Tech sector rallies: Communication services and semiconductors lead the charge

2026-01-22 14:46:00

Highlights of Today’s Market Performance

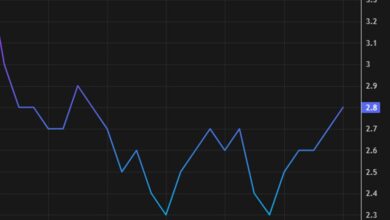

The US stock market is abuzz as technology and communication services sectors dominate the trading landscape, signaling a robust market sentiment. Investors are eyeing opportunities as semiconductor giants and communication services anchor the day’s gains.

📈 Technology and Communication in the Green

- Semiconductors: The semiconductor sector is experiencing a notable uptick, with Broadcom (AVGO) up by 1.78% and NVidia (NVDA) climbing 1.37%. This surge highlights renewed confidence in tech-driven growth.

- Communication Services: Pioneers like Google (GOOG) see a rise of 1.14%, while Meta (META) surges 2.30%, reflecting increasing investor enthusiasm in digital communication platforms.

📉 Mixed Signals Across Sectors

- Consumer Electronics: Despite an overall positive sentiment, Apple (AAPL) shows modest growth at 0.73%, suggesting cautious optimism in consumer tech.

- Industrials: Large-scale industrial entities like General Electric (GE) face headwinds, declining by 3.69%, indicative of broader challenges in traditional sectors.

- Healthcare: Abbott Labs (ABT) is down by 1.03%, representing pressure on medical devices amid contrasting sector dynamics.

🧐 Market Sentiment and Emerging Trends

The overall market sentiment leans positive, supported by developments in technology and digital communications. Investors appear cautiously optimistic, steering funds towards sectors primed for growth while maintaining vigilance due to mixed outcomes in industrial and healthcare segments.

💡 Strategic Recommendations

Given the vigorous performance in tech, investors may consider increasing exposure to promising semiconductor stocks and established digital communication players. Monitoring industrial stocks for signs of recovery could also provide diversification benefits. As always, stay informed with real-time insights at InvestingLive.com for up-to-the-minute market evaluations and strategic analyses. Diversifying across both growth and stable sectors might be a wise approach in navigating today’s complex market dynamics.