Financial & Forex Market Recap: Jan. 28, 2026

Markets navigated a complex session on Wednesday as the Federal Reserve held interest rates steady in a 10-2 decision, with Chair Jerome Powell signaling no imminent policy changes while defending central bank independence amid ongoing political pressures and gold surged past $5,300 per ounce for the first time on dollar weakness.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- API Crude Oil Stock Change for January 23, 2026: -0.25M (3.04M previous)

- Bank of Japan Monetary Policy Meeting Minutes: The minutes from the December 18–19 Monetary Policy Meeting showed that members agreed to maintain the current accommodative framework while closely monitoring whether wage gains and inflation become sustainably aligned with the 2% target. The discussion highlighted uncertainties around overseas economies and domestic wage negotiations, with several members emphasizing the need to retain flexibility in adjusting policy if the outlook for prices and growth changes materially.

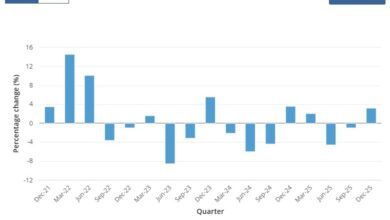

- Australia CPI Growth Rate for December 2025: 1.0% m/m (0.9% m/m forecast; 0.0% m/m previous); 3.8% y/y (3.6% y/y forecast; 3.4% y/y previous)

- Germany GfK Consumer Confidence for February 2026: -24.1 (-26.0 forecast; -26.9 previous)

- Swiss Economic Sentiment Index for January 2026: -4.7 (5.5 forecast; 6.2 previous)

- U.S. MBA Mortgage Applications for January 23, 2026: -8.5% (14.1% previous)

- U.S. MBA 30-Year Mortgage Rate for January 23, 2026: 6.24% (6.16% previous)

- The Bank of Canada left its policy rate unchanged at 2.25%, judging the current stance as appropriate with the outlook for growth and inflation broadly in line with its October projections and inflation expected to stay near the 2% target. In the press conference and accompanying communications, Governor Macklem emphasized that heightened uncertainty around U.S. trade policy and modest domestic growth keep risks two‑sided, so the Bank is monitoring conditions closely and stands ready to adjust policy if the outlook materially changes.

- U.S. EIA Crude Oil Stocks Change for January 23, 2026: -2.3M (3.6M previous)

- The Federal Reserve left the federal funds rate unchanged at 3.50%–3.75%, citing still-elevated inflation, solid economic growth, and a labor market showing low but stabilizing job gains. Chair Jerome Powell signaled that future policy will remain data-dependent, with officials willing to keep rates on hold for an extended period and offering little guidance on the timing of any further cuts.

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay – Chart Faster With TradingView

Wednesday’s trading reflected a market grappling with multiple crosscurrents as monetary policy decisions, geopolitical developments, and currency volatility shaped price action across asset classes.

Gold emerged as the session’s standout performer, surging 4.37% to close around $5,400 per ounce after briefly topping $5,311 earlier in the session for a new all-time high. The precious metal extended Tuesday’s 3% gain as dollar weakness to four-year lows and growing concerns over the value of the U.S. dollar as the world’s premier reserve currency sparked investment demand for gold as a safer alternative. The rally appeared to gather momentum during the Asian and London sessions, and then popped higher once again after the FOMC statement and press conference.

WTI crude oil advanced 1.59% to settle near $63.30 per barrel, extending gains from recent sessions. The move higher appeared to correlate with tight supply conditions, as both API and EIA inventory data showed drawdowns for the week ending January 23. The API reported a decline of 0.25 million barrels while the EIA showed a larger 2.3 million barrel decrease, both suggesting tighter physical market conditions than the previous week’s builds.

The S&P 500 closed slightly higher at 0.12% to close around 6,988, holding some of Tuesday’s gains after briefly touching 7,000 during intraday trading. The index traded relatively flat through the Asian and London sessions before experiencing choppy price action during the U.S. session before and after the 2:00 PM ET FOMC statement and Powell’s 2:30 PM press conference. The modest gain suggested investors took a cautious stance following the Fed’s decision to hold rates steady, likely due to mega cap tech earnings ahead.

Bitcoin gained 0.40% to trade around $89,183, showing resilience despite choppy intraday price action. The cryptocurrency exhibited volatility through the day, initially dipping during Asian trading before pulling back during the London and U.S. sessions before and after the FOMC decision. The modest gain occurred alongside mixed broader market performance, with the cryptocurrency maintaining its recent range.

U.S. Treasury yields remained essentially unchanged, with the 10-year note closing at approximately 4.20%. Yields traded in a tight range through most of the session, showing little reaction to either the Australian inflation data during Asian hours or the Fed’s policy statement. The stability in bond markets suggested traders were comfortable with the Fed’s messaging about holding rates steady while maintaining optionality for future adjustments.

The Daily Recap is Only Half the Story!

Understanding market moves are essential, but having a strategy to capitalize on it is what builds an edge. BabyPips Premium bridges the gap between market awareness and high quality analysis! Our Premium toolkit includes: tactical Event Guides, Watchlists, Weekly Prep & Recaps, & partner perks!

[Learn more & Get the Premium Edge!]

FX Market Behavior: U.S. Dollar vs. Majors

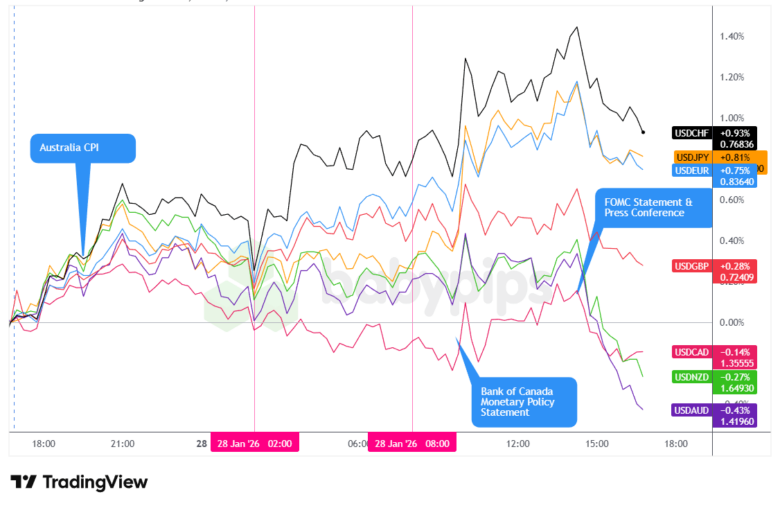

Overlay of USD vs. Majors – Chart Faster with TradingView

The U.S. dollar experienced a choppy session on Wednesday, ultimately closing as a net gainer on the day following a late session pullback.

During the Asian session, the dollar rallied against the major currencies but was quickly capped mid-morning and pulled back slightly heading into the London session. Australian inflation data showed a hotter-than-expected print with headline CPI rising 3.8% y/y versus 3.6% forecast, driven by a 21.5% surge in electricity prices as state rebates ended. The trimmed mean measure also accelerated to 3.3% y/y from 3.2% previously, complicating the Reserve Bank of Australia’s rate outlook. Despite the stronger Australian data, the dollar’s initial strength proved short-lived as traders appeared to position cautiously ahead of the day’s key events.

During the London session, the dollar continued to trade with a net positive lean against the major currencies overall, though price action remained choppy and mixed across individual pairs. The morning brought generally benign European economic data, with German consumer confidence improving slightly to -24.1 from -26.9, though Swiss economic sentiment disappointed sharply at -4.7 versus 5.5 expected. The euro traded relatively steady despite the mixed regional data, while sterling showed resilience following Tuesday’s stronger-than-expected wage growth figures.

The U.S. session opened with the dollar continuing mostly sideways trading ahead of the 2:00 PM ET FOMC statement. The morning U.S. session did include the latest monetary policy statement from the Bank of Canada, where they held rates at 2.25% as expected. This event appeared to have minimal impact on both the broad market and the Canadian dollar. We also saw comments on the U.S. dollar from Treasury Secretary Bessent, when he stated “absolutely not” when asked if the U.S. was intervening to strengthen the yen. His reaffirmation of a strong dollar policy sparked an immediate and sustained dollar rally that held going into the FOMC event.

The initial Fed decision to hold rates at 3.5%-3.75% in a 10-2 vote generated only modest market reaction, with two dissents from Governors Waller and Miran favoring a quarter-point cut. Chair Powell’s 2:30 PM press conference emphasized the economy’s “firm footing” and noted job gains have remained low while the unemployment rate has shown “some signs of stabilization.” His defense of Fed independence and measured tone on future policy appeared to weigh modestly on the dollar.

At Wednesday’s close, the dollar posted net gains against the major currencies, with its strongest performance coming against the Swiss franc and Japanese yen. The dollar’s resilience during the U.S. session, despite two dovish dissents at the Fed and Powell’s balanced commentary, suggested that Bessent’s currency comments and the renewed focus on strong dollar policy may have provided dominant support for the greenback heading into the close.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand Balance of Trade for December 2025 at 9:45 pm GMT

- New Zealand ANZ Business Confidence for January 2026 at 12:00 am GMT

- U.K. Car Production YoY for December 2025 at 12:01 am GMT

- Australia Import & Export Prices for December 31, 2025 at 12:30 am GMT

- Japan Consumer Confidence for January 2026 at 5:00 am GMT

- Swiss Balance of Trade for December 2025 at 7:00 am GMT

- Euro area Monetary Developments for December 2025 at 9:00 am GMT

- Euro area Economic Sentiment for January 2026 at 10:00 am GMT

- Euro area Consumer Confidence & Inflation Expectations for January 2026 at 10:00 am GMT

- Canada Balance of Trade for November 2025 at 1:30 pm GMT

- Canada Average Weekly Earnings for November 2025 at 1:30 pm GMT

- U.S. Initial Jobless Claims for January 24, 2026 at 1:30 pm GMT

- U.S. Balance of Trade for November 2025 at 1:30 pm GMT

- U.S. Factory Orders for November 2025 at 3:00 pm GMT

Thursday’s calendar features a relatively light data schedule compared to Wednesday’s central bank decisions, with the main focus likely shifting to U.S. initial jobless claims and trade balance data during the North American session. Jobless claims will provide another read on labor market conditions following Wednesday’s Fed commentary about employment showing “some signs of stabilization,” though data quality remains questionable given lingering effects from the recent government shutdown.

Canadian trade and earnings data could spark volatility in the loonie following Governor Macklem’s Wednesday emphasis on heightened trade policy uncertainty affecting the outlook. Euro area sentiment indicators will offer insight into whether European economic momentum is stabilizing after recent manufacturing weakness, while traders will continue monitoring currency markets for any follow-through effects from Treasury Secretary Bessent’s strong dollar policy reaffirmation.

Markets will remain attentive to any additional commentary from Fed officials or Trump administration members on monetary policy independence, Fed chair succession, or currency policy following Wednesday’s notable developments on all three fronts.

Starting your trading journey can feel like navigating a storm without a compass. TradingView simplifies the complex, providing world-class charts that are as easy to use as they are powerful. Whether you are tracking Gold’s latest surge or monitoring the U.S. dollar, you can join millions of traders who share ideas, use free paper trading to practice risk-free, and set instant alerts so you never miss a move.

Don’t just watch the markets—master them.