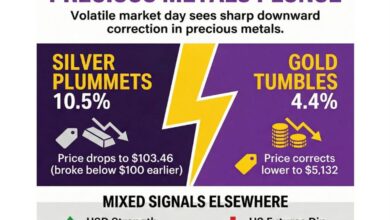

Silver dropped by more than 20% in just two days amid massive profit-taking. What’s next?

2026-01-30 11:25:00

FUNDAMENTAL

OVERVIEW

The strong bullish momentum

seems to have waned for precious metals and silver is getting hit the most

given its smaller market compared to gold. It’s not clear what caused

yesterday’s drop as pretty much all markets went down at the same time. There

were only talks of multiple US warships arriving in the Middle East but given

that oil prices dropped too, I wouldn’t bet on that reason.

Overnight, we got reports

that Trump was going to announce his Fed chair pick today and everything

suggested that it was going to be Kevin Warsh. We got a hawkish reaction across

markets as Warsh was a hawk during his last term at the Fed, although the historical

stance is never a guarantee.

The narratives underpinning

silver in the past several months have been the same as for gold, that is

de-dollarisation, geopolitical tensions, and so on. Given the lack of bearish

catalysts, the price continued to rise just by inertia. We reached a point

where it looks like just FOMO rather than something fundamental because these

prices are not justified in the short-term.

Since last week, I’ve been

turning more bearish in the short-term as I feel like we are reaching an

inflection point and February could be the first major negative month for

precious metals if the right conditions fall in place.

The most important catalyst

next week could be the US NFP report. We’ve been seeing improvements in the US

Jobless Claims data that seem to suggest a pickup in labour market activity. A

strong report would trigger a hawkish repricing in interest rate expectations

and put pressure on silver.

The other top tier data

could also start to weigh on silver if they come out strong, but the NFP report

should be the main event of the week. In case we don’t get the bearish

catalysts, silver could resume its upside trend.

SILVER TECHNICAL

ANALYSIS – DAILY TIMEFRAME

Silver – daily

On the daily chart, we can

see silver dropped by more than 20% since yesterday as profit-taking hit the

market. From a risk management perspective, the buyers will have a better risk

to reward setup around the major trendline to target new record highs. The

sellers, on the other hand, will look for a break lower to extend the selloff

into the 70.00 level next.

SILVER TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

Silver – 4 hour

On the 4 hour chart, we can

see that the price broke below the trendline that was defining the bullish

momentum on this timeframe. This is generally a signal of a loss of momentum

and potentially a bigger pullback. The sellers will likely step in around the

broken trendline with a defined risk above it to keep pushing into the next

trendline. The buyers, on the other hand, will look for a break higher to start

piling back in into longs and target new record highs.

SILVER TECHNICAL ANALYSIS – 1

HOUR TIMEFRAME

Silver – 1 hour

On the 1 hour chart, we can

see that we have a minor downward trendline defining the current bearish

momentum. The sellers will likely lean on the trendline to keep pushing into

new lows, while the buyers will look for a break higher to increase the bullish

bets into the next downward trendline around the 110.00 level. We can also

notice that the price is trading at the lower bound of the average daily range for today. In such instances, we

can generally see a consolidation or a pullback before the next move.

UPCOMING CATALYSTS

Today we conclude the week with the US PPI report and Trump’s announcement of

his Fed chair pick.