Premium Watchlist Recap: U.S. CPI (December 2025)

The U.S. Consumer Price Index for December came in with a softer-than-expected core reading, briefly sparking dovish Fed expectations before geopolitical tensions and tariff concerns reasserted dollar strength through safe-haven flows.

Which USD strategies moved beyond the watchlist stage, and how did shifting overall market sentiment impact the outcomes?

Watchlists are price outlook & strategy discussions supported by both fundamental & technical analysis, a crucial step towards creating a high-quality discretionary trade idea before working on a risk & trade management plan.

If you’d like to follow our “Watchlist” picks right when they are published throughout the week, check out our BabyPips Premium subscribe page to learn more!

We’re breaking down our dollar setups this week and examining how each pair performed after the mixed CPI release while markets navigated Fed independence concerns, Japan’s snap election speculation, and escalating U.S.-Iran tensions.

The Setup

What We Were Watching: U.S. CPI (December 2025)

- Expectation: Headline CPI: +0.2% m/m expected, +2.6% y/y expected, Core CPI: +0.2% m/m expected, +2.6% y/y expected

- Data outcome: Headline CPI: +0.3% m/m (matched expectations), +2.7% y/y (matched expectations), Core CPI: +0.2% m/m (below 0.3% consensus), +2.6% y/y (below 2.7% expectations)

- Market environment surrounding the event: Slightly negative risk sentiment dominated by political pressure on Fed Chair Powell following DOJ subpoena disclosures, Japanese snap election speculation triggering sustained yen weakness, President Trump’s 25% tariff threats on Iran’s trading partners, and de-escalating then re-escalating U.S.-Iran military tensions.

Event Outcome

Headline CPI slowed from 3.8% year-on-year in October to just 3.4% in November, as both goods and services inflation moderated. Trimmed mean inflation also eased, although housing costs continued to exert strong upward pressure.

Key Takeaways:

- Headline inflation held steady at 2.7% year-over-year, matching November’s rate and meeting economist expectations, with monthly prices rising 0.3%

- Core inflation came in at 2.6% annually, slightly below the 2.7% forecast and marking the lowest level since early 2021, with monthly core prices rising just 0.2% versus 0.3% consensus

- Food prices jumped 3.1% annually and 0.7% monthly—the highest monthly gain since 2022, with ground beef up 15.5% and coffee surging 19.8% year-over-year

- Shelter costs rose 3.2% year-over-year, accounting for the largest single factor in the monthly increase, with rent and homeowner costs both climbing 0.4% in December

- Energy prices moderated to +2.3% annually from 4.2% the previous month, with gasoline prices falling 3.4% year-over-year and dropping 0.5% for the month

- Egg prices plummeted 20.9% from a year ago as avian flu supply disruptions eased

USD initially weakened on the softer core reading as traders increased expectations for Fed rate cuts in 2026. However, the dollar reversed course within an hour and strengthened through the afternoon session, ultimately closing higher against all major currencies.

The turnaround appeared driven by President Trump’s Monday evening announcement of 25% tariffs on countries conducting business with Iran, which sparked fresh geopolitical uncertainty and triggered safe-haven flows into the dollar despite the inflation data’s dovish implications.

Fundamental Bias Triggered: Bearish USD setups

Broad Market and Exogenous Drivers:

Fed Independence Crisis (Monday): Markets opened the week digesting Fed Chair Jerome Powell’s rare weekend disclosure that the Justice Department had issued grand jury subpoenas tied to his congressional testimony. The political pressure rattled confidence in Fed independence, triggering early dollar weakness. Gold jumped on safe haven demand before paring gains, while the dollar stayed on the back foot through the overnight session.

Japan Snap Election Speculation (Monday to Wednesday): The yen ended up as the weakest major currency of the week despite softer dollar conditions. Talk that Prime Minister Takaichi could call a snap election in early February fueled expectations for heavier fiscal spending and looser policy, overpowering repeated intervention warnings from Tokyo. USD/JPY pushed above 159.00, while EUR/JPY, GBP/JPY, and CHF/JPY all printed fresh multi-year or record highs.

Iran Tariff Escalation (Tuesday to Wednesday): President Trump’s announcement of 25% tariffs on countries doing business with Iran lifted the dollar and sent WTI crude up to $60.80 on supply risk fears. That move reversed quickly after Trump softened his tone on Tuesday afternoon, knocking oil lower and draining the geopolitical risk premium.

