Bitcoin Struggles Below $90K While Gold Breaks Records

When uncertainty hits, traders choose sides—and right now, Bitcoin’s getting left behind. Let’s try to break it down and understand this current market rotation dynamic.

Bitcoin has been stuck in a frustrating rut. After starting January near $95,000, the world’s largest cryptocurrency has spent most of the past week hovering around $87,000-$88,000, struggling to regain momentum. Meanwhile, gold has been on an absolute tear, smashing through $5,000 per ounce on Monday, January 27 and hitting a fresh all-time high above $5,100 before pulling back slightly.

This isn’t just about two assets moving in opposite directions. It’s about a fundamental shift in how traders are thinking about risk right now—and Bitcoin, despite years of being pitched as “digital gold,” appears to be behaving more like a tech stock than a safe haven.

The contrast is striking: Gold has surged approximately 17% so far in 2026 (and we’re barely a month in), while Bitcoin has dropped about 7% from its early January highs. Crypto exchange-traded funds saw more than $1.3 billion in outflows over the past week, according to market data, signaling that institutional money is heading for the exits. At the same time, gold ETFs are seeing sustained inflows, with major investment banks like Goldman Sachs raising their year-end gold forecast to $5,400 per ounce.

Here’s the part that stings for crypto enthusiasts: when markets get nervous—whether it’s about geopolitical tensions, inflation concerns, or political uncertainty—traders tend to move money out of riskier assets (like cryptocurrencies and growth stocks) and into safer assets (like gold and government bonds). This movement is what market professionals call “risk-off” rotation, and Bitcoin appears to be firmly planted in the “risky asset” category.

Why Is This Happening?

Several factors seem to be contributing to Bitcoin’s struggles while gold soars, and understanding these dynamics helps explain how different assets behave during uncertain times.

Understanding Risk-On vs. Risk-Off

First, let’s break down what traders mean when they talk about “risk-on” and “risk-off” environments, because this concept is central to what’s happening right now.

Think of risk sentiment like the mood in a trading room. In “risk-on” periods, traders feel confident about the economy and willing to take chances for potentially higher returns. They buy stocks, cryptocurrencies, high-yield bonds, and emerging market currencies—anything that might deliver outsized gains. In these environments, safe assets like gold and government bonds often underperform because traders don’t see the need for protection.

In “risk-off” periods, the opposite occurs. When uncertainty rises—maybe there’s a geopolitical crisis, worrying economic data, or political turmoil—traders become cautious. They sell their riskier holdings and move money into assets that historically preserve capital during storms. Gold, U.S. Treasury bonds, the Japanese yen, and the Swiss franc all tend to rally during these episodes as capital seeks shelter.

Right now, markets appear to be in risk-off mode, and Bitcoin is getting caught in the selling pressure alongside stocks and other growth-oriented investments.

What’s Spooking Markets?

Multiple concerns appear to be weighing on trader sentiment simultaneously:

Geopolitical tensions have been escalating. President Trump announced new tariff plans on South Korean imports on Monday, adding to ongoing trade tensions. There are also ongoing concerns about U.S.-Canada relations, conflicts in the Middle East, and tensions over Greenland that have rattled markets.

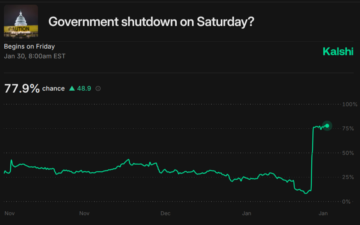

U.S. government shutdown risk has increased significantly. Senate Democrats have pledged to block a major spending bill, raising the probability of a funding lapse by the January 31 deadline. Kalshi traders currently assign a 76% chance to a shutdown happening before month’s end. Historically, government shutdowns tend to create uncertainty that pressures riskier assets while boosting safe havens.

Federal Reserve uncertainty adds another layer of complexity. The Fed began its two-day policy meeting on Tuesday, January 27, and while markets widely expect interest rates to remain unchanged (CME FedWatch Tool shows 97% probability), there’s considerable uncertainty about the path ahead. Additionally, political pressure on the Fed has intensified, with a Justice Department investigation into Fed Chair Jerome Powell and ongoing questions about Fed independence creating unusual dynamics.

Crypto-specific headwinds have compounded the pressure. Bitcoin ETFs experienced their worst two-month stretch on record in November-December, bleeding $4.57 billion in combined outflows. While the first trading day of 2026 brought a strong reversal with $670 million in inflows, subsequent days have shown volatility returning, with mixed flows suggesting institutional investors remain uncertain about crypto’s near-term prospects.

Why Gold Is Winning

Overlay of BTC vs. Gold – Chart Faster with TradingView

While Bitcoin struggles, gold’s rally appears to be driven by a convergence of supportive factors that go beyond simple safe-haven demand.

Central banks around the world have been aggressive buyers. Goldman Sachs estimates that central bank purchases now average around 60 tonnes per month—more than three times the pre-2022 average of 17 tonnes. Emerging market central banks in particular have been shifting reserves into gold, likely diversifying away from dollar-denominated assets.

The U.S. dollar has weakened significantly, with the dollar index falling to around 107 from recent highs. A weaker dollar typically supports gold prices because gold becomes cheaper for holders of other currencies. This dollar weakness appears to be driven partly by market concerns about U.S. fiscal sustainability and partly by speculation that the Fed’s next chair (whoever replaces Jerome Powell when his term ends in May 2026) may pursue more dovish (rate-cutting friendly) policies.

There’s also what some analysts call the “debasement trade”—investors buying gold as a hedge against fiscal concerns and potential currency instability. With U.S. government debt levels high and questions about long-term fiscal sustainability, some institutions appear to be treating gold as insurance against monetary system stress.

What Does This Mean for Markets?

The divergence between Bitcoin and gold highlights an important reality that new traders should understand: not all “alternative assets” behave the same way during periods of stress.

Bitcoin’s Identity Crisis

Bitcoin advocates have long argued that the cryptocurrency should function as “digital gold”—a scarce, decentralized asset that holds value when trust in traditional financial systems wavers. The current environment suggests markets aren’t quite buying that narrative yet.

Instead, Bitcoin seems to be trading more like a risk asset, rising and falling with stocks and other growth-oriented investments. When the S&P 500 rallies, Bitcoin often follows. When risk appetite fades and traders sell tech stocks, Bitcoin tends to get hit too. This correlation suggests that despite its unique properties, institutional investors currently view Bitcoin more as a speculative growth asset than as a safe-haven store of value.

Navigate the Rotation with Institutional-Grade Tools. As Bitcoin transitions from “digital gold” to a high-volatility tech-correlated asset, the right execution platform is more critical than ever. Whether you’re hedging with stablecoins or trading the “risk-off” move, Gemini provides the deep liquidity and advanced order types required for today’s complex market dynamics. Start here to learn more about Gemini

What Traders Are Watching

The near-term outlook for both assets may hinge on several key developments:

For Bitcoin, the Federal Reserve’s decision and Chair Powell’s comments on Wednesday, January 28, could move markets significantly. If Powell signals confidence in the economy and downplays recession risks, it might encourage risk-taking and support crypto prices. Conversely, if he sounds cautious or acknowledges growing uncertainties, the risk-off trade could intensify.

The potential U.S. government shutdown looms large. If Congress fails to pass funding legislation by Friday, January 31, the resulting uncertainty could pressure Bitcoin while supporting gold’s rally. Previous shutdowns have typically created short-term volatility for risk assets.

Big Tech earnings this week (Microsoft, Meta, Tesla, Apple, and others) could also influence crypto. Since Bitcoin has been trading with high correlation to tech stocks lately, strong earnings that lift the Nasdaq could provide a tailwind for crypto. Weak results might do the opposite.

For gold, traders are watching whether the rally can sustain these elevated levels. Analysts now forecast gold reaching $6,000 per ounce by year-end 2026, but such aggressive moves typically invite profit-taking. Silver has also joined the party, surging more than 50% year-to-date to above $109 per ounce after hitting a record high above $117 on Monday, though both metals pulled back from their peaks.

The Bottom Line

The current market dynamics offer several important lessons for developing traders:

Asset behavior changes with sentiment. How an asset performs during calm, confident markets can differ dramatically from how it behaves when uncertainty rises. Gold has centuries of history as a crisis hedge, while Bitcoin is still relatively new and hasn’t established a consistent safe-haven reputation during multiple market cycles.

Correlation matters. Bitcoin’s tendency to move with tech stocks and other risk assets means that diversifying a portfolio by adding crypto alongside equities may provide less protection during downturns than some investors expect. True diversification requires assets that behave differently under various conditions.

ETF flows signal institutional thinking. The record outflows from Bitcoin ETFs in late 2025, followed by volatile flows in early 2026, suggest institutional investors are reassessing their crypto allocations. These “smart money” flows can provide clues about professional sentiment, though they’re not infallible predictors.

Risk-off doesn’t mean sell everything. The rotation from Bitcoin to gold shows that during uncertain periods, capital doesn’t just go to cash—it moves between different types of assets. Understanding these flows can help traders position themselves better for varying market conditions.

Multiple factors drive price action. It’s rarely just one thing. Right now, Bitcoin faces headwinds from geopolitical concerns, crypto-specific selling pressure, regulatory uncertainty, and unfavorable comparisons to gold’s momentum. Markets are complex systems where multiple forces interact.

Stop Watching the Markets and Start Trading the Catalysts. Understanding the divergence between Gold and Bitcoin is only the first step. BabyPips Premium helps put the fundamentals with the technicals to create high quality outlooks. From Event Guides for the next Fed meeting to Short-Term Strategies and Weekly Recaps, we provide the high-quality analysis you need to build your edge.

Join our membership for less than $0.36 a day and unlock exclusive partner perks, including deep discounts on pro-level trading tools.