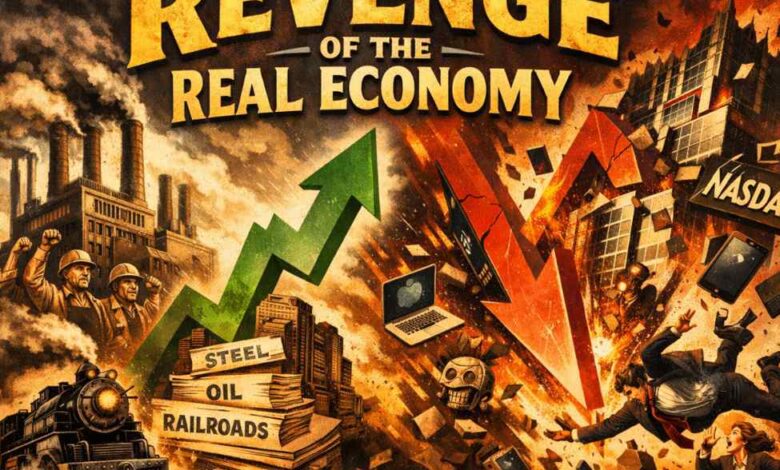

Big divergence hits US stocks: Is the cyclical trade back on?

2026-02-03 15:22:00

US equity markets have quickly turned lower after a positive open and it’s largely being driven by tech. The Nasdaq is now down 1% and some laggards include:

- PYPL -17.7%

- INTU -1.8%

- MU -5.1%

- ADBE -4.9%

- NVDA -2.8%

- MSFT -2.2%

- ASML -3.6%

Those big losers obscure some large gains on the other side of the economy. Yesterday, I highlighted a breakout in transports and that’s continuing today. Miners are also back in the green after the rout on Friday/Monday.

- AAL +3.8%

- FCX +5.9%

- ULA +3.9%

- DOW +3.8%

- CLF +4.9%

Today, the Fed’s Barkin said US economic data for the last month-and-a-half has been encouraging on the demand side. We could be finally seeing a hand off from tech to the real economy. I don’t think it will take much because things like housing, materials and old industrial stocks have been beaten up so badly over the past two years. There’s a big relative valuation shift there and they’re classic cyclical stocks.

Both the Fed and the government have been trying to manufacture a resurrection of the old economy and this week’s ISM manufacturing report rose to 52.6 from 48.5. It’s just one number but the S&P Global survey was a bit better and so was the Chicago PMI. Plus, look at the new orders component:

I would be wary that’s an aberration but it’s worth clawing through the earnings transcripts of these old economy stocks to see what they’re saying about a turn in demand.

Right now there is an impressive amount of resilience on a day when broad stock markets are down. To me that screams that someone is rotating. Last week, I highlighted how David Tepper seemed to be making a bet on this kind of cyclical rotation and his Whirlpool stock has continued to bounce from the earnings rout and is up another 6% today.