Institutions call it a bear market but still say Bitcoin is undervalued

In a global investor survey from Coinbase Institutional and Glassnode, 1 in 4 institutions agreed that crypto has now entered a bear market. Yet the majority of institutions still said Bitcoin was undervalued, and most said they had held or increased exposure since October.

That discrepancy matters because it captures how institutions are positioning right now: caution about the regime, a willingness to stay allocated, and a preference for concentrating risk in Bitcoin rather than in smaller, more volatile tokens that can unwind quickly when leverage comes out.

A bear market label, a value bid

The report’s market framing explains why the paradox exists.

October’s deleveraging did real damage to altcoin price action, but Bitcoin dominance barely moved, edging from 58% to 59% in the fourth quarter of 2025.

That stability matters because it shows the selling wasn’t evenly distributed. It was a washout in the long tail more than a broad rejection of crypto, with Bitcoin acting like the asset you keep when you’re cutting risk but not exiting the category.

David Duong, Coinbase Institutional’s global head of research, offered a clean way to reconcile the “bear market” language with “undervalued” conviction in an interview for CryptoSlate.

His point was that institutions often use cycle labels to describe regime and positioning, while “value” is a longer-horizon assessment tied to adoption, scarcity, structure, and the policy backdrop.

“When institutions assess Bitcoin’s value, they look beyond near-term price action to factors such as adoption, scarcity, improving market structure, and clearer regulatory frameworks.

Historically, bear markets often signal periods of tighter liquidity and weaker sentiment that ultimately lay the foundation for renewed institutional participation and future growth.

In other words, when an investor calls this a bear market (and that’s not our view, by the way), they’re describing the phase of the cycle and prevailing risk appetite.

Positioning may be defensive, liquidity is selective, and price action might either be trending lower or chopping with a negative skew.

They’re talking about the regime we’re trading in right now, not where they think Bitcoin should ultimately settle.”

The report’s own data lines up with that interpretation. It shows a market that has stopped rewarding indiscriminate risk-taking but hasn’t lost the bid for the largest assets.

Coinbase and Glassnode say perpetual futures were hit hardest, with their systematic leverage ratio falling to 3% of the total crypto market cap (excluding stablecoins).

At the same time, options open interest spiked as traders rushed to defend against further price weakness.

As an institution, if your instinct is that it’s a bear market, you buy insurance, reduce liquidation risk, and keep the exposure you still want through vehicles that won’t force you out at the worst possible time.

From perps to protection

The easiest mistake to make here is to treat “undervalued” as a single valuation model that everyone shares.

In practice, both the report and Duong describe a bundle of assumptions that looks more like market structure than a neat discounted cash flow argument.

Start with what changed in derivatives.

The report says BTC options OI has overtaken perpetual futures OI, with the 25-delta put-call skew in positive territory across 30-day, 90-day, and 180-day expiries, and that doesn’t happen in a market that’s trying to maximize upside through leverage.

It happens in a market that’s willing to stay long, but determined to define risk.

Duong described the same migration to options when asked what institutions did after October’s liquidation reset:

“Institutional interest in expanding on-chain remained after the October reset, but in a measured, multi-venue way.

Moreover, institutions increasingly expressed views via options and basis trades, which give convexity or carry without the same liquidation risk that drove the October move.”

That last line is the key, and it shows that institutions changed how they take exposure.

Options and basis trades aren’t headline-making strategies, but they are how a professional book stays in the game when the regime punishes overextension.

On-chain data is telling the same story.

Coinbase and Glassnode say sentiment, as measured by entity-adjusted NUPL, deteriorated from Belief to Anxiety in October and stayed there through the quarter. While that’s certainly not euphoric, it isn’t capitulation either.

The drop in entity-adjusted NUPL shows the market stopped paying you for optimism, but is still hanging around. This interpretation fits a world where investors can be wary about the current phase while still seeing the asset as cheap relative to where they think the equilibrium sits.

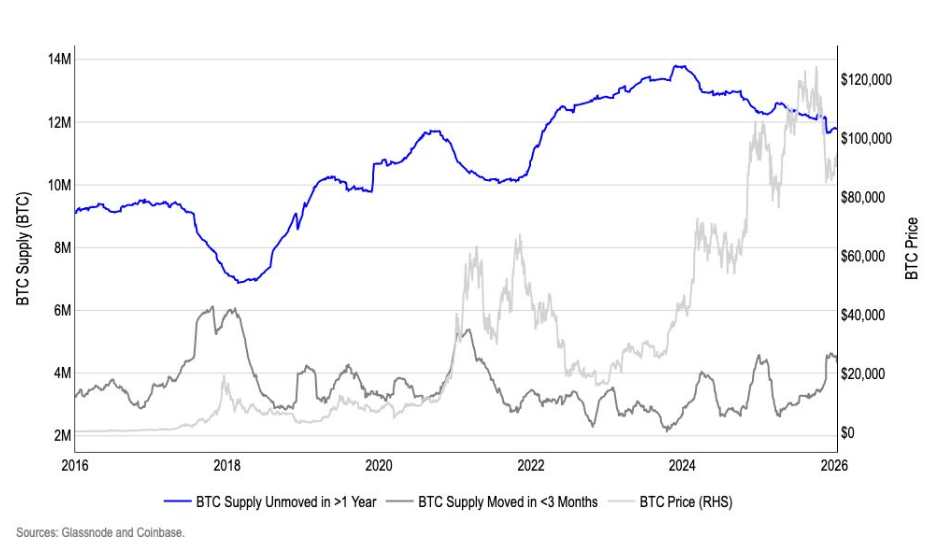

The report also notes that, in the fourth quarter of 2025, BTC that moved within three months rose by 37%, while BTC that remained unmoved for more than a year fell by 2%, which the authors interpret as a distribution phase late in 2025.

If you want to take the institutional viewpoint seriously, distribution doesn’t have to be a death sentence. It can mean large holders de-risked into strength, and the market is now trying to find the next set of hands that will own supply without needing a constant liquidity drip.

This is where the claim about Bitcoin being “undervalued” stops being about a single fair-value number and starts being about the belief that Bitcoin has become the only asset in crypto that can absorb capital in size without needing a retail bid to hold the structure together.

Duong explicitly separated Bitcoin’s underwriting framework from the rest of the crypto market:

“Unlike retail participants, who often focus on short-term price movements and market cycles, institutions place less emphasis on timing and more on Bitcoin’s long-term value proposition.

In this context, Bitcoin is increasingly treated as a strategic, store-of-value asset and macro hedge, rather than a speculative token within the broader crypto universe.”

That maps onto what the report says about large-caps versus small-caps.

Their topline view for the first quarter of 2026 favors larger-cap tokens, with smaller caps still dealing with October’s aftermath.

Given this, seeing Bitcoin as “undervalued” may be less about it being cheap in isolation and more about it being the only crypto asset that institutions can treat as a durable allocation when the regime is unfriendly.

Liquidity is the real cycle

The second pillar of the paradox is the time horizon.

Calling something a bear market is usually a shorter-window judgment, while calling something undervalued is often a longer-window judgment. The bridge between them is whether institutions still believe the market is ruled by a four-year clock, or whether they have moved toward a macro framework where liquidity, rates, and policy do most of the work.

Duong’s view is that the four-year cycle still exists as a behavioral reference point, but institutions don’t treat it as a hard model.

He argued that the halving has less power for institutions once you control for the macro variables that drive all risk assets:

“In our conversations with these entities, the four-year cycle is still a reference point, but mostly as a behavioral template rather than a hard model.

They’ll look at where we are relative to prior cycle lows/highs, halving dates, and typical drawdown/recovery patterns, because those levels matter for positioning and sentiment.

That said, the evidence that halvings causally drive each cycle is weak: we only have four observations, and they’re heavily confounded by big macro and policy shifts (QE, COVID stimulus, etc.).

In our 2026 Outlook, we explicitly argue the economic relevance of the halving is somewhat specious once you control for liquidity, rates, and dollar dynamics.”

The report points to December CPI holding at 2.7%, and cites the Atlanta Fed GDPNow projecting 5.3% real GDP growth for the fourth quarter of 2025. It outlines a base case where the Fed delivers the two rate cuts (50 bps total) priced into fed funds futures, which the authors view as a tailwind for risk assets.

