Bitcoin $92K Drop Resets Leverage, Clears Unhealthy Investor Optimism

Bitcoin (BTC) saw a sharp pullback during the Asian market open, shaking out leveraged positions without breaking its market structure. While sentiment cooled rapidly, onchain and derivatives data suggest that the move resembles a structural reset rather than a deeper trend reversal.

Key takeaways:

$233 million in Bitcoin long liquidations flushed leverage while spot selling stayed muted, pointing to a reset, not panic distribution.

Sentiment collapsed from 80% to 45% as open interest fell to $28 billion, confirming a mild risk-off unwinding.

Bitcoin dip flushes leverage as sentiment cools

Bitcoin slid from $95,300 to $91,800, a 3.7% drop, during the Asian market open on Monday, triggering roughly $233 million in long liquidations over the past 24 hours. The move followed a period of elevated bullish positioning, leaving the market open for a downside sweep.

Bitcoin researcher Axel Adler Jr. noted that Bitcoin’s Advanced Sentiment Index fell sharply from 80% to 44.9%. The index, which integrates volume-weighted average price (VWAP), net taker volume, open interest, and volume delta, had reached extreme bullish levels between Jan. 13 to 15, aligning with a local high near $97,000.

The drop below the neutral 50% threshold signals a shift toward weaker risk conditions. According to Adler, price stabilization would require a sustained recovery above 50%, while a further slide toward the 20% zone could increase the odds of a deeper correction.

BTC open interest also declined back to its yearly opening levels near $28 billion. This suggests that leveraged positions were unwound rather than new shorts aggressively entering the market. Aggregated futures cumulative volume delta (CVD) remained slightly elevated relative to open interest, while spot CVD stayed flat, indicating limited spot-driven selling pressure.

Related: Bitcoin futures OI rebounds 13% as analysts see cautious return of risk appetite

Will traders cut and run, or buy the dip?

From a technical standpoint, Bitcoin continues to print higher highs and higher lows on the daily chart. The $92,000 to $93,000 region aligns with a daily order block demand zone and a retest of the rolling monthly VWAP support, making it a plausible higher-low area before another upside attempt toward $100,000.

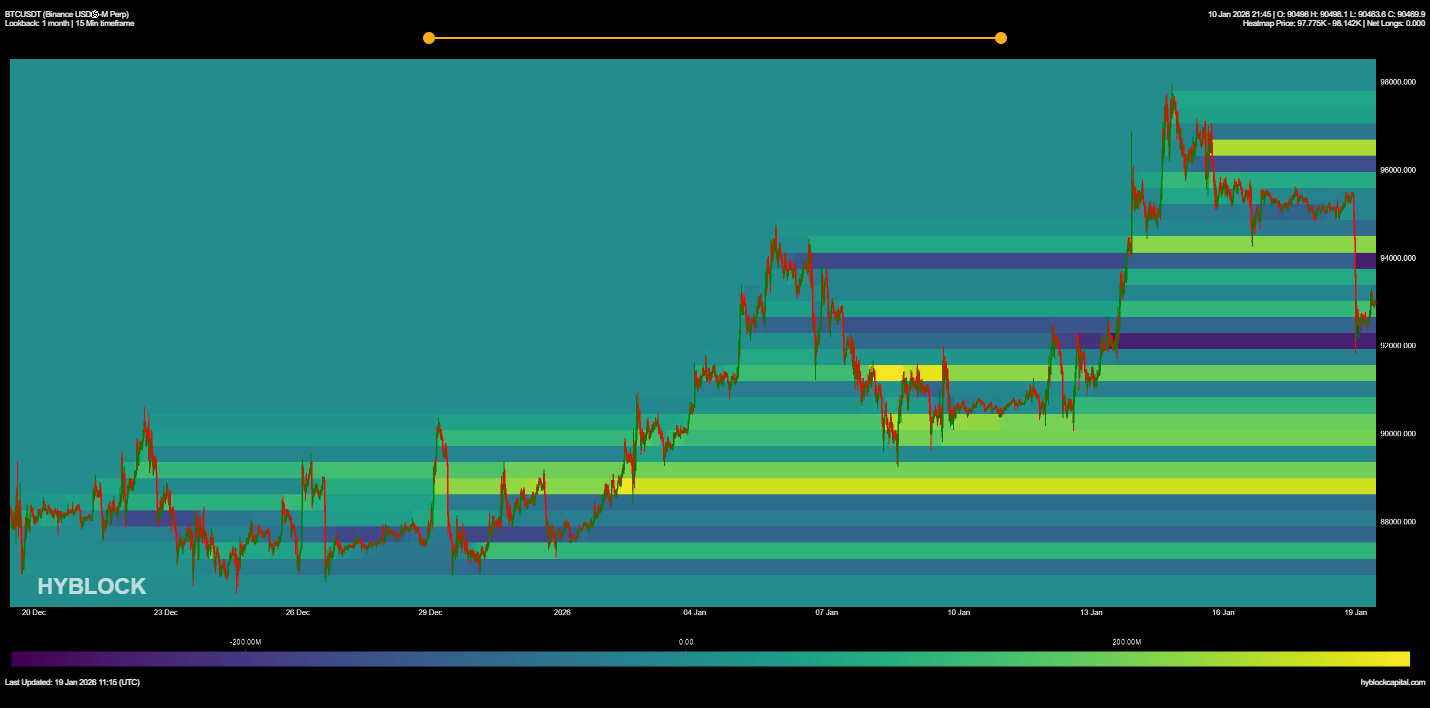

Hyblock Capital data also shows that around $250 million in net long positions were filled near $92,000 over the past day, suggesting dip demand rather than capitulation.

In the near term, price action may round out within this order block range, provided Bitcoin holds above $90,000. With US equity markets closed on Monday, clearer directional pressure may emerge on Tuesday, potentially allowing bulls to reassert control.

Related: BTC vs. new $80K ‘liquidity grab’: 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.