Revolut Seeks Peru Banking License Amid Latin America Expansion

Revolut, a London-based digital banking and payments company, has applied for a full banking license in Peru as part of its expansion across Latin America, Bloomberg reported on Monday.

If approved, the license will allow the company to operate as a regulated bank in the country, adding Peru to a list of regional markets alongside Mexico, Colombia and Brazil. Bloomberg said Revolut plans to compete primarily with incumbent banks rather than newer fintech rivals.

Revolut has identified remittances and cross-border payments as key parts of its local strategy, noting that about 1 million people in Peru rely on money sent from abroad.

According to World Bank data, personal remittances to Peru totaled $4.93 billion in 2024. Julien Labrot, Revolut’s Peru CEO, said the expansion is aimed at increasing competition and improving access to financial services in the local market.

Revolut, a neobank founded in 2015, has recently expanded its crypto offerings alongside broader growth across its platform. In April 2025, the company reported a record year, with 2024 net profit increasing 130% to 790 million pounds ($1.06 million) year-on-year, fueled by strong customer growth and a rebound in cryptocurrency trading activity.

In October 2025 Revolut introduced 1:1 USD conversion for stablecoins, allowing users to exchange dollars for USDC (USDC) and USDt (USDT).

Stablecoin payment volumes on Revolut’s platform were estimated to have climbed 156% year-on-year in 2025 to about $10.5 billion, according to an independent analysis by researcher Alex Obchakevich.

Related: Trust Wallet taps Revolut for crypto purchases in Europe

Latin American fintechs push deeper into stablecoins

Revolut’s stablecoin push reflects a broader trend among fintech companies moving into stablecoins and crypto-based services across Latin America.

In August 2024, Mercado Libre launched a US dollar–pegged stablecoin in Brazil through its financial services arm, Mercado Pago. The token, called Meli Dollar, is available for trading within the Mercado Pago app in Brazil, the company’s largest market.

Nubank, Latin America’s largest digital bank, is also developing dollar-pegged stablecoin payments tied to its credit card products.

In Argentina, crypto wallet and payments company Lemon raised $20 million in a Series B funding round in October to fund its expansion across the region. The company already operates in Peru, where it says it has issued more than 1 million wallets in less than a year.

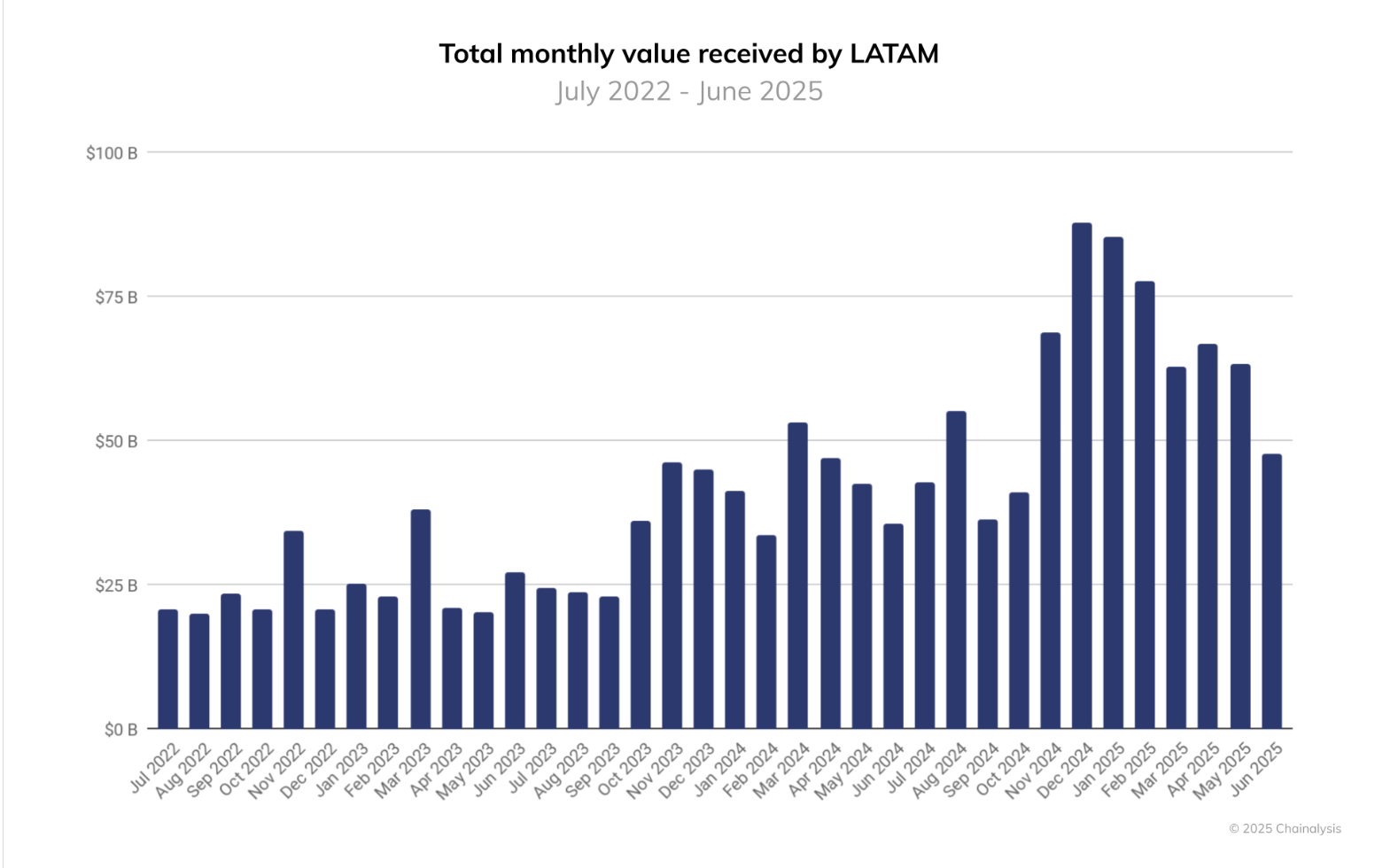

According to a report published by Chainalysis, Latin America generated almost $1.5 trillion in cryptocurrency transaction volume from July 2022 to June 2025.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi