Australia Reported Hotter than Expected 3.8% Inflation in December, AUD Briefly Higher

2026-01-28 03:38:00

Australia’s Consumer Price Index rose 3.8% year-on-year in December 2025, up from 3.4% in November, according to data released by the Australian Bureau of Statistics.

The monthly increase of 1.0% (0.2% seasonally adjusted) exceeded expectations and marked the fastest pace of annual inflation in several months, as electricity rebates expired and holiday travel demand surged, complicating the Reserve Bank of Australia’s policy outlook.

Key Takeaways

- Annual CPI inflation accelerated to 3.8% from 3.4% in November, with the monthly increase reaching 1.0% in original terms

- Trimmed mean inflation rose to 3.3% annually from 3.2%, suggesting underlying price pressures remain elevated

- Electricity prices surged 21.5% year-over-year as state government rebates were exhausted, up from 19.7% in November

- Housing costs climbed 5.5% annually, driven by electricity, rents (+3.9%), and new dwellings (+3.0%)

- Services inflation accelerated to 4.1% from 3.6%, while goods inflation edged up to 3.4% from 3.3%

The most significant contributor to December’s inflation spike was electricity, which rose 21.5% over the 12 months. This increase primarily reflects the timing of government electricity rebates rather than underlying cost pressures.

The ABS noted that excluding the impact of Commonwealth and state government rebates over the past year, electricity prices would have risen a more modest 4.6% or unchanged from November.

Link to official ABS Australian CPI (December 2025)

Recreation and culture prices rose 7.4% in December, following just a 1.8% annual increase in November. The sharp monthly acceleration was driven by domestic holiday travel and accommodation, which jumped 8.2% as demand surged ahead of Christmas, the summer school holidays, and major events like the Ashes cricket test series.

International holiday travel and accommodation also contributed significantly, rising 24.4% as airfare prices increased across popular destinations during the peak holiday season.

Food and non-alcoholic beverage prices rose 3.4% annually, up slightly from 3.3% in November. Services inflation accelerated to 4.1% annually in December from 3.6% in November, while goods inflation edged up to 3.4% from 3.3%. The widening gap between services and goods inflation suggests labor cost pressures and domestic demand remain elevated in the Australian economy.

Market Reaction

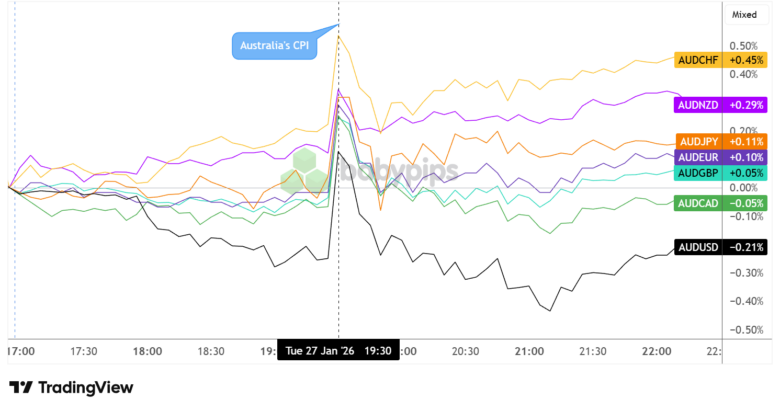

Australian Dollar vs. Major Currencies: 5-min

AUD vs. Major Currencies 5-min Forex Chart by TradingView

The Australian dollar, which had been trading mixed leading up to the CPI release, popped higher across the board upon seeing much stronger than expected results. However rallies were quickly erased as traders dug deeper into the numbers and noticed that the pickup was mostly attributed to energy costs and seasonal travel-related factors.

AUD managed to recover most of its gains against CHF (+0.45%) and NZD (+0.29%), which were already on the back foot from earlier in the session, but continued to slump against the stronger USD (-0.21%) and CAD (-0.05%).

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!