Fed seen on hold in January, then cutting twice this year. USD to dip before H2 rebound.

2026-01-20 22:34:00

Wells Fargo sees limited global easing, with early Fed cuts driving near-term USD weakness before a second-half rebound.

Summary:

-

Wells Fargo expects two Fed rate cuts in March and June.

-

Fed funds seen settling at 3.00%–3.25% before an extended hold.

-

USD weakness expected early 2026, followed by H2 recovery.

-

EM currencies likely to underperform during renewed dollar strength.

-

Only Fed, BoE and Norges Bank seen cutting among G10.

Analysts at Wells Fargo expect the Federal Reserve on hold at its January 27-28 meeting but to continue edging policy toward neutral in the first half of 2026, arguing that a still-softening labour market and improving inflation backdrop leave room for further rate cuts before an extended pause.

The bank forecasts two 25bp reductions in the federal funds rate at the March and June meetings of the Federal Open Market Committee, which would take the policy rate to a 3.00%–3.25% range. Wells Fargo characterises labour-market conditions as “modestly on the wrong side of full employment,” while recent inflation prints have been sufficiently encouraging to allow the Fed to continue normalising policy. After mid-year, the bank expects an extended hold as policymakers assess whether inflation continues to move sustainably toward target.

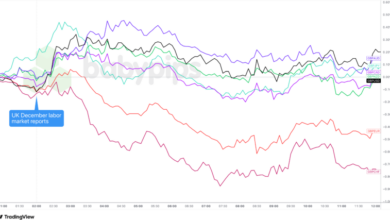

On currencies, Wells Fargo maintains a bifurcated outlook for the US dollar. While the greenback has traded mixed at the start of 2026, the bank expects further downside pressure in the early part of the year, broadly aligned with anticipated Fed easing. However, Wells Fargo sees this weakness as temporary, forecasting a more durable and broad-based dollar recovery beginning in the second half of 2026.

In that environment, the bank expects emerging market currencies to bear the brunt of renewed dollar strength later in the year, underperforming developed market peers as global financial conditions tighten again.

Beyond the US, Wells Fargo argues that scope for monetary easing across G10 economies remains limited. The firm expects only a small group of central banks to cut rates in 2026, reflecting sticky inflation dynamics and constrained policy flexibility. In addition to the Fed, Wells Fargo sees easing from the Bank of England and the Norges Bank, while most other major central banks are expected to remain on hold.

Overall, the outlook points to a front-loaded easing cycle in the US, a temporary dip in the dollar, and a more restrictive global monetary backdrop as 2026 progresses.