Geopolitical De-escalation (Wednesday to Thursday): Midweek brought a sharp reversal as U.S.-Iran tensions eased and stronger intervention rhetoric from Japanese officials sparked yen buying. Risk appetite improved Thursday after Trump said the killing had stopped, though hawkish Fed signals and BOJ rate hike chatter kept currency moves contained.

Mixed U.S. Data & Fed Chair Speculation (Wednesday-Friday): U.S. data through midweek leaned firm, with retail sales beating expectations and inflation and labor indicators coming in hotter than forecast, reinforcing a resilient growth narrative. The dollar briefly slipped Friday after fresh tariff threats but quickly rebounded when Trump signaled he would keep Kevin Hassett at the National Economic Council, boosting speculation that Kevin Warsh could emerge as the next Fed Chair.

USD/JPY: Bearish USD Event Outcome + Risk-Off Scenario = Arguably good odds of a net positive outcome

USD/JPY 1-hour Forex Chart by TradingView

Our bearish USD/JPY watchlist anticipated that a cooler CPI could push markets toward a more aggressive Fed rate cut path, and if broad sentiment was net negative, drive safe haven flows into the yen, and pull the pair toward the 157.20–157.60 Fibonacci zone or even 156.50–157.00 support.

Core CPI came in softer than expected at 0.2% m/m versus 0.3% expected, validating the bearish USD thesis. The initial dollar dip was brief, though, as geopolitical headlines took over. Japan snap election speculation triggered aggressive yen selling, sending USD/JPY to 159.45, well above our preferred levels, as markets priced in delayed BOJ normalization under a potential Takaichi victory.

The reversal came on Wednesday afternoon. Rising U.S.–Iran tensions and stronger jawboning from Tokyo officials, including Finance Minister Katayama calling yen weakness unjustified and flagging intervention risk, sparked sharp yen buying. USD/JPY looked like it was headed to our 157.20–157.60 trigger zone.

We stayed patient ahead of PPI. The data largely matched expectations, with a flat core reading reinforcing the view that CPI was not a one-off dovish miss. With our technical bias playing out and fundamentals aligned, the setup moved beyond the watchlist stage.

Follow through, however, is not as simple. Competing narratives around Fed independence, geopolitical swings, and BOJ intervention threats kept price action choppy, highlighting how execution and risk management matter even when a setup checks every box. USD/JPY capped the week just above 158.00 despite speculations of a dovish replacement for Fed Chair Powell and Trump’s fresh tariff threats on European goods.

Not Eligible to Move Beyond Watchlist – AUD/USD & Bullish USD Setups

AUD/USD: Bearish USD Event Outcome + Risk-On Scenario

AUD/USD 1-hour Forex Chart by TradingView

Our bearish AUD/USD watchlist setup flagged the pair trading near .6700, with resistance around .6725 and higher inflection points in the .6770 to .6800 area. The idea was that a softer CPI print, combined with a risk-off backdrop, could eventually weigh on the Aussie amid China growth worries, softer gold, and defensive USD positioning.

Core CPI did come in softer, briefly pressuring the dollar and lifting AUD/USD toward .6725. That move ran against the setup, as the CPI surprise triggered risk-on flows instead of the risk-off environment we were looking for.

The rest of the week saw AUD/USD hold in a 20 – 40 pip range. Stronger Chinese data, easing geopolitical tensions, and upbeat global data kept risk appetite firm. From a technical standpoint, AUD/USD held above .6670 and never delivered a bearish breakdown, leaving the setup on the watchlist and untriggered.

USD/JPY: Bullish USD Event Outcome + Risk-On Scenario

USD/JPY 1-hour Forex Chart by TradingView

Our bullish USD/JPY setup eyed a possible bounce off the retracement levels should the U.S. CPI report briefly take the pair down to the pullback area, projecting that the uptrend could resume in the succeeding trading sessions while markets position for a more hawkish Fed.

However, the actual results revealed softer core inflationary pressures, invalidating the idea as the pair failed to hold above the 38.2% Fib and 158.00 support level and instead edged lower throughout the week.

Although Japanese snap elections jitters put the yen on the back foot midweek and likely spurred a USD/JPY rally to 158.85, profit-taking soon erased its gains while traders turned their attention to Fed political pressures, tariffs drama, and yen jawboning. Eventually, price resumed its bearish trajectory to dip close to the 50% Fib at 157.76 by week’s end.

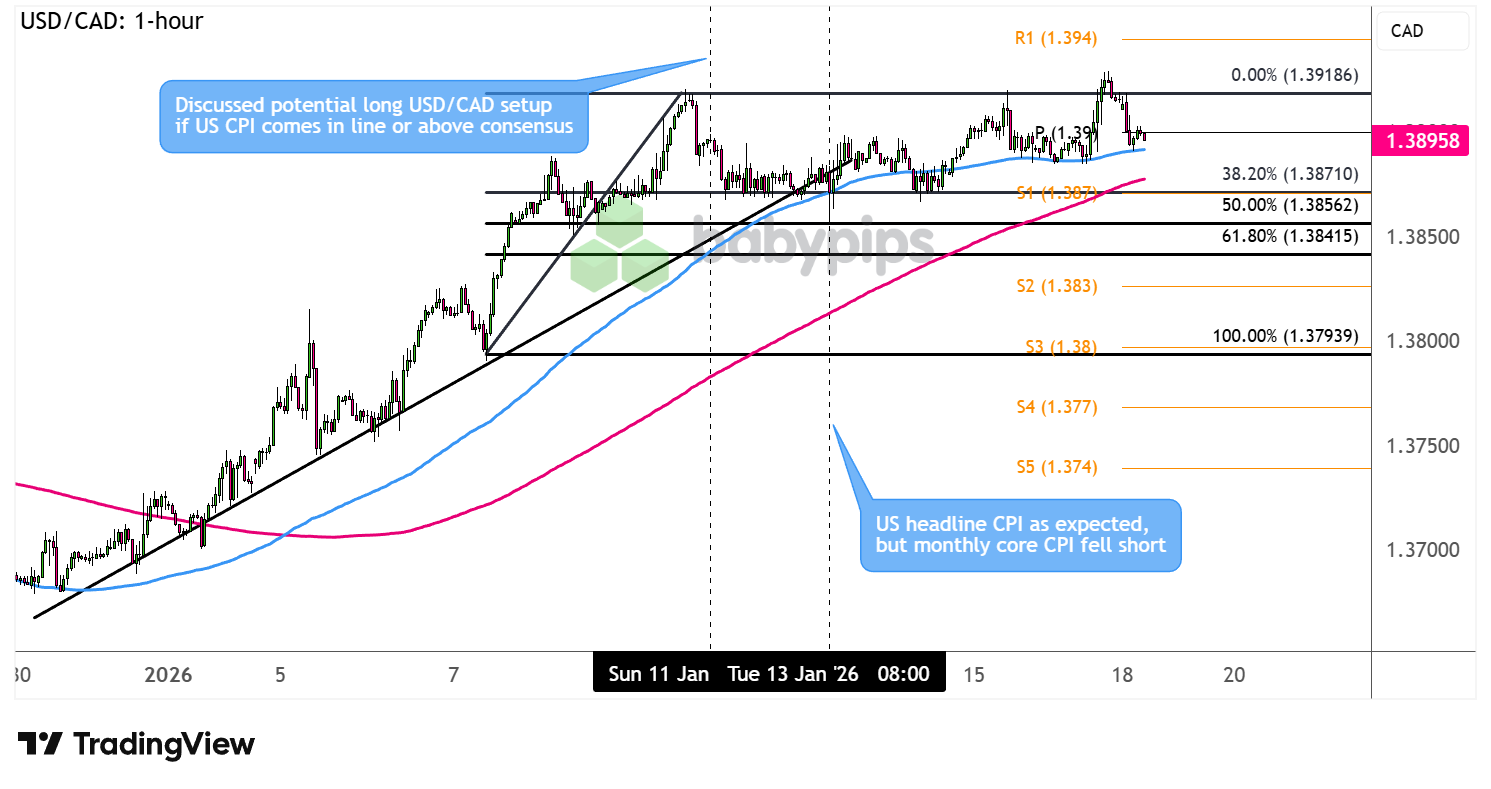

USD/CAD: Bullish USD Event Outcome + Risk-Off Scenario

USD/CAD 1-hour Forex Chart by TradingView

Our bullish USD/CAD setup eyed a short-term rising trend line that could hold as support in the event the U.S. CPI comes in line with expectations or higher. The actual results reflected weaker core inflation, rendering this idea not viable to move beