investingLive Americas market news wrap: US PCE inflation runs a tad hot

2026-01-22 21:00:00

Markets:

- Gold up $85 to record $4921

- US 10-year yields flat at 4.25%

- WTI crude oil down $1.28 to $59.34

- S&P 500 up 0.5%

- AUD leads, JPY lags

US economic data was generally dollar-supportive on Thursday but that didn’t lead to a dollar bid. The US dollar instead traded lower as the market remained fixated on geopolitical developments. President Donald Trump announced a framework for a deal regarding Greenland, while on the Russia/Ukraine front, a productive meeting between Trump and Zelensky has set the stage for a trilateral summit with Russia later this week, with US officials arriving today.

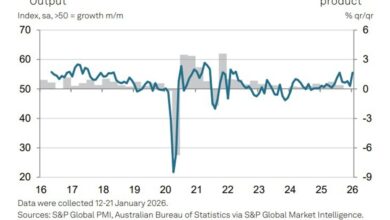

The Antipodean currencies were the top performers of the session, capitalizing on the broader risk-on sentiment and the weaker Greenback. The Australian dollar received an additional boost from a robust overnight employment report, which showed the economy adding more jobs than expected—driven largely by full-time positions—and the unemployment rate falling to 4.1% against a 4.4% forecast. That has the market pricing in a 66% chance of a rate hike in February. This strength saw AUD/USD trade between 0.6754 and 0.6845, finishing at the top end, which is a 15-month high.

In the wider G10 space, the dollar weakened with the notable exception of the Japanese yen. The ten was the clear laggard, pushing USD/JPY to a peak of 158.89 ahead of the Bank of Japan’s rate decision later.

Finally, the pound showed overall strength but navigated a bout of volatility during the European morning. Sterling initially dipped on political reports suggesting UK Labour MP Andrew Gwynne might stand down to make way for Andy Burnham. However, the currency recovered those losses after follow-up reporting highlighted the significant hurdles required for Burnham to return to parliament. The general USD weakness certainly helped to lift it.

In the equity market, the Trump TACO trade was in full force early, with tech leading the way. There were some back and-forth swings but ultimately the S&P 500 finished about where it started after the opening gap. Meta was a big winner, up 5.3%, while Netflix finished down another 2.4% as this week’s earnings report continues to weigh. Tesla rose nearly 4% after finally rolling out a driverless car in Austin.

The big winner once again was the precious metals market as gold quickly rebounded from the Greenland selloff to hit a record $4920 while silver hit $96 for the first time.