Financial & Forex Market Recap – Jan. 20, 2026

Markets sold off sharply on Tuesday as President Trump escalated his Greenland acquisition push with tariff threats against eight NATO allies, triggering a geopolitical crisis that sent investors fleeing U.S. assets on the one-year anniversary of his second inauguration.

Check out the forex news and economic updates you may have missed in the latest trading session!

Forex News Headlines & Data:

- Japan’s 40-year government bond yield hit record 4.21%, 10-year yield reached 2.38% (highest since 1999) as Prime Minister Takaichi called snap election and proposed unfunded food tax cuts

- New Zealand Services NZ PSI for December 2025: 51.5 (48.0 forecast; 46.9 previous)

- Swiss World Economic Forum Annual Meeting

- Germany PPI for December 2025: -0.2% m/m (0.1% m/m forecast; 0.0% m/m previous); -2.5% y/y (-2.1% y/y forecast; -2.3% y/y previous)

-

U.K. Employment Change for November 2025: 82.0k (-25.0k forecast; -16.0k previous)

- U.K. Unemployment Rate for November 2025: 5.1% (5.1% forecast; 5.1% previous)

- U.K. Claimant Count Change for December 2025: 17.9k (20.5k forecast; 20.1k previous)

- Swiss Producer & Import Prices for December 2025: -0.2% m/m (-0.2% m/m forecast; -0.5% m/m previous); -1.8% y/y

- (-1.3% y/y forecast; -1.6% y/y previous)

- Euro area Current Account for November 2025: 12.6B (25.0B forecast; 32.0B previous)

- Germany ZEW Economic Sentiment Index for January 2026: 59.6 (49.0 forecast; 45.8 previous)

- Euro area ZEW Economic Sentiment Index for January 2026: 40.8 (34.0 forecast; 33.7 previous)

- U.S. ADP Employment Change Weekly for December 27, 2025: 8.0k (11.75k previous)

- New Zealand Global Dairy Trade Price Index for January 20, 2026: 1.5% (6.3% previous)

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Tuesday’s session delivered a stark risk-off tone as President Trump’s escalating tariff threats against NATO allies over Greenland sparked the sharpest transatlantic crisis in generations, sending U.S. equities tumbling while safe-haven gold surged to record highs.

The S&P 500 suffered significant losses, declining 1.01% to close around 6,803, extending its 2026 losses to 0.7%. The index opened with mild weakness during Asian hours before accelerating lower then bouncing during the morning London session, ultimately breaching key support levels during U.S. trading as the full implications of Trump’s weekend tariff announcement reverberated through markets. The selloff appeared to reflect concerns about a potential trade war with major European economies, with investors questioning the economic consequences of disrupting relationships with allies that collectively represent over $10 trillion in U.S. asset holdings. Technology shares led the decline, with the Nasdaq falling deeper into negative territory for the year.

Gold emerged as the session’s strongest performer, rallying 1.91% to close near $4,760 per ounce—a fresh all-time high. The precious metal climbed steadily from Asian trading through the U.S. close, reflecting its traditional safe-haven role during periods of geopolitical uncertainty. The rally likely correlated with multiple factors: Trump’s unprecedented tariff threats against NATO allies, European officials’ warnings of a “dangerous downward spiral” in transatlantic relations, and reports that Danish pension funds were already beginning to divest from U.S. Treasury securities in response to the Greenland dispute. With silver also surging more than 7% to record highs, the precious metals complex demonstrated clear demand for non-dollar stores of value.

Bitcoin extended recent weakness, falling 3.88% to trade near $89,484, breaching the psychologically important $90,000 level and triggering over $750 million in forced liquidations within a four-hour window. The cryptocurrency declined steadily throughout the session with no direct crypto-specific catalysts, but its sharp underperformance relative to traditional safe havens like gold highlighted its continued categorization as a high-beta risk asset rather than “digital gold.” The 30-day rolling correlation between Bitcoin and the Nasdaq 100 reportedly hit 0.80—the highest level in nearly four years—suggesting that during periods of extreme geopolitical stress, Bitcoin moves in lockstep with speculative tech stocks rather than providing portfolio diversification.

Treasury yields climbed 0.85% to settle around 4.30%, with the 10-year note rising throughout the session despite the equity selloff. The counterintuitive move—bonds typically rally when stocks fall—reflected a combination of factors that sparked a global bond market rout. U.S. Treasuries opened sharply lower as contagion spread from Japan’s $7.6 trillion bond market, which experienced what market participants described as its most chaotic session in recent memory.

Japanese government bond yields surged to record highs, with the 40-year JGB climbing 29 basis points to breach 4% for the first time and the 10-year yield reaching 2.38%—the highest level since 1999. The Japanese selloff was triggered by Prime Minister Sanae Takaichi’s call for a snap election and her proposal for food tax cuts without clear funding mechanisms, raising concerns about fiscal sustainability in one of the world’s most debt-burdened nations. The spillover to global bond markets occurred through multiple channels: reduced Japanese demand for foreign bonds as domestic yields became more attractive, unwinding of carry trades that had borrowed in low-yield yen to invest in higher-yielding assets, and a broader repricing of term premiums as markets reassessed fiscal credibility across heavily indebted nations. Treasury yields were pushed even higher after a Danish pension fund announced it would divest its U.S. government debt holdings by month-end in response to Trump’s Greenland threats, though the fund’s $100 million position was largely symbolic against the $30 trillion Treasury market. The 30-year Treasury yield briefly touched 4.95%—approaching the psychologically important 5% threshold—before stabilizing as traders assessed the magnitude of potential European retaliation.

WTI crude oil posted modest gains of 0.24% to close near $59.37 per barrel, trading in a relatively narrow range throughout the session. The muted price action came despite heightened geopolitical tensions, possibly reflecting offsetting forces of safe-haven demand versus concerns about potential demand destruction if a U.S.-Europe trade war materializes. Oil had rallied sharply in recent sessions on Trump’s Venezuela policy actions but consolidated those gains on Tuesday.

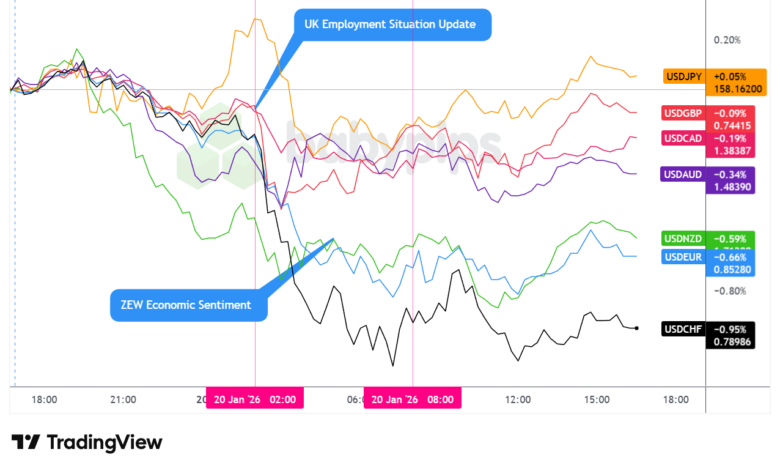

FX Market Behavior: U.S. Dollar vs. Majors

During the Asian session, the dollar bounced modestly at the open before turning decisively lower through the morning hours. New Zealand data provided early support to the kiwi, with both the Composite PMI and Services PMI surprising significantly to the upside and crossing back into expansion territory. The dollar’s weakness accelerated as Asian traders digested the full implications of Trump’s weekend tariff announcement against eight NATO allies, with the unprecedented nature of threatening major European economies apparently weighing on dollar sentiment. By the time London opened, the greenback had established a clear bearish trajectory.

The London session saw the dollar continue its descent through the European morning before finding a floor a few hours later, after which it stabilized and traded mostly sideways and choppy for the remainder of the session. The UK employment report showed a surprising increase of 82,000 jobs versus expectations of a 25,000 decline, while wage growth remained elevated at 4.7% including bonuses, though sterling’s reaction was relatively muted as traders appeared to view the data as backward-looking.

Germany’s ZEW Economic Sentiment Index posted a strong beat at 59.6 versus 49.0 expected, providing some support to the euro. However, the dollar’s stabilization following its earlier decline appeared driven more by technical factors and a pause in selling momentum rather than any fundamental shift in sentiment. European officials’ increasingly forceful responses to the Greenland dispute—including warnings of retaliatory tariffs and references to deploying the EU’s “Anti-Coercion Instrument”—possibly kept pressure on the greenback even as it traded range-bound.

The U.S. session saw slight renewed bearish pressure at the open before the dollar rebounded into the close. The Supreme Court issued three rulings but notably did not decide the closely watched dispute over Trump’s tariffs, dashing hopes for a quick rollback and potentially reinforcing his ability to implement the threatened Greenland tariffs. The late-session rebound appeared to correlate with this development, though the dollar’s inability to fully recover earlier losses underscored the “Sell America” theme.

At Tuesday’s close, the dollar emerged as one of the worst-performing major currencies, posting net losses against nearly all its peers and gaining only against the Japanese yen (+0.05%). The dollar showed significant weakness versus the Swiss franc (-0.95%), the euro (-0.66%), the New Zealand dollar (-0.59%), and the Australian dollar (-0.34%).

Upcoming Potential Catalysts on the Economic Calendar

- Australia Westpac Leading Index MoM for December 2025 at 12:00 am GMT

- Swiss World Economic Forum Annual Meeting

- U.K. Inflation updates for December 2025 at 7:00 am GMT

- ECB President Lagarde Speech at 7:30 am GMT

- U.K. CBI Business Optimism Index for March 31, 2026 at 11:00 am GMT

- U.K. CBI Industrial Trends Orders for January 2026 at 11:00 am GMT

- U.S. MBA 30-Year Mortgage Rate & Applications for January 16, 2026 at 12:00 pm GMT

- Canada Raw Materials & Industrial PPI for December 2025 at 1:30 pm GMT

- Bank of England Woods Speech at 2:15 pm GMT

- U.S. Construction Spending for October 2025 at 3:00 pm GMT

- U.S. Pending Home Sales for December 2025 at 3:00 pm GMT

- ECB President Lagarde Speech at 4:45 pm GMT

Wednesday’s calendar features critical UK inflation data at 7:00 am GMT that could influence Bank of England policy expectations, particularly following Tuesday’s stronger-than-expected employment and wage growth figures. ECB President Lagarde delivers speeches both before and after U.S. trading hours, with markets watching closely for any commentary on the escalating trade tensions with the United States and their potential impact on European growth.

The World Economic Forum in Davos continues, with President Trump scheduled to attend and meet with European leaders who are reportedly furious over his Greenland acquisition push and tariff threats. Any developments from these meetings could generate significant market volatility, particularly if Trump provides clarity on his willingness to follow through with the threatened February 1 tariff implementation or if European officials announce concrete retaliatory measures.

Markets remain highly sensitive to any escalation or de-escalation in the transatlantic dispute, with the unprecedented nature of tariff threats against NATO allies creating uncertainty about traditional alliance structures and trade relationships that have underpinned the post-World War II economic order.

If you’re SERIOUS about your growth, trade journaling is the best way to track, measure and manage your performance AND psychology! Check out TradeZella, the #1 AI-powered journal and backtester to help you trade like a pro. BabyPips Premium Annual Members get an exclusive 30% discount on the annual TradeZella subscription for the first year ($120 in savings)! Click here for more info!