NZ consumer confidence hits four-year high in January as retail gauge turns positive

2026-01-29 22:29:00

NZ consumer confidence hit a four-year high as the key “big ticket purchase” gauge turned positive, but ANZ still sees only “par” growth amid offsetting headwinds and tailwinds.

Summary:

-

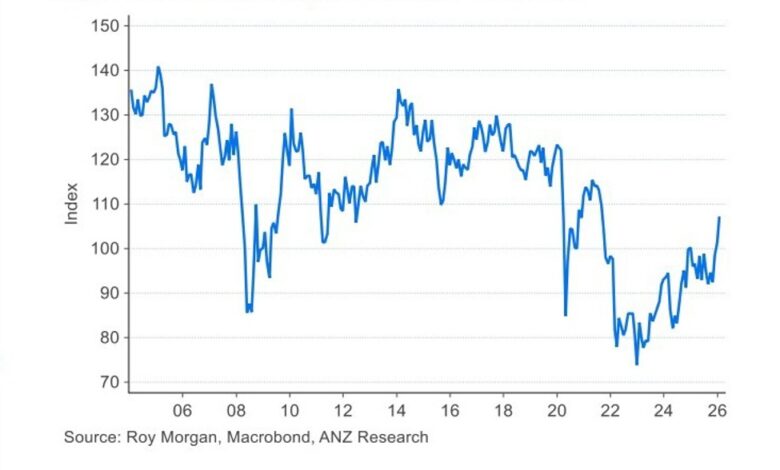

ANZ-Roy Morgan consumer confidence rose to 107.2 in January from 101.5, the highest since August 2021.

-

The “good time to buy a major household item” gauge moved to +1, turning net positive for the first time in nearly four years — a key signal for retail demand.

-

Inflation expectations were steady at 4.6%, still elevated and consistent with ongoing cost-of-living pressure.

-

ANZ sees the recovery in H2 last year arriving faster than expected, but expects “par” growth this year as momentum becomes harder to sustain.

-

The outlook is framed as headwinds (rates, NZD strength, essentials inflation, election/global uncertainty) versus tailwinds (still-stimulatory rates, healthy balance sheets, stronger business confidence and hiring/investment intent).

New Zealand consumer sentiment strengthened again in January, with the ANZ-Roy Morgan Consumer Confidence index rising to 107.2 from 101.5 — its highest reading since August 2021.

A notable detail for markets and retailers was the lift in the survey’s best retail signal: the share of households saying it’s a good time to buy a major household item increased to +1, moving into net positive territory for the first time in almost four years. ANZ argues this improvement adds weight to recent signs that domestic activity firmed sooner than expected in the second half of last year.

Even so, ANZ cautioned that while confidence is now at a multi-year high, it remains only around average when viewed over a longer historical cycle — a meaningful improvement given how depressed sentiment has been in recent years, but not yet a sign of boom-time behaviour.

Inflation expectations were unchanged at 4.6%, underscoring that price pressures — particularly in essential items — remain a core constraint on household spending decisions.

Looking ahead, ANZ expects growth to run around “par” this year. The bank suggests the early phase of recovery may have already captured the easier gains, making rapid growth mathematically harder from here. It sees a push-pull backdrop: headwinds from rising interest rates, a firmer New Zealand dollar, elevated necessities inflation, election-related uncertainty, and ongoing global volatility. These are offset by tailwinds including still-supportive monetary conditions, generally sound private-sector balance sheets, and stronger business confidence alongside improved investment and employment intentions.

ANZ concluded that while the housing market remains subdued, the steady lift in confidence should give retailers some optimism that late-2025 momentum can extend into 2026.