Kiwi Stays Afloat As New Zealand Inflation Cooled to 0.6% in Q4 2025

2026-01-23 02:14:00

New Zealand’s consumer price inflation dipped from 1.0% to 0.6% on a quarterly basis in Q4 2025, bringing the annual rate to 3.1%. This surpassed both market expectations of a 0.5% quarter-on-quarter gain and the Reserve Bank of New Zealand’s forecasts, as elevated domestic price pressures continued to offset weaker international pricing.

Key Takeaways

- Annual headline CPI rose 3.1% year-on-year, up from 2.7% in September 2025. Quarterly inflation registered 0.6%, exceeding market and RBNZ forecasts by a tenth of a percentage point.

- Domestic vs. International Pressures: Non-tradeable inflation, which reflects domestic demand and supply conditions, increased 3.5% annually but showed signs of moderation. Tradeable inflation, influenced by foreign markets, rose 2.6% over the year, indicating persistent external price pressures despite global economic headwinds.

- Major Contributors: International air transport surged 7.2% in the quarter, contributing 20% to the overall quarterly rise. Petrol prices increased 2.5%, accounting for 13.2% of the quarterly movement. Telecommunication services rose 2.8%, contributing 9.1% to the headline figure.

- Offsetting Factors: Vegetable prices plummeted 16.5%, providing a substantial -34.6% offset to the quarterly increase. Pharmaceutical products fell 4.3%, contributing -4.7% to the quarterly change.

- Annual Drivers: Electricity costs jumped 12.2%, contributing 10.3% to the annual inflation rate. Local authority rates climbed 8.8%, accounting for 8.7% of the yearly increase. Actual rentals for housing rose 1.9%, contributing 6.9% to the annual figure.

- Core Inflation Remains Sticky: The measure excluding food, household energy, and vehicle fuels rose 0.8% quarterly and 2.5% annually, suggesting underlying price pressures remain resilient despite significant spare capacity in the economy.

Link to official Stats NZ Quarterly CPI (December 2025 Quarter)

Despite the modest inflation overshoot, the underlying narrative suggests continued disinflationary momentum in the domestic economy.

Non-tradeable inflation, while still elevated at 3.5%, showed further deceleration from previous quarters, indicating that weak domestic demand and spare economic capacity are gradually eroding persistent price pressures.

Furthermore, the data reflected divergence between tradeable and non-tradeable inflation components. Tradeable inflation rose 0.7% in the December quarter and 2.6% annually, while non-tradeable inflation increased 0.6% quarterly and 3.5% over the year. This contrast highlights the different dynamics at play between domestically-driven prices and those influenced by international markets.

Market Reactions

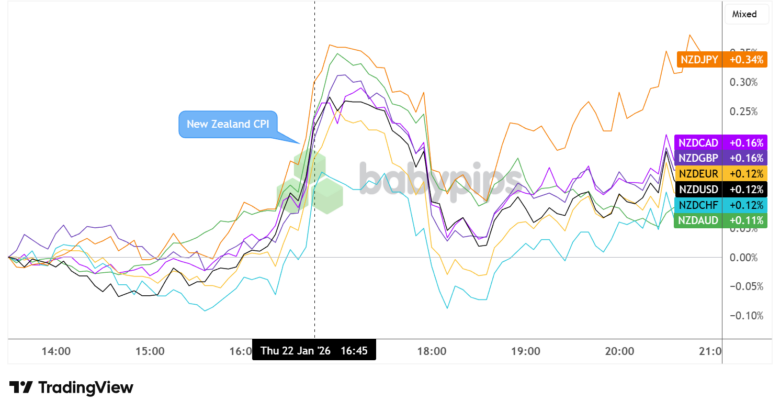

New Zealand Dollar vs. Major Currencies: 5-min

The New Zealand dollar exhibited initial strength following the data release before fading its initial gains roughly an hour later. Still, the currency was able to recover above pre-CPI levels and sustain a more gradual bullish trajectory as the Asian session went on.

The Kiwi appreciated approximately 0.34% against the Japanese yen, likely reflecting the yen’s broader weakness amid diverging global monetary policy expectations. Against other major currencies, the NZD showed more modest gains against the British pound (+0.16%), euro (+0.12%), US dollar (+0.12%), and Swiss franc (+0.12%) while keeping rallies limited against AUD (+0.11%).

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!