Economic and event calendar in Asia 23 January 2026; NZ & Japan CPI, BOJ decision day

2026-01-22 21:20:00

New Zealand inflation data:

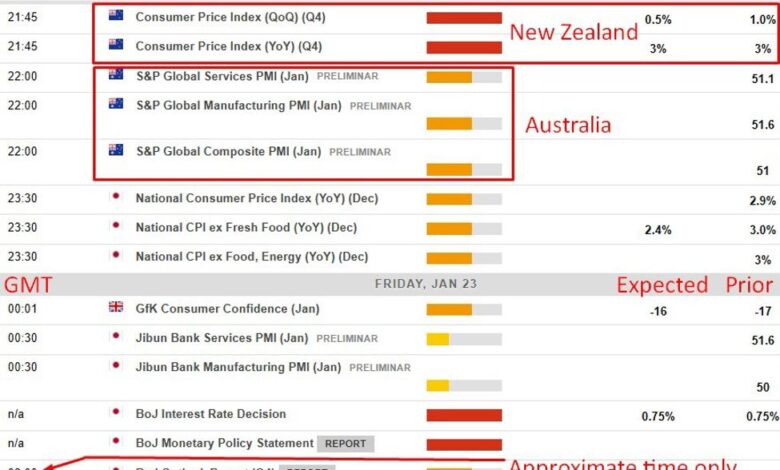

Analysts expect New Zealand consumer prices to have increased by around 0.5% in the December quarter, leaving annual inflation steady at 3.0%. The quarterly rise is largely attributed to higher petrol prices and seasonal increases in travel and accommodation costs over the holiday period. These pressures were partly offset by a typical seasonal decline in food prices. Beneath the headline figures, measures of core inflation have continued to ease over the past year, with most indicators now sitting in the 2–3% range. This projection is above the RBNZ’s November MPS forecast of 0.2% quarterly inflation and an annual rate of 2.7%.

For the New Zealand dollar, a firmer-than-RBNZ CPI outcome would lean modestly supportive at the margin, reinforcing the view that inflation is proving more persistent than the central bank assumed in its November forecasts. A +0.5% quarterly print would help anchor NZD downside and potentially offer short-term support against the AUD and USD. That said, with core inflation continuing to trend lower and annual inflation holding near 3%, the data are unlikely to trigger a material repricing of the policy outlook on their own, leaving the NZD sensitive to broader risk sentiment and offshore rate dynamics.

Japan inflation data:

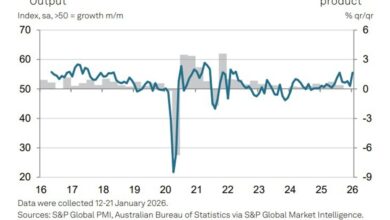

Recent data showed headline CPI running at 2.9% y/y, with national core inflation (excluding fresh food) at 3.0% and monthly prices rising 0.4%. Core-core inflation, which strips out both fresh food and energy, edged down to 3.0% from 3.1%, but inflation remains well above the Bank of Japan’s 2% target for a 44th straight month, sustaining expectations of further policy normalisation over time. Analyst notes indicate policymakers are increasingly focused on the inflationary effects of a weak yen, as higher import costs are passed through to consumers. Even so, the BoJ is widely expected to leave policy unchanged at its January meeting. More on the BoJ following below …

Bank of Japan:

You’ll note the time for the BoJ statement listed at 0300 GMT. This is approximate only. The BoJ never has a set time for its policy announcement. An 0230 to 0330 GMT time window is a reasonable expectation. What is known is the Bank of Japan Governor Ueda will begin his press conference at 0630 GMT.

The Bank of Japan is widely expected to keep its policy rate unchanged at 0.75% while signalling a continued tightening bias. Growth forecasts are likely to be revised higher, reflecting fiscal stimulus and easing external headwinds, while inflation risks remain elevated due to yen weakness and firm wage growth. Attention will centre on Governor Ueda’s guidance, particularly whether he opens the door to an earlier rate hike if the yen slides further. Markets are also alert to any adjustment in bond-purchase tapering to contain rising yields, a move that could weaken the yen and lift equities.

More detailed previews can be found here: