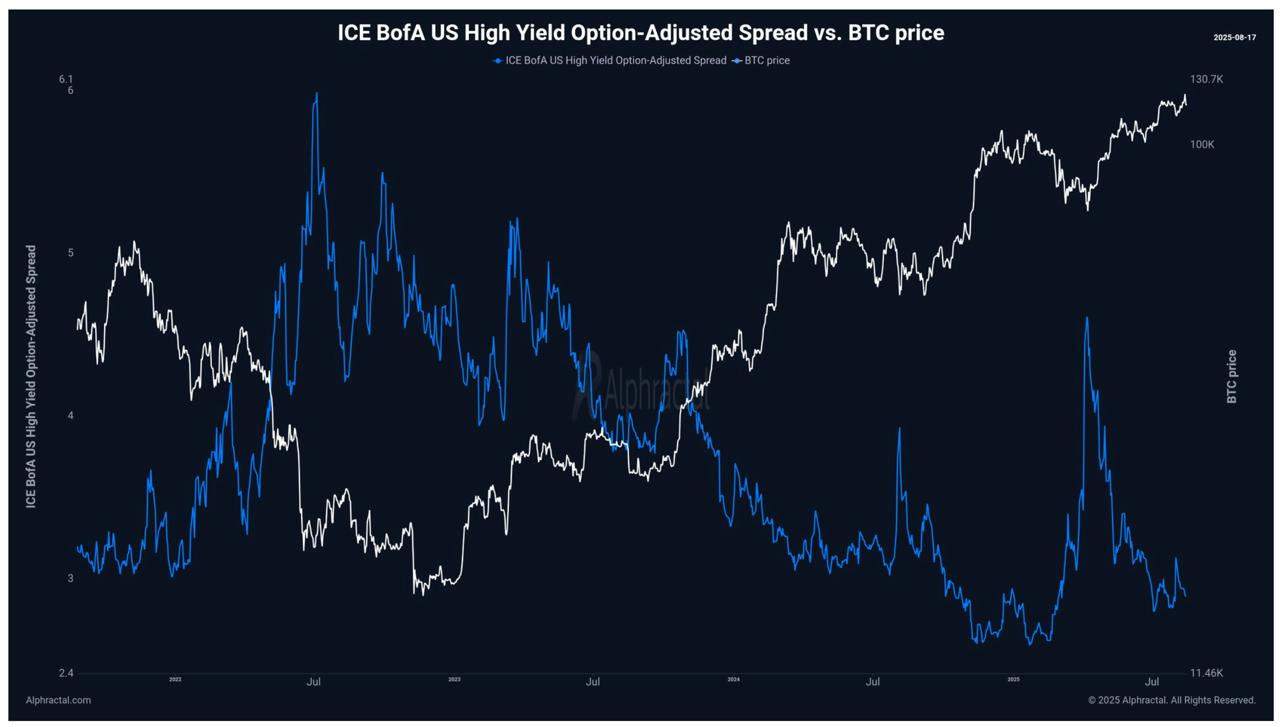

In August, 2025, Alphractal founder Joao Wedson argued that if liquidity tightens and credit spreads rise in the coming months, Bitcoin could enter another accumulation phase before the broader market stress becomes visible.

Related: Bitcoin, crypto ‘winter’ soon over, says BitWise exec as gold retargets $5K

Bitcoin whale selling rises, but longer-term pressure is cooling down

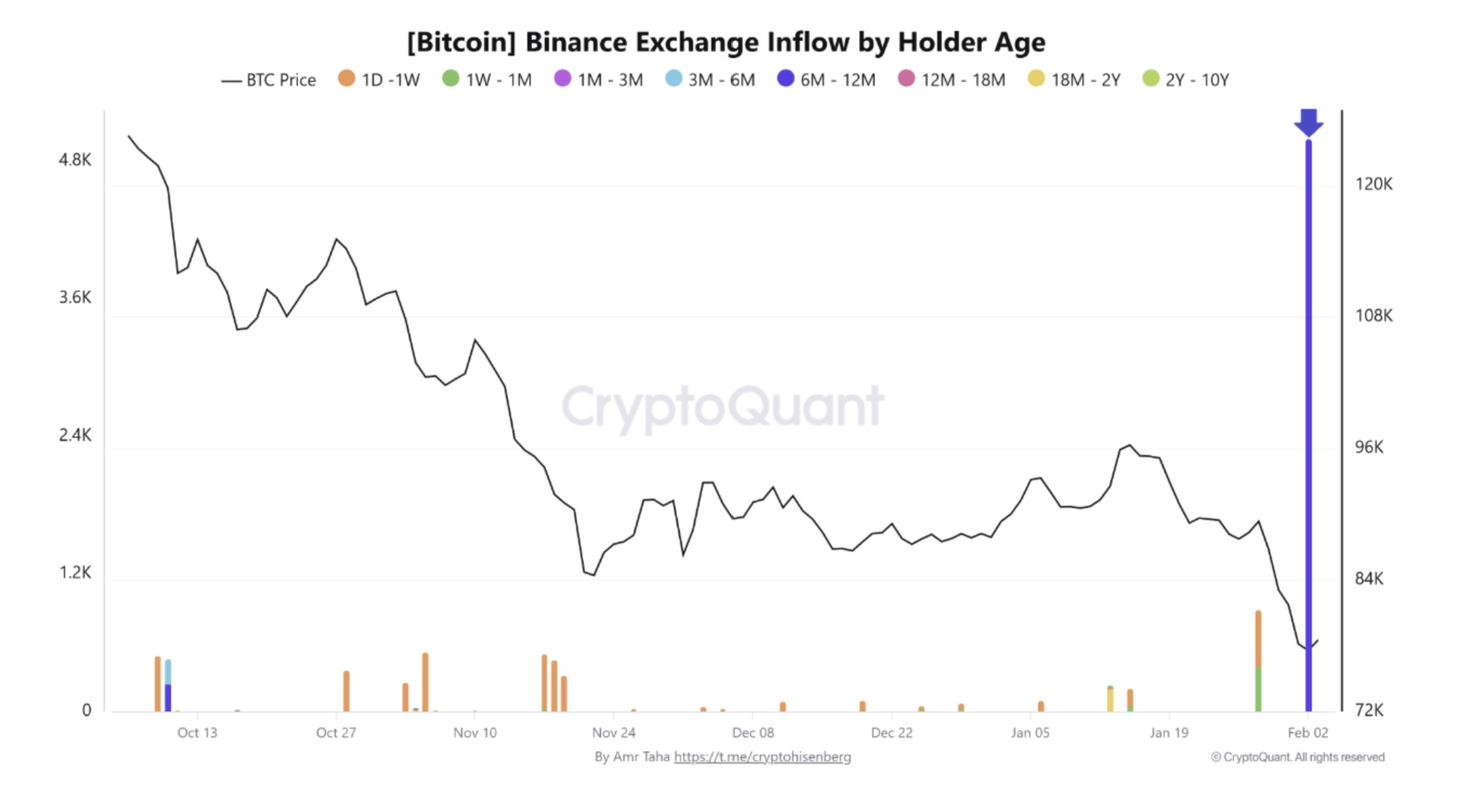

Short-term selling activity has increased for Bitcoin this week. Crypto analyst Amr Taha noted that both whales and mid-term holders recently transferred a significant amount of BTC to Binance. On Monday, wallets holding more than 1,000 BTC deposited about 5,000 BTC, matching a similar spike seen in December.

At the same time, holders from the 6-to-12-month age group also moved 5,000 BTC to exchanges, the largest inflow from this cohort since early 2024.

However, broader selling pressure appears to be fading. CryptoQuant data shows the spent output profit ratio (SOPR) has dropped toward 1, its lowest level in a year, as Bitcoin dropped to a year-to-date low of $73,900 on Tuesday.

Historical patterns outline that a Bitcoin bottom has played out between three-to-six months after credit spreads begin to widen. Rising Treasury yields may pressure the credit markets, potentially driving spreads toward the 1.5–2% range through April.

This may lead to an accumulation window between May and July 2026, as the market absorbs this stress, aligning with the current SOPR data, signalling long-term seller exhaustion.

Related: Bitcoin flash crash recovery to $100K could take months: Analyst

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.