Financial & Forex Market Recap: Jan. 22, 2026

Markets rallied on Thursday as geopolitical tensions eased following President Trump’s withdrawal of threatened tariffs against European allies, while solid US economic data reinforced expectations for the Federal Reserve to maintain its cautious approach to policy adjustments.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- New Zealand Electronic Retail Card Spending for December 2025: -1.0% y/y (1.8% y/y forecast; 1.6% y/y previous)

- New Zealand Visitor Arrivals for November 2025: 8.2% y/y (4.0% y/y forecast; 9.4% y/y previous)

- Japan Balance of Trade for December 2025: 105.7B (-400.0B forecast; 322.2B previous)

-

Australia Employment Change for December 2025: 65.2k (40.0k forecast; -21.3k previous)

- Australia Unemployment Rate for December 2025: 4.1% (4.4% forecast; 4.3% previous)

- Canada CFIB Business Barometer for January 2026: 59.5 (59.5 forecast; 59.9 previous)

- Canada New Housing Price Index for December 2025: -0.2% m/m (0.1% m/m forecast; 0.0% m/m previous)

- U.S. GDP Growth Rate for September 30, 2025: 4.4% q/q (4.3% q/q forecast; 3.8% q/q previous)

- U.S. Initial Jobless Claims for January 17, 2026: 200.0k (195.0k forecast; 198.0k previous)

- Euro area Consumer Confidence Flash for January 2026: -12.4 (-13.6 forecast; -13.1 previous)

- U.S. Core PCE Price Index for November 2025: 0.2% m/m (0.1% m/m forecast; 0.2% m/m previous); 2.8% y/y (2.7% y/y forecast; 2.7% y/y previous)

- U.S. Personal Income for November 2025: 0.3% m/m (0.3% m/m forecast; 0.1% m/m previous)

- U.S. Kansas Fed Manufacturing Index for January 2026: -2.0 (5.0 forecast; -3.0 previous)

- EIA Crude Oil Stocks Change for January 16, 2026: 3.6M (3.39M previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Thursday’s session delivered a broad risk-on tone as President Trump’s retreat from threatened European tariffs sparked relief across global markets, while robust US economic data reinforced the view that the economy remains resilient despite elevated inflation.

Gold rallied strongly, climbing 1.89% to close around $4,923 per ounce. The precious metal extended its remarkable run to fresh all-time highs, having touched $4,888 on Tuesday amid the initial Greenland tensions. Gold’s strength throughout the session likely reflected a combination of factors, including ongoing safe-haven demand despite easing geopolitical tensions, persistent concerns about fiscal policy and Fed independence, and positioning ahead of the Bank of Japan’s highly anticipated rate decision scheduled for Friday morning. The continued advance despite the risk-on tone in equities suggested institutional accumulation and portfolio diversification flows remain supportive.

The S&P 500 posted gains of 0.38% to settle near 6,909, recovering from earlier weakness as traders embraced the de-escalation of transatlantic tensions. The index opened with a slight gap higher following Trump’s overnight announcement of a framework deal with NATO on Arctic security, then traded mostly sideways through the Asian and early London sessions around 6,900. Following the 8:30 am ET data releases showing better-than-expected GDP growth and in-line PCE inflation, the index initially dipped before finding support and grinding higher through the afternoon. Mega-cap technology shares led the advance, with notable strength in artificial intelligence-related names. Small-cap stocks continued their outperformance, marking the 14th consecutive session of relative strength versus large-caps, suggesting ongoing expectations for rate cuts and improved financing conditions benefiting smaller companies.

Bitcoin declined 0.82% to trade near $89,443, underperforming traditional risk assets despite the broader market rally. The cryptocurrency exhibited a volatile session, leaning negative through Asia and London, before moving sharply lower following the US economic data releases. The weakness accelerated through the London close, with Bitcoin dropping to session lows around $88,400 before stabilizing into the US afternoon and rebounding ahead of the close. The divergence from equities likely reflected profit-taking after recent gains and possibly concerns that stronger economic data supporting a higher-for-longer Fed policy stance could reduce speculative appetite for non-yielding digital assets.

WTI crude oil fell 1.80% to close around $59.36 per barrel, extending losses from the previous session. The decline may have been some reaction to Ukrainian President Zelenskiy’s comments about progress toward peace negotiations with Russia, including reports that a 20-point peace plan is 90% complete pending input from Trump and Russian officials. The prospect of reduced geopolitical risk premium and potentially increased Russian oil flows if sanctions are eventually lifted likely weighed on prices. We also saw a larger-than-expected 3.6 million barrel build in EIA crude inventories, potentially adding to the pressure.

Treasury yields edged up 0.05% to approximately 4.20%, with the 10-year note showing modest upward pressure through most of the session. Yields traded relatively flat through the Asian session before rising gradually following the 8:30 am ET data releases. The upward move likely reflected the market’s reassessment that stronger GDP growth and sticky core PCE inflation support the Federal Reserve’s patient approach to further rate cuts. Two-year yields climbed more noticeably, steepening the yield curve slightly as traders pushed back expectations for near-term Fed easing, with rate cut odds for the January 27-28 FOMC meeting remaining minimal.

Interested in fundamental analysis made for newbies and how to pair it up with technical analysis to find high quality opportunities that may match your trading and risk management style? Check out our Premium membership for event trading guides, short-term strategies, weekly recaps and more!

BabyPips.com Annual Premium Members also get an exclusive 30% discount on the annual subscription for the first year on Tradezella–the top rated journaling app! ($120 in savings)! Click here for more info!

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Majors Forex Chart by TradingView

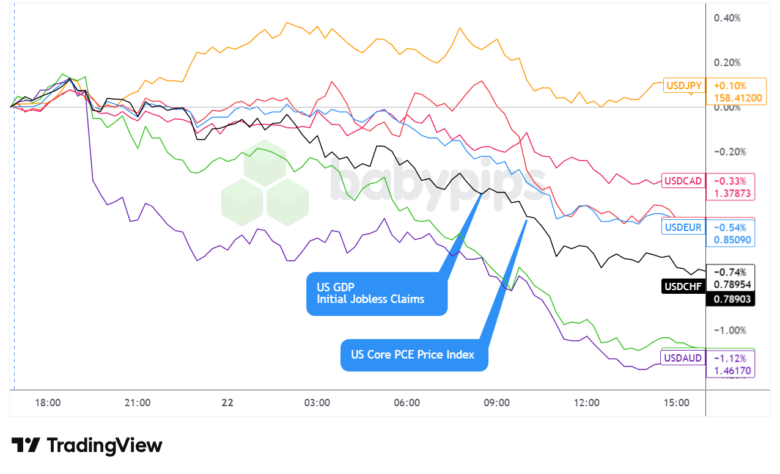

The US dollar traded under sustained pressure on Thursday, ultimately closing as the second-worst performing major currency with only a marginal gain against the Japanese yen, as traders reassessed the de-escalation of geopolitical tensions and digested solid US economic data.

During the Asian session, the dollar initially traded with a net bullish lean as Trump’s overnight announcement of a framework deal with NATO regarding Greenland reduced fears of owning U.S. assets. But we saw a quick cap and turn lower during mid-morning Asian trading hours, possibly on an improvement in risk appetite as transatlantic tensions declined. Australia’s stronger-than-expected employment data, showing 65,200 jobs added versus 40,000 forecast and unemployment falling to 4.1% from 4.3%, possibly provided particular support to the Australian dollar, which emerged as the session’s top performer.

The London session saw the dollar’s weakness persist and deepen despite European data that came in mixed. UK CBI Distributive Trades showed a less negative reading than expected at -17 versus -57 forecast, providing modest support to sterling. Euro area Consumer Confidence also improved more than expected to -12.4 from -13.1. However, these regional data points failed to stem the dollar’s decline, which continued steadily lower through the European morning. The greenback’s inability to find support suggested the geopolitical de-escalation was the dominant driver, with traders unwinding safe-haven positioning built during the prior days’ Greenland tensions.

