investingLive Americas market news wrap: Silver squeezes to $117 then fades

2026-01-26 21:08:00

Markets:

- Silver touches $117.69, finishes up $5.75 to $108.71

- Gold up $74 to $5056

- WTI crude oil down 28-cents to $60.78

- S&P 500 up 36 points to 6951

- JPY leads, CAD lags

- US 10-year yields down 2.6 bps to 4.21%

Newsflow was light be trading action was lively on Monday, particularly in previous metals. Gold hit $5000 for the first time in Asia and broke $5100 in New York before sliding back to $5054 but it was silver that stole the show. It went parabolic in a quick move to $118 from $110 before fading all the way back to $108 as profit taking finally hit. At the peak, it was the largest intraday nominal gain on record, beating out the Hunt brothers squeeze from 1980. Now we’ll watch to see if we get Asia bids or more profit taking.

Late in the day, there started to be some talk of military intervention in Iran so that could help to keep a bid under oil and gold.

Equities managed to shrug off the shutdown fears. There was a poor open due to government shutdown fears but that slowly faded and then the cash market was strong, led by large caps. In terms of names, the top performers were CSCO, ORCL, AAPL, AIG and META while Intel continued to give back its big rally, falling 5.8%. Tesla also struggled, down 3.1%.

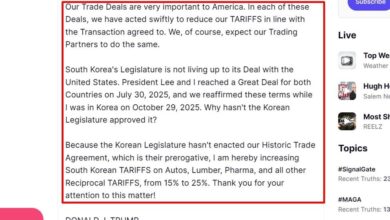

The US dollar was generally soft on internal discord and shutdown fears but CAD lagged just behind it after Trump threatened 100% tariffs. I think that’s a hollow threat as there’s no scope for a Canada-China trade deal but the market might be sensing more trouble between Canada and the USA.

USD/JPY remained in focus. The pair fell as low as 153.31 into the London fix but battled back to just above 154. We will be on intervention watch again in Asia-Pacific trading.