FX Weekly Recap: January 26 – 30, 2026

2026-01-30 22:00:00

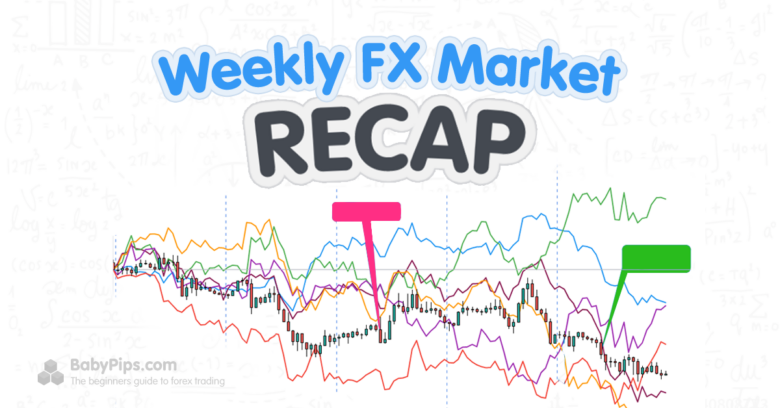

The final week of January 2026 delivered some of the most dramatic forex market action in recent memory, as currency traders navigated a perfect storm of policy uncertainty, precious metals carnage, and whiplash-inducing dollar volatility. What started as speculation about coordinated yen intervention evolved into a full-blown currency policy debate after President Trump’s eyebrow-raising comments about dollar weakness, only to reverse course spectacularly when his Fed Chair nomination triggered a massive unwind of the “debasement trade” that had punished the greenback earlier in the week.

The five-day stretch showcased just how quickly sentiment can shift in modern currency markets. Gold and silver experienced their worst two-day collapse in years—with the white metal plunging over 17% at one point—while the dollar swung from four-year lows to Friday strength on Kevin Warsh’s nomination as the next Federal Reserve Chair. Central bank decisions from both the Fed and Bank of Canada added to the volatility, even as most policymakers opted to stand pat on rates amid conflicting economic signals.

This comprehensive weekly recap breaks down the session-by-session price action across all major currency pairs, examining how the dollar, euro, pound, franc, loonie, aussie, kiwi, and yen responded to an unrelenting stream of catalysts. From Trump’s “yo-yo” currency comments to Treasury Secretary Bessent’s strong dollar reaffirmation, from Australia’s hotter-than-expected inflation print to Japan’s softer Tokyo CPI—every major development that moved markets gets the detailed treatment it deserves.

This Article Is For Premium Members Only

Become a Premium member for full website access, plus get:

- Ad-free experience

- Daily actionable short-term strategies

- High-impact economic event trading guides

- Unlimited Access access to MarketMilk™

- Plus More!