The US session brought accelerated dollar weakness following the 8:30 am ET data releases, despite the headline figures appearing superficially supportive for the greenback. The updated Q3 GDP estimate of 4.4% annualized growth versus 4.3% expected, combined with in-line November PCE inflation readings, appeared to have no effect on bearish dollar sentiment. Also, initial jobless claims of 200,000 came in above the 195,000 forecast, suggesting some cooling at the margin in labor market conditions. The dollar continued to see weakness intensified through the mid-morning hours and selling pressure persisting into the afternoon close. The move likely reflected positioning adjustments as markets priced reduced geopolitical risk premium over solid U.S. growth data.

At Thursday’s close, the US dollar posted net losses against all major currencies except the Japanese yen, where it managed a marginal 0.10% gain. The dollar’s weakness appeared to reflect a combination of reduced safe-haven demand following Trump’s tariff retreat, strong commodity-linked currency performance, and market positioning ahead of the Bank of Japan’s rate decision early Friday morning, which could spark further yen volatility and dollar weakness if the BOJ delivers a hawkish hike.

Upcoming Potential Catalysts on the Economic Calendar

- New Zealand CPI Growth Rate for December 31, 2025 at 9:45 pm GMT

- Australia S&P Global Manufacturing & Services PMI Flash for January 2026 at 10:00 pm GMT

- Japan CPI Growth Rate for December 2025 at 11:30 pm GMT

- U.K. Gfk Consumer Confidence for January 2026 at 12:01 am GMT

- Japan S&P Global Manufacturing & Services PMI Flash for January 2026 at 12:30 am GMT

- Japan BoJ Interest Rate Decision for January 23, 2026 at 3:00 am GMT

- U.K. Retail Sales for December 2025 at 7:00 am GMT

- Euro area HCOB Manufacturing & Services PMI Flash for January 2026 at 9:00 am GMT

- U.K. S&P Global Manufacturing & Services PMI Flash for January 2026 at 9:30 am GMT

- U.K. BoE Greene Speech at 9:30 am GMT

- European Central Bank President Lagarde Speech at 10:00 am GMT

- Canada Retail Sales Prel for December 2025 at 1:30 pm GMT

- U.S. S&P Global Manufacturing & Services PMI Flash for January 2026 at 2:45 pm GMT

- U.S. CB Leading Index for November 2025

- U.S. UoM Consumer Sentiment Index for January 2026 at 3:00 pm GMT

Friday’s calendar is dominated by the Bank of Japan’s highly anticipated policy decision at 3:00 am GMT, where markets are watching for confirmation of an expected rate hike and any signals about the timing of future policy normalization. Japanese CPI data releasing ahead of the decision at 11:30 pm GMT Thursday will provide crucial context for the BOJ’s deliberations, with inflation trends likely influencing the central bank’s forward guidance.

During European hours, UK retail sales at 7:00 am GMT will offer insight into consumer resilience heading into 2026, particularly important following recent rate cuts from the Bank of England. The dense run of flash PMI data from the euro area and UK at 9:00 am and 9:30 am GMT respectively will provide the first January readings on manufacturing and services sector momentum, with particular focus on whether the economic soft patch is stabilizing or deteriorating further.

The US session features preliminary retail sales data from Canada at 1:30 pm GMT alongside flash U.S. PMI readings for January at 2:45 pm GMT, which will offer early evidence on whether the US economy’s momentum is carrying into the new year. The University of Michigan consumer sentiment survey at 3:00 pm GMT will be closely monitored for any shifts in inflation expectations that could influence Federal Reserve thinking heading into next week’s FOMC meeting on January 27-28.

With central bank policy, economic activity indicators, and inflation expectations all in focus, Friday sets the stage for what promises to be a volatile start to next week’s critical FOMC meeting.