Bitcoin breaking above $100k silently broke its positive adoption curve as usage craters

Bitcoin Is Being Bought, Not Used

For most of Bitcoin’s history, price and usage told broadly the same story.

When price moved higher, more people showed up. More wallets became active. More transactions hit the chain. The relationship was never perfect, but it was stable enough to treat price as a rough signal for adoption.

That relationship has now broken.

For years, we compared Bitcoin adoption to the growth of the internet, screaming, “We’re still early.” The graph went up and to the right. Since 2021, that is no longer the case for Bitcoin.

| Years of Growth | Internet Year (Total Users) | Bitcoin Year (Active Addresses SMA) | Observation |

|---|---|---|---|

| Year 1 | 1991: 4.3M | 2010: ~105 | BTC started from a much smaller base. |

| Year 5 | 1995: 39.2M | 2014: ~150k | BTC scaling rapidly. |

| Year 10 | 2000: 361M | 2019: ~750k | BTC on-chain growth begins to slow. |

| Year 12 | 2002: 669M | 2021: ~1.0M | The Peak: BTC adoption stalls here. |

| Year 17 | 2007: 1.3B | 2026: ~900k | The Stagnation: BTC activity is down ~10% from 2021. |

Bitcoin is trading at levels that would have sounded implausible just a few years ago, yet fewer people are actually using the network. On-chain activity has not completely vanished, but it has clearly failed to keep pace with price.

The data points to a market that is being accumulated aggressively, while the blockchain itself is seeing less engagement than it did four years ago.

This looks less like a temporary divergence and more like a structural shift.

Price hit new highs, usage didn’t

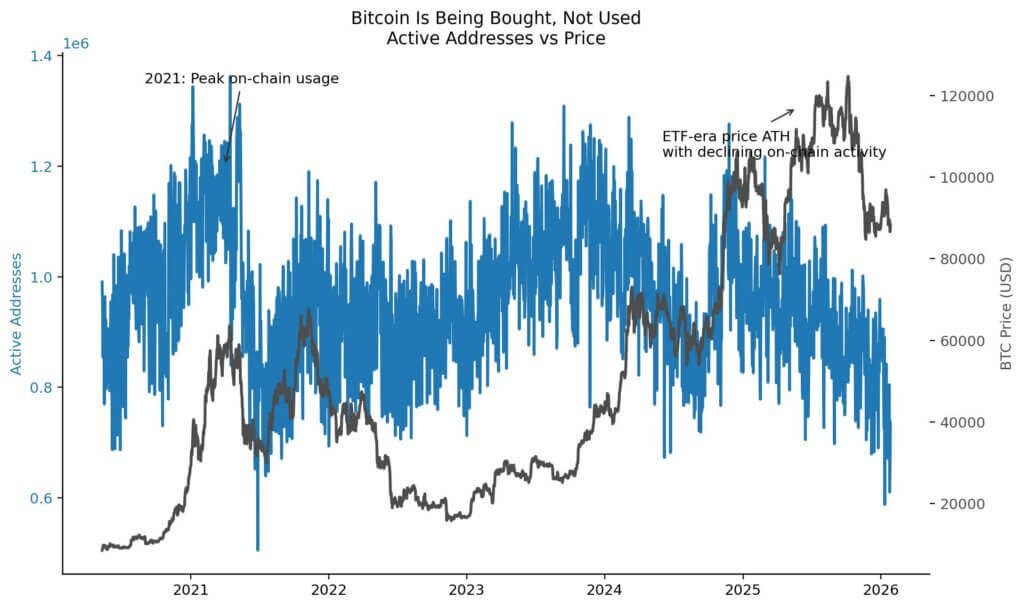

Our first chart makes the problem obvious. The number of active Bitcoin addresses has fallen to the lowest average level since January 2020.

For context, miners received 12.5 BTC per block to verify these transactions when usage was last this low. That’s $1.1 million per block by today’s prices. Miners today receive an average of just $275,000.

Daily active addresses, sourced from CryptoQuant, peaked during the 2021 bull market, reaching roughly 1.2 to 1.3 million addresses per day. That period marked the high watermark for on-chain participation.

Since then, activity has never returned to those levels.

Bitcoin went on to set new all-time highs in the ETF era, yet active addresses failed to make a higher high. By early 2025, as price pushed to record levels, on-chain activity was already rolling over, sitting closer to ranges last seen during the 2022 bear market.

