Strategy’s BTC Holdings Flip Red as Bitcoin Crashes to as Low as $75,500

Bitcoin saw a sudden weekend liquidity cascade that took BTC price to near $75,000 for the first time since its April 2025 low.

Bitcoin (BTC) fell over 7% during weekend trading as a fresh price collapse liquidated $800 million.

Key points:

Bitcoin drops to near its 2025 low as mass liquidations accelerate.

BTC price action fails to hold $80,000 and its key true market mean level.

Strategy’s 700,000 BTC corporate treasury falls into the red versus its aggregate cost basis.

BTC price collapses below $76,000

Data from TradingView showed BTC price losses taking BTC/USD below $80,000 for the first time since April 2025.

Already licking their wounds from a brutal week, Bitcoin traders faced stronger downside as low-liquidity weekend conditions exacerbated volatility.

At the time of writing, BTC/USD traded below $78,000, with the April 2025 bottom near $74,500 now in focus.

“Local Low at $80.5k was annihilated,” Keith Alan, cofounder of trading resource Material Indicators, reacted on X.

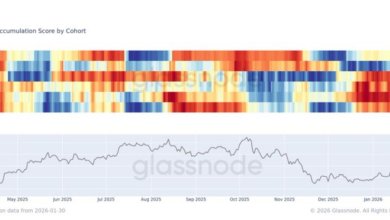

Analyst On-Chain College noted that Bitcoin had now lost its true market mean — the aggregate cost basis for the current active BTC supply.

“Bitcoin is now BELOW the True Market Mean ($80.7K) for the first time since October 2023, when the price was at $29K,” he noted.

“Put simply, this is not good for Bitcoin’s short to medium term price action.”

Alan supplied various downside levels to note, including the top of Bitcoin’s last bull market from November 2021 at $69,000.

Earlier, Cointelegraph reported on $76,000 as a popular target as Bitcoin failed to catch a bid despite stocks and precious metals beating all-time highs.

Strategy Bitcoin holdings dip negative

Another cost basis level, meanwhile, loomed large for both crypto market participants and beyond.

Related: Bitcoin vs. gold: BTC is a ‘better opportunity’ than in 2017, data says

Strategy, the firm with the largest corporate Bitcoin treasury, faced going into the red on its BTC holdings at $76,037.

The company currently holds in excess of 700,000 BTC, with its stock price at $143, having tumbled nearly 70% from its local highs of $455 in July last year.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.