February is BTC’s Most Reliable Bullish Month: Analyst

Bitcoin’s (BTC) monthly gains have been limited to just 2.2%, but February could mark a bullish shift. Since 2016, the week ending Feb. 21 has recorded the highest median return at 8.4%, with Bitcoin closing higher 60% of the time.

Key takeaways:

February has delivered a median 7% weekly BTC return historically, outperforming October’s seasonal strength.

Early-February performance has reliably flagged bearish periods, with 2018, 2022, and 2025 all setting the tone within the first three weeks.

February’s seasonal edge and its impact on BTC

Network Economist Timothy Peterson highlighted that February has historically been one of Bitcoin’s most consistent bullish months, often surpassing the well-known “Uptober” effect in Q4. According to Peterson, the driver is macroeconomic-related rather than crypto-specific.

Mid-February marks the release of full-year corporate earnings and forward guidance, which tends to be optimistic. This outlook typically nudges investors toward a risk-on posture, with some capital rotating into Bitcoin. Peterson said,

“The two-week period for Feb 7-21 features a median weekly return of => 7% per week!!”

Peterson also noted that the first three weeks of February have been particularly telling during correction years. Bitcoin gained 4% in early 2018, fell 3% in 2022, and declined 5% in 2025, all years that ultimately closed lower.

With volatility elevated but easing, Peterson argued that Bitcoin could be well-positioned for a rebound if macroeconomic stress indicators, such as the CBOE’s volatility index (VIX), cool off.

Related: Bitcoin offers ‘no haven’ from Trump’s Greenland dreams

Bitcoin’s ceiling in 2026 remains above $200,000

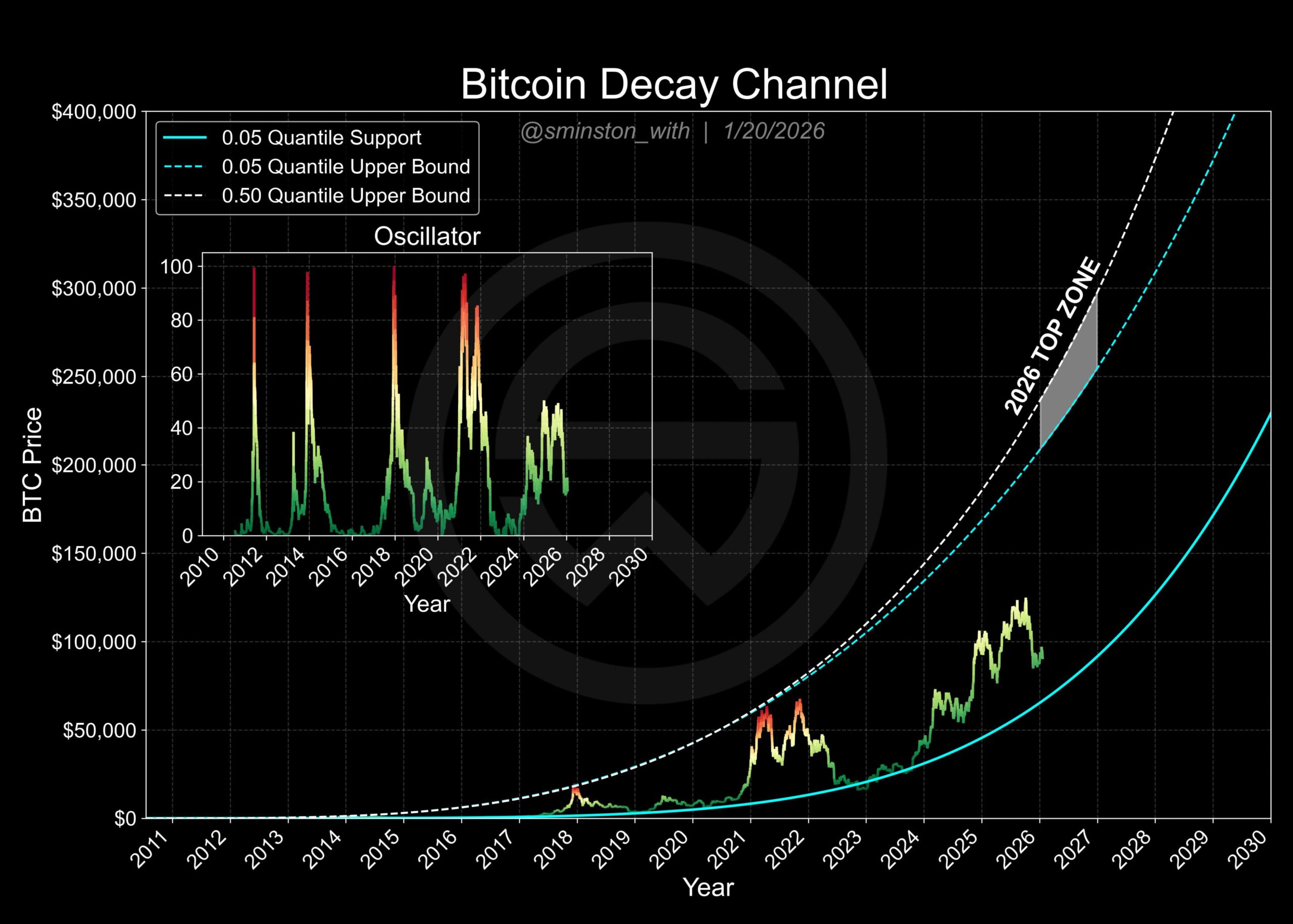

Bitcoin researcher Sminston With remains bullish on BTC’s long-cycle potential. Using the Bitcoin Decay Channel, With placed Bitcoin’s 2026 top price between $210,000 and $300,000, noting that while the model does not predict timing, its price bands have historically been reliable.

That longer-term view is reinforced by momentum data. Sina, author of the Bitcoin Intelligence Report, said Bitcoin’s momentum has turned positive despite the recent sharp correction.

According to Sina, consolidation since early January preserved the broader flow structure. The sell-off coincided with the Nasdaq’s decline following renewed US tariff tensions, signaling a news-driven move rather than a Bitcoin-specific breakdown.

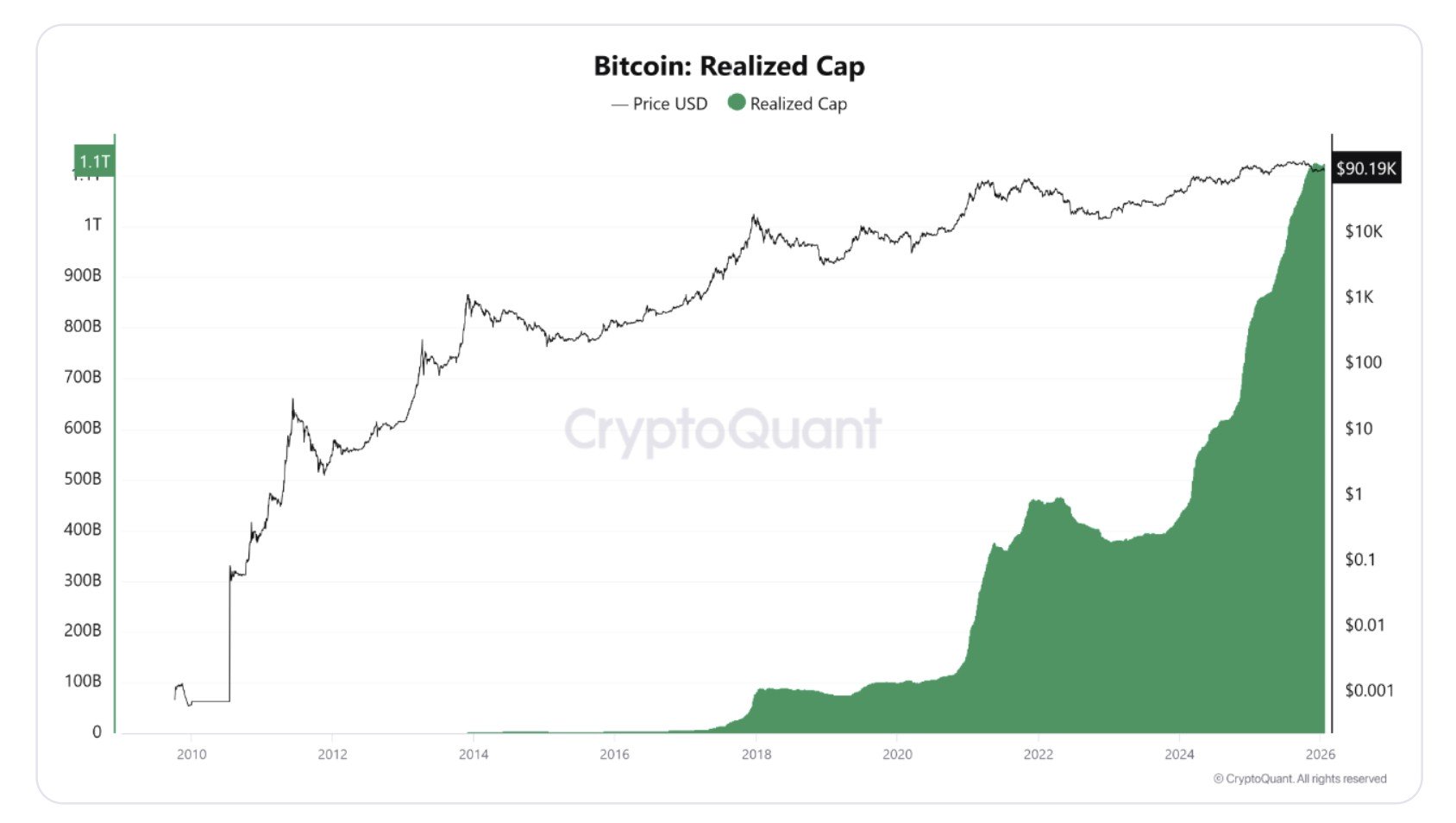

Supporting this view, XWIN Research noted that Bitcoin remains in a consolidation phase rather than a clear risk-off trend. While elevated long-term bond yields are limiting valuation expansion, the Realized Cap continues to rise, a sign that spot-based capital is still entering the network.

Related: Bitcoin-to-gold ratio falls to new low, but analysts say BTC’s discounted ‘setups are rare’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.