Westpac trade recap: Doubling down on the antipodeans

2026-01-29 18:23:00

Westpac’s dealing desk is pressing three interconnected bets that all point to the same theme: the US dollar’s dominance is cracking, and antipodean currencies are ready to capitalize. This is a theme that I’ve also been writing about.

Trade #1: The Aussie Juggernaut

The headline trade is a long AUD basket launched at 100.0 on October 29th, targeting 105.00 with stops now at breakeven. The fundamental backdrop is stacking up nicely. Markets are pricing in 18 basis points of RBA tightening for next week’s meeting, a dramatic shift that’s caught some offside. But even if Governor Bullock disappoints the hawks and talks down further hikes, Westpac sees limited downside risk.

Why? Three solid pillars: CNY’s gradual grind lower is lifting Australia’s competitive position, commodities are holding firm, and MSCI ex-US equities are showing that classic new-year strength. AUD/USD was last down 18 pips to 0.7023.

Trade #2: The Dollar Short

The broader play is a short USD basket, initiated December 11th at 100.0, also targeting 105 with stops at entry. Sure, the greenback caught a bid after Treasury Secretary Bessent ruled out coordinated FX intervention with Japan, and Powell’s recent comments downplayed labor market concerns. But Westpac sees this as noise.

“The deeper structural pathologies that ail the USD are still there, including valuation, and a post-Davos reassessment of the geopolitical order that revives long term USD credibility and doubts about US allocations,” Westpac writes.

Trade #3: The Kiwi Comeback

Finally, there’s NZD/USD. Westpac nailed the January dip to 0.5711, and those who followed their original buy recommendation are sitting on 6% gains.

“Our end-2025 publication describing high conviction trades for 2026, we advocated buying NZD/USD on any dip to 0.5700, targeting 0.6100. NZD/USD did dip to 0.5711, on 9 January, and has risen 6.0% since (to 0.6051),” they note.

Now they’re looking to reload on any pullback to 0.5880, targeting 0.6100+ with a stop at 0.5830.

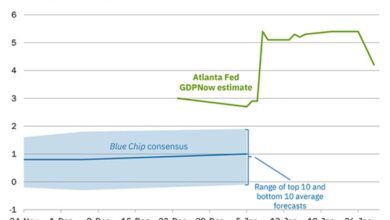

The logic is straightforward: combine a bearish dollar view with an improving New Zealand economy. GDP nowcasts from both Westpac and the RBNZ, plus their own economic pulse models, show green shoots. The big question—whether this recovery has legs through 2026—won’t be answered until May’s data dump (Q1 CPI, labor market, Q4 GDP). But Westpac’s willing to give NZ the benefit of the doubt for now, as long as the entry point offers decent risk-reward.

NZD/USD daily

I think it’s impressive that NZD is up today despite a big risk-off day.