Australia PMI January jump. Business activity accelerates. Composite highest since Apr 22

2026-01-22 22:15:00

Australia’s flash PMIs point to a strong start to 2026, with growth accelerating while price pressures ease.

Summary:

-

Composite PMI surged to a joint-highest level since April 2022

-

Manufacturing and services both recorded faster growth

-

Export demand strengthened, led by manufactured goods

-

Input and output price inflation eased further

-

Business optimism dipped despite strong activity

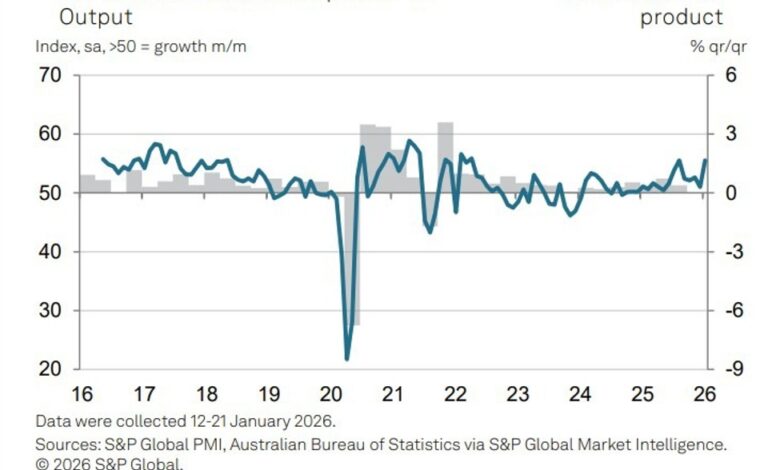

Australia’s private-sector activity accelerated sharply at the start of 2026, with the latest flash PMI data pointing to broad-based momentum across both manufacturing and services. The headline S&P Global Flash Australia Composite PMI rose to 55.5 in January from 51.0 in December, marking a sixteenth consecutive month of expansion and the strongest reading since April 2022, matched only by August 2025.

The improvement reflected faster growth in both major sectors. Manufacturing PMI edged higher to 52.4 from 51.6, while the Services PMI jumped to 56.0 from 51.1, highlighting a strong rebound in activity following a softer end to last year. Panellists reported quicker expansions in new business, supported by customer base growth and successful business development initiatives.

External demand also provided a lift, particularly for manufacturers. Survey data showed a renewed rise in overseas orders, driving the fastest expansion in total export business in more than three years. Stronger demand led firms to increase staffing levels in January as they sought to manage higher workloads, although the pace of hiring slowed slightly compared with December due to softer employment growth in the services sector.

The combination of stronger new orders and a moderation in job creation resulted in a modest rise in outstanding work, the first increase in backlogs in nine months. While the build-up was limited, it nonetheless signals emerging capacity pressures as activity levels improve.

On the inflation front, price pressures showed further signs of easing. Input costs continued to rise, but the rate of inflation fell to a 14-month low, driven by slower cost increases in the services sector. This partially offset firmer input cost pressures among manufacturers, where rising demand, higher purchasing activity and lingering supply constraints pushed goods input prices to their fastest pace in nine months. Output price inflation also softened, allowing firms to raise selling prices at a slower pace than at the end of 2025.

Business sentiment remained positive overall, with the Future Output Index staying above the expansion threshold. However, optimism slipped to a 15-month low as concerns around competition and geopolitical uncertainty weighed on confidence, particularly in services. The data suggest Australia’s economy entered 2026 with solid momentum, but with emerging risks to confidence worth monitoring.