Australia’s Q4 trade prices lift terms of trade as export prices rebound

2026-01-29 00:35:00

Australia’s Q4 trade prices point to improving terms of trade, offering modest support for national income and the AUD.

Summary:

-

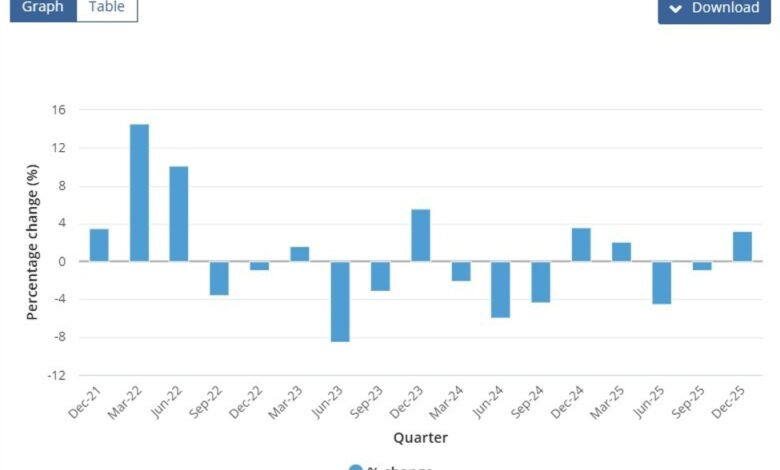

Australian export prices rebounded strongly in Q4, rising 3.2% q/q after a sharp decline in the prior quarter.

-

Import prices rose 0.9% q/q, defying expectations for a decline and marking a clear turnaround from Q3.

-

The combined move implies an improvement in Australia’s terms of trade late in 2025.

-

Stronger terms of trade tend to support national income, fiscal revenues and the Australian dollar.

-

The data reinforces a more resilient external backdrop for Australia despite mixed domestic growth signals.

Australian trade price data for the December quarter pointed to a notable improvement in the external backdrop, with export prices rebounding sharply and import prices rising unexpectedly, lifting Australia’s terms of trade.

Export prices rose 3.2% quarter-on-quarter in Q4, reversing a 0.9% fall in Q3, as commodity prices stabilised and demand conditions improved late in the year. At the same time, import prices increased 0.9% q/q, well above expectations for a 0.2% decline and marking a clear turnaround from the previous quarter’s 0.4% fall.

Taken together, the data imply a positive shift in Australia’s terms of trade, which measure the ratio of export prices to import prices. When export prices rise faster than import prices, the terms of trade improve, meaning the country earns more for its exports relative to what it pays for imports. This typically boosts national income, corporate profits in export-facing sectors and government revenues.

For financial markets, the terms of trade are an important transmission channel to the Australian dollar. An improving terms-of-trade backdrop tends to support the currency by lifting export receipts, improving the current account position and reinforcing Australia’s attractiveness to foreign capital. Historically, sustained rises in export prices — particularly for bulk commodities — have been closely associated with periods of AUD strength.

However, the relationship is not mechanical. Rising import prices can also feed into domestic inflation, particularly if higher costs are passed through to consumers. That dynamic may complicate the policy outlook if stronger trade prices coincide with already-sticky services inflation.

Overall, the Q4 trade price data suggest Australia ended 2025 with a firmer external position than earlier in the year. While domestic growth and monetary policy remain the primary drivers for markets, an improving terms-of-trade profile provides a supportive backdrop for the Australian dollar and broader macro resilience into 2026.