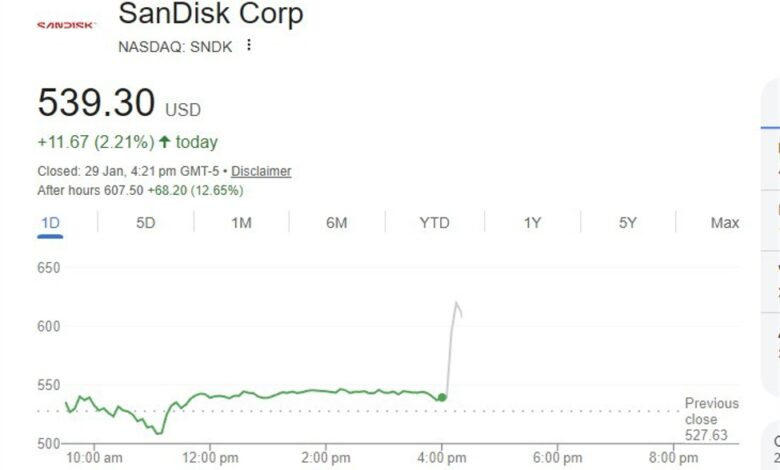

Sandisk delivered a major beat on both earnings and revenue, stock price soars

2026-01-29 21:24:00

Sandisk crushed Q2 expectations and delivered a blockbuster Q3 guide that resets near-term earnings and revenue assumptions.

Summary:

-

Sandisk delivered a major beat on both earnings and revenue versus consensus.

-

Guidance for Q3 was the big shock: management sees a step-change higher on both EPS and sales.

-

The outlook implies strong pricing and/or mix, plus meaningful operating leverage.

-

Such a large guide-up typically forces analysts to rebase near-term estimates and margin assumptions.

-

Market focus now shifts to sustainability: supply discipline, demand durability, and competitive dynamics.

Sandisk posted a standout second-quarter FY2026 result, smashing expectations on both profitability and top-line performance, and then raising the bar again with an aggressive outlook for the current quarter.

Adjusted earnings per share came in at $6.20, well above the $3.62 consensus estimate. Revenue was reported at $3.03 billion, also ahead of expectations for $2.69 billion. The size of the earnings beat suggests stronger-than-anticipated gross margin performance and/or operating leverage, likely reflecting a favourable product mix, firmer pricing conditions, and disciplined cost execution.

The bigger story, however, was forward guidance. For Q3, Sandisk expects adjusted EPS of $12–$14, a dramatic step up from the $4.62 consensus estimate. Revenue guidance was equally punchy at $4.4–$4.8 billion versus expectations near $2.84 billion. The magnitude of the gap implies a sharp acceleration in near-term conditions, pointing to either a rapid upswing in demand, materially improved pricing, or both — as well as the potential for strong incremental margins as volumes rise.

Analysts will likely move quickly to reassess the trajectory for margins, inventory dynamics, and the durability of the current pricing environment. Investors will be watching for evidence that this is more than a one-quarter surge — particularly around supply discipline, customer ordering patterns, and any signs of demand pull-forward.

Overall, the result and guidance package signal a company operating with momentum, with the Q3 outlook setting a new baseline for near-term expectations and shifting attention to how long these conditions can persist.