Blue Monday isn’t so gloomy for natural gas traders

2026-01-19 20:11:00

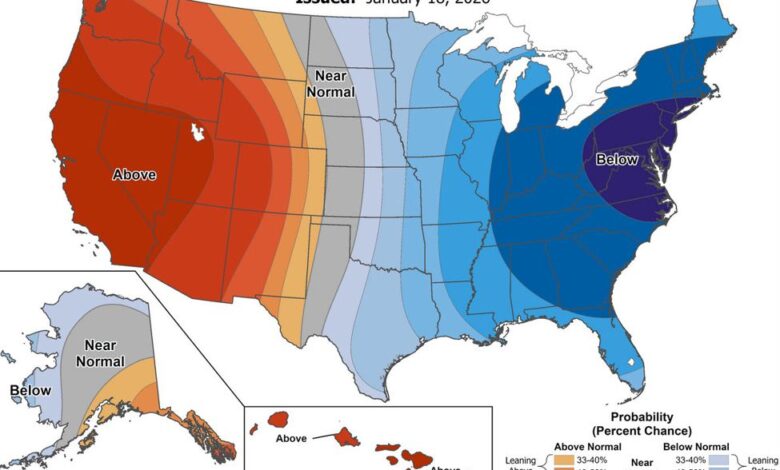

It’s been a rough start to the year for natural gas as prices have fallen back to October levels but help is on the way with a cold forecast for the eastern USA.

That has February natural gas up 15% today, through only to a one-week high. The strong start to the gas withdrawal season has been curbed by higher production, leading to prices fall below $4 for February gas and below $3 from March through May.

In the next three years there is slate to be a large jump in demand due to US LNG facilities coming online but there are fresh questions about whether that will materially tighten the market or be met with more-intense pumping.

The good news for gas is that low oil prices make some oil-weighted wells less economical and that could dampen supply and drilling budgets for 2026, particularly with gas prices depressed once again.

Today is so-called ‘blue Monday’, which is fake ‘day’ but is supposed to be most-depressing day of the year. It’s certainly a cold one where I am in Canada and those cold long-range forecasts don’t help.

Natural gas daily

In the bigger picture, Europe is suddenly worried about the supply of natural gas from the United States being weaponized in the same way that Russia used its gas exports. That event caused a near-existential crisis in Europe and this one would be doubly so.

Eyes will be on Davos this week as Trump travels to Europe and will meet with European counterparts. The stakes certainly got raised and broader markets are concerned. It’s a US holiday but S&P 500 futures are down 0.9% to start the week and gold hit another fresh record high. The US dollar is under pressure as the market grows concerned about a fresh EU-US trade war.