They also flag a cooling jobs market, with 584,000 jobs added in 2025 versus 2 million in 2024, and they name AI adoption as one driver of that moderation.

You don’t need to buy every macro inference to see what’s happening: the institutional view of Bitcoin being “undervalued” is built on a macro-and-liquidity scaffold rather than a pure crypto-cycle scaffold.

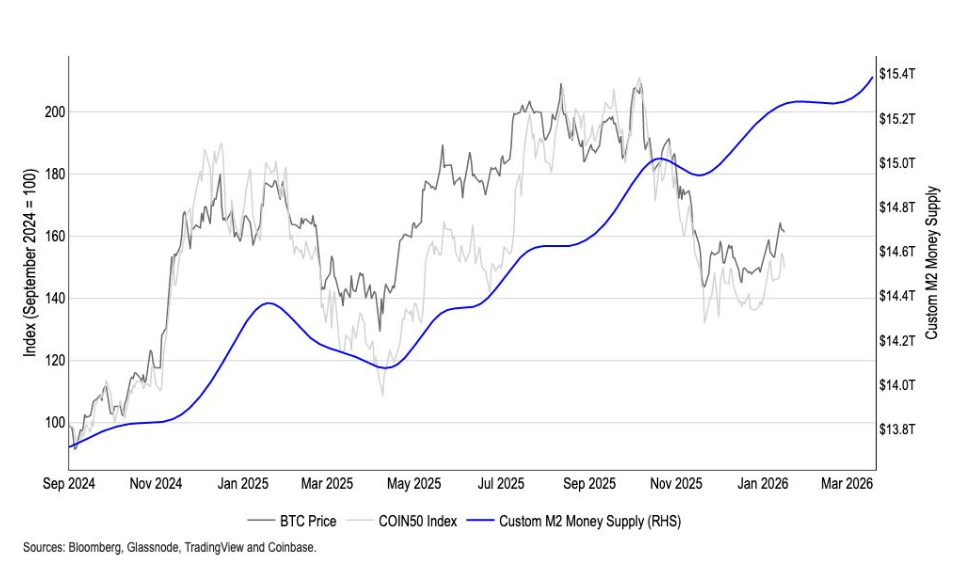

The report’s liquidity section makes that explicit with a custom Global M2 index that Coinbase says leads Bitcoin by 110 days and shows a 0.9 correlation with BTC’s moves across many look-back windows. If you accept that framing, the paradox becomes easier to understand.

You can look at the regime, see the scars from October, see a market that still wants downside protection, and still conclude that Bitcoin sits in a favorable long-duration setup if policy and liquidity do what you expect them to do.

Only then does “bear market” become a description of how the market behaves today, and “undervalued” becomes a statement about how that market reprices once the macro inputs turn more supportive.

So what would break this thesis?

Duong rejected the idea that a routine pullback would be enough and instead pointed to a cluster of macro and on-chain conditions that would have to fail together:

“Institutions aren’t anchoring on price alone, they’re anchoring on macro liquidity conditions and onchain market structure.

The clearest signal that they might be wrong wouldn’t be a routine pullback, but a breakdown in the fundamental drivers of that thesis.

In other words, it wouldn’t be one signal alone, but it would have to be a cluster of signals.

For example, if macro liquidity conditions were to turn decisively against risk assets, if onchain accumulation metrics were to reverse, if long-term holders were distributing into weakness, and if institutional demand indicators were to trend persistently negative, that combination might meaningfully challenge the view that Bitcoin is undervalued or structurally supported at present.”

The survey numbers suggest institutions are split on what phase the market is in, but aligned on Bitcoin’s relative appeal.

The report’s charts show how that belief expresses itself in real positioning: less reliance on fragile leverage, more use of options for defined risk, and a market that has cooled without fully breaking.

Duong’s answers add connective tissue to this thesis that shows “undervalued” is a framework anchored to liquidity, structure, and time horizon, not a vibe check of the market.

Whether institutions end up right depends less on winning a short-term argument about cycle labels and more on whether that framework holds together when the next macro test arrives.