The implication is uncomfortable but hard to ignore. Bitcoin’s highest prices now occur with fewer active users than four years ago.

That alone challenges the assumption that rising prices automatically reflect growing adoption. Capital is clearly flowing into Bitcoin, but far fewer participants are interacting with the network itself.

Moreover, the trend from November 2024 to today may be even more concerning, as shown below.

ETFs changed Bitcoin’s market structure

To understand why this divergence matters, it helps to step back and look at adoption more holistically.

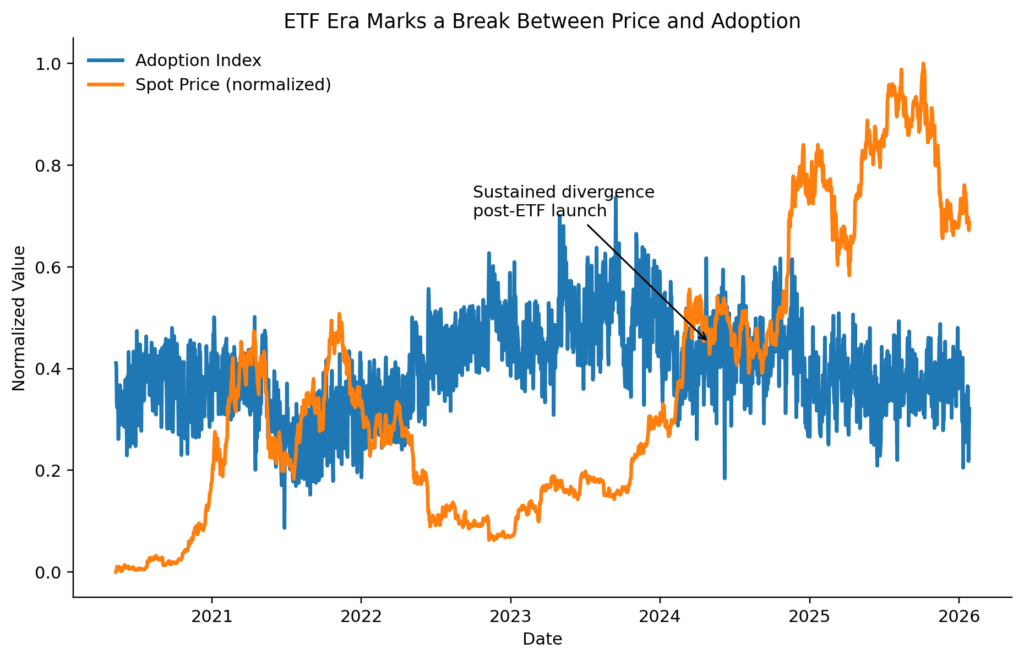

Rather than relying on a single metric, we constructed a composite adoption index using only on-chain fundamentals. The index combines daily active addresses, total transaction count, and the ratio between realized price and spot price, with all inputs normalized and weighted toward usage rather than valuation.

The goal was straightforward, isolate real engagement with the Bitcoin network while filtering out price-driven noise.

When this adoption index is plotted against normalized spot price, a clear divergence emerges in early 2024, shortly after the approval of US spot Bitcoin ETFs by the SEC.

Price continues to climb. Adoption stalls and then begins to trend lower.

This pattern did not appear in prior cycles. In 2020 and 2021, price and adoption rose together. In 2022, both fell together. In the ETF era, price has moved ahead while on-chain usage failed to follow.

Since ETFs launched, price has risen faster than adoption, marking a break from how Bitcoin has historically behaved.

That break matters because ETFs change who is buying Bitcoin and how they hold it. Exposure can now be gained without touching the blockchain at all through custodians like Coinbase. No wallets are created. No transactions are broadcast. No fees are paid to miners.

[Editor’s Note: OTC transfers by Authorized Participants are regularly registered on-chain, but ETF trades are all off-chain, and many OTC trades also take place off-chain between Coinbase Prime account holders.]

The asset can change hands while the network remains largely untouched.

