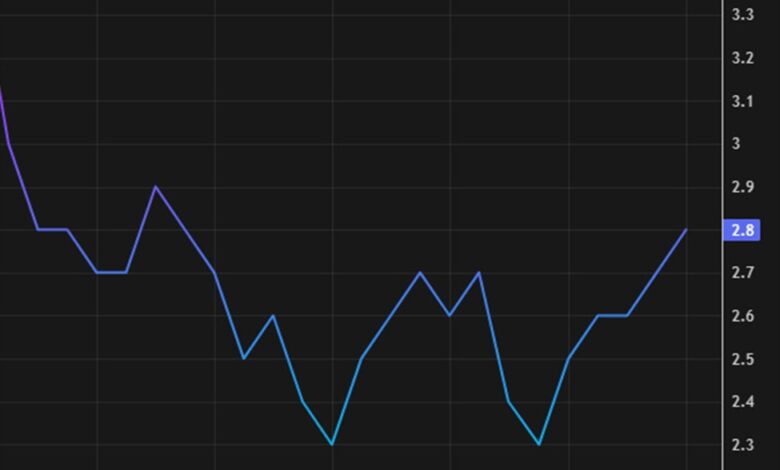

US November PCE inflation 2.8% vs 2.7% expected

2026-01-22 15:01:00

- Prior was +2.8% y/y

- Core PCE 2.8% vs 2.8% expected

- Core m/m +0.2% vs +0.2% exp

- Unrounded core PCE +0.160% was vs +0.274% m/m prior

- Deflator +0.2% m/m vs +0.2% expected

- Unrounded +0.207% vs +0.238% m/m prior

Consumer spending and income for November :

- Personal income +0.3% vs +0.4% expected. Prior month +0.6%

- Personal spending +0.5% vs +0.5% expected. Prior month +0.4%

- Real personal spending +0.3% vs +0.1% prior

- Savings rate 3.5% vs 3.7% prior

This is a messy report because of data collection issues during the government shutdown. That’s forced the statisticians to use CPI data to synthesize some of the numbers

For background:

The Personal Consumption Expenditures (PCE) report is a monthly economic release from the U.S. Bureau of Economic Analysis (BEA) that tracks how much consumers spend on goods and services. It serves as a primary pillar of the U.S. economy, as consumer spending accounts for approximately two-thirds of domestic economic activity.

The report is most famous for its PCE Price Index, which the Federal Reserve considers its “gold standard” for measuring inflation. Unlike the more common Consumer Price Index (CPI), the PCE captures a broader scope of costs, including those paid on behalf of consumers (such as employer-provided healthcare). It also uses a “chain-type” formula that accounts for substitution behavior—if beef prices skyrocket and shoppers switch to chicken, the PCE reflects that shift, whereas the CPI often lags in doing so.

Investors and policymakers watch two versions: “Headline” PCE (or the deflator) and “Core” PCE, which excludes volatile food and energy prices to reveal long-term inflation trends.