Top Bitcoin Mining Stocks Soar Over US Winter Storm Hashrate Decline

Bitcoin mining stocks saw a significant bump on Wednesday after the US winter storm forced some companies to wind down operations, leading to lower block competition and more profitable mining operations.

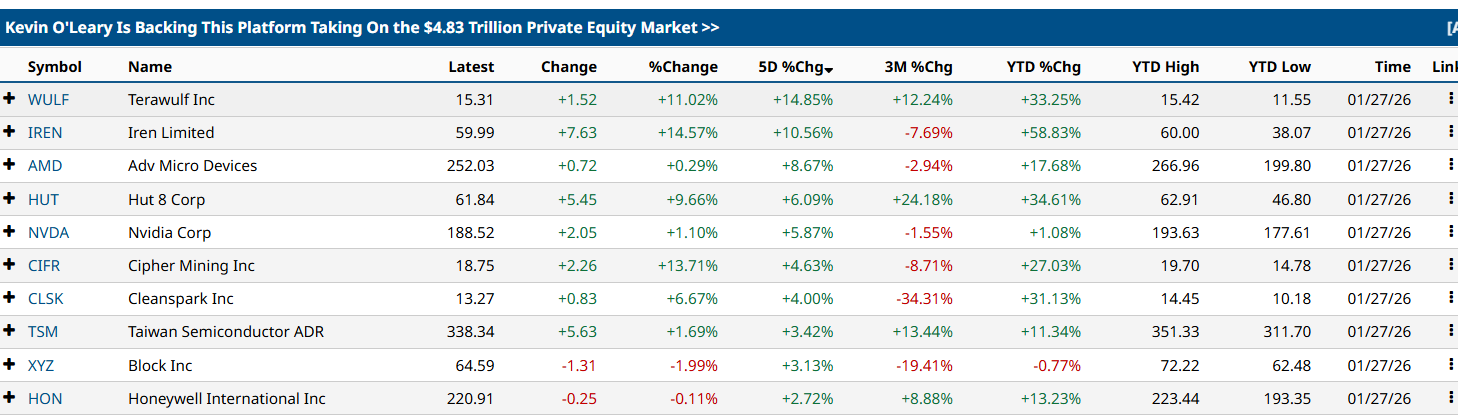

Shares of several major mining companies posted double-digit gains over the past 24 hours. TeraWulf rose about 11%, Iren Limited gained roughly 14%, and Cipher Mining climbed around 13%, according to data from Barchart.

The rally occurred days after the Bitcoin network’s hashrate sank to a seven-month low of 663 exahashes per second (EH/s) on Sunday, a 40% drop in two days due to a severe winter storm battering the US.

The hashrate recovered to 814 EH/s on Wednesday, but has yet to recover to the 1.1 zettahash per second (ZH/s) level before the weekend decline, data from Coinwarz shows.

A lower hashrate signals that fewer miners are online, reducing the competition for mining a block on the Bitcoin network, making Bitcoin (BTC) mining more profitable for miners who stay online.

Related: Bitcoin rallies, ETF flows rebound as US crypto policy stalls: Finance Redefined

The Bitcoin hash price index, a benchmark for measuring miner profitability through the revenue generated per terahash, also points to more lucrative mining conditions.

The Bitcoin hashprice index rose to $0.040 per terahash per day on Wednesday, up from $0.038 TH/s per day, according to the HashrateIndex.

Related: Crypto loses speculative edge as AI and robotics attract capital: Delphi

Bitcoin miners wind down operations amid US winter storm

The improvement highlights how large, well-capitalized mining firms can benefit during temporary network disruptions, while smaller or less efficient operations may be forced offline.

The US winter storm forced multiple Bitcoin mining companies to reduce operations to support the power grid, said Julio Moreno, the head of research at data platform CryptoQuant.

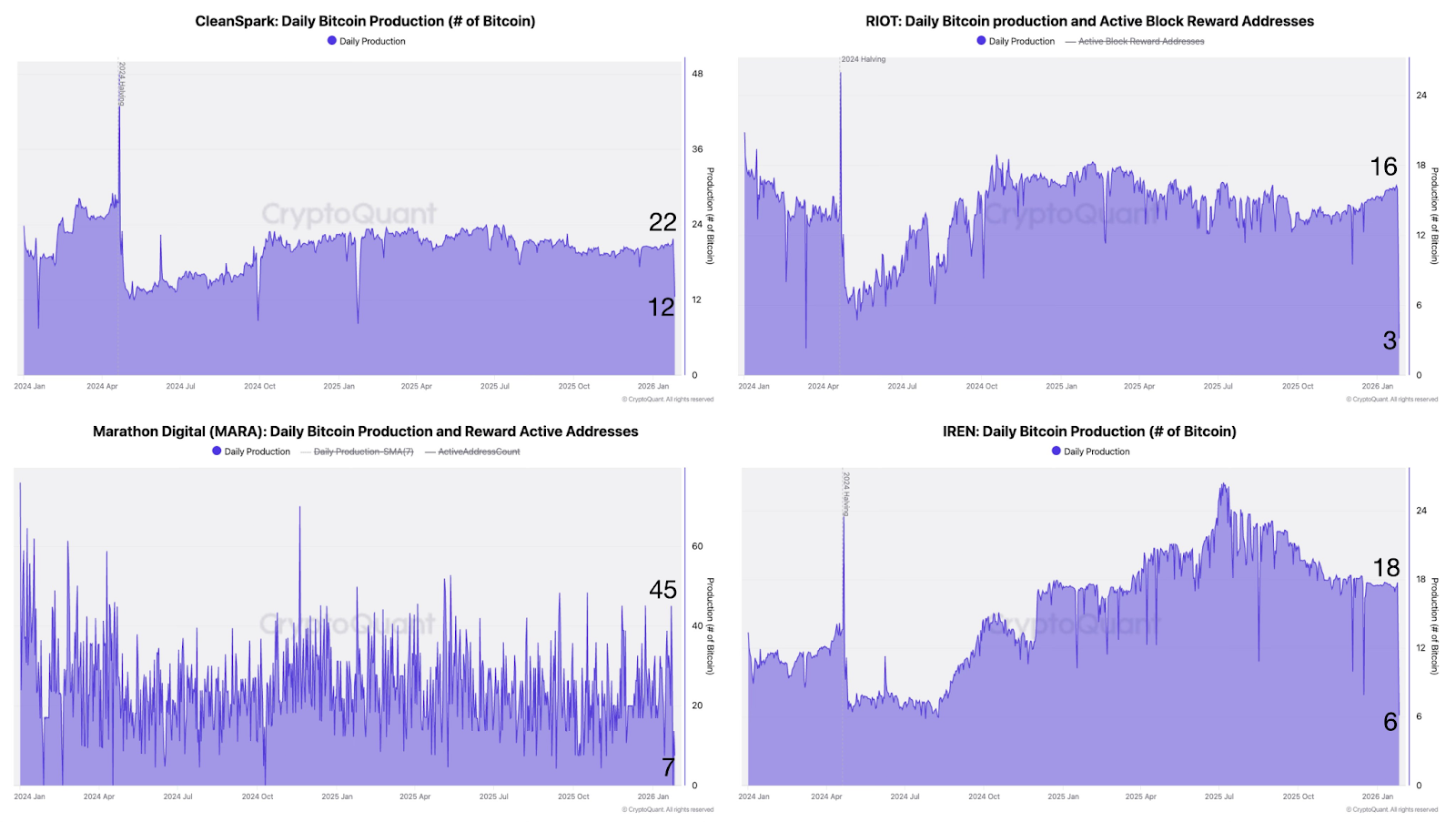

This included a daily Bitcoin production decrease from 22 BTC to 12 BTC for CleanSpark, a 16 BTC to 3 BTC reduction for Riot Platforms, a decline from 45 BTC to 7 BTC for Marathon Digital Holdings, and a drop from 18 BTC to 6 BTC mined daily by Iren, wrote Moreno in a Monday X post.

Meanwhile, the extreme winter weather in the US “punished weak mining operations,” which is another reason for the sharp decline in global hash rate, according to Bitcoin mining ecosystem Braiins.

“Winter punishes poor preparation and rushed decisions,” wrote Braiins in a Tuesday X post, warning miners that most equipment damage happens when mining machines are restarted in freezing temperatures, or the facilities lack proper airflow and temperature control.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’ — Bit Digital CEO