Capital is deepening, activity is not

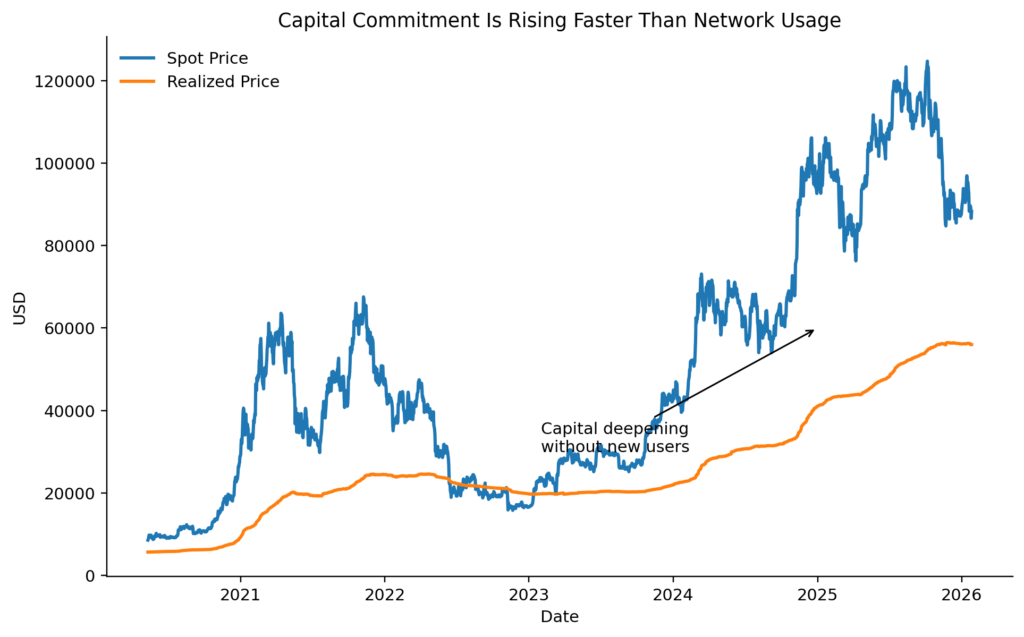

The relationship between spot price and realized price makes this shift even clearer.

Realized price reflects the average cost basis of all coins in circulation. It moves slowly and tends to rise as long-term holders accumulate at higher prices. Spot price reacts far more quickly to marginal demand.

Since 2023, realized price has climbed steadily, showing that capital entering Bitcoin is increasingly committed and long-term in nature. Over the same period, spot price has repeatedly overshot, particularly during the ETF-driven rally.

The widening gap between spot price and realized price tells a specific story.

Capital is entering at a higher cost basis. Existing holders are not transacting more frequently. Network velocity is declining.

Bitcoin is increasingly functioning as collateral, a treasury asset, and a long-duration store of value. Those roles are materially different from the transactional adoption narratives often implied by rising prices.

This chart adds economic depth to the broader picture. Bitcoin is being accumulated, while circulation continues to slow.

A regime shift, not a cycle

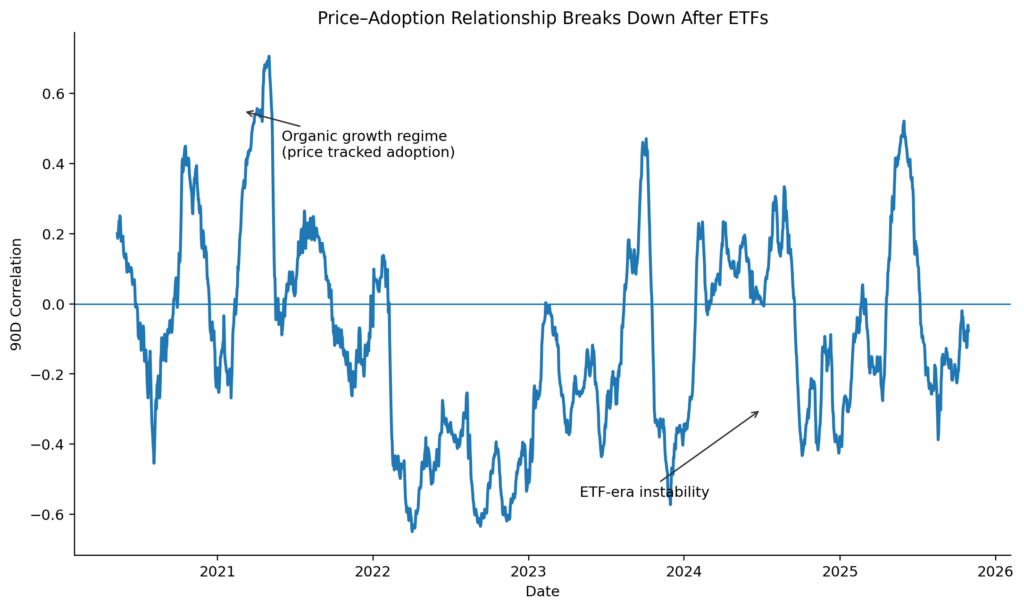

The final chart puts numbers behind what the earlier charts suggest.

By calculating a rolling 90-day correlation between the adoption index and spot price, it becomes possible to see how tightly price has tracked on-chain usage over time.

From 2020 through most of 2021, the correlation remained consistently positive. Price moved in step with adoption, reflecting organic network growth. In 2022, the correlation turned sharply negative as price collapsed faster than usage, a typical capitulation phase.

After ETFs entered the market, that relationship became unstable.

Correlation now swings between positive and negative, often remaining below zero for extended periods. Price movements increasingly fail to reflect changes in on-chain engagement.

For the first time in Bitcoin’s history, price appreciation is no longer reliably associated with rising on-chain adoption.

That change reflects a shift in how Bitcoin is owned, accessed, and valued.

What this means for Bitcoin adoption

None of this suggests Bitcoin is failing.

What the data shows is a network moving into a different phase of its life cycle.

On-chain adoption appears to have peaked in 2021. The 2024–2025 rally was driven primarily by price discovery away from the base layer. ETFs introduced a structural decoupling between price and usage. Rising realized prices signal conviction among existing holders rather than an expanding user base.

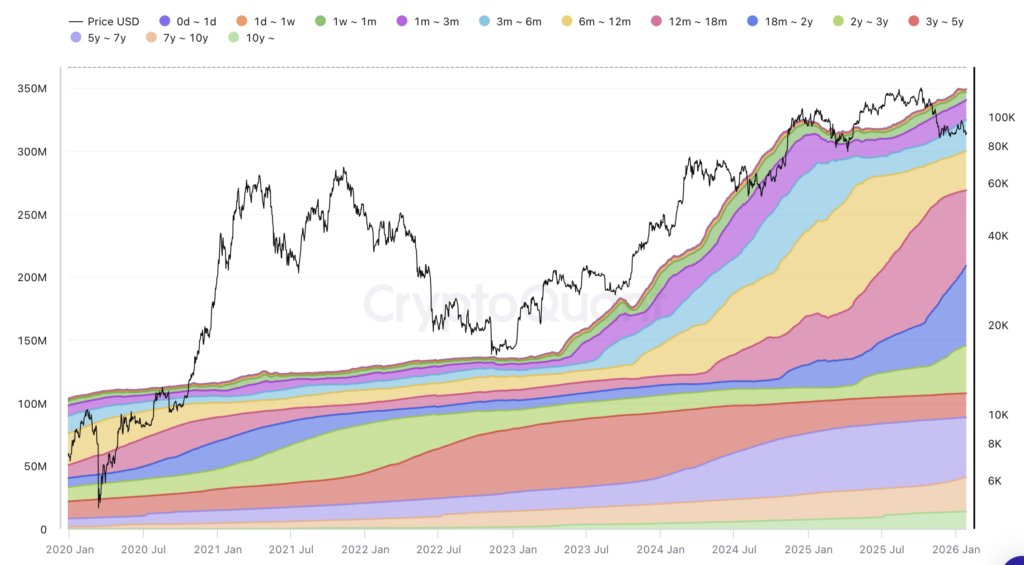

Supporting data from UTXO age bands reinforces this picture. Older coins account for a growing share of supply, while short-term UTXOs show weaker growth. Exchange netflows also point toward accumulation rather than distribution, and transaction counts have remained broadly flat since 2022, even as prices more than doubled.

Bitcoin is entering a more capital-intensive, lower-velocity phase.

That shift does not invalidate the asset. It changes how adoption should be measured and how price should be interpreted.

Reading price as a proxy for usage no longer works in the ETF era.

Bitcoin is being bought, enthusiastically and at scale. It is simply being used less than it once was.

The blockchain has been signalling that change for some time. The charts make it difficult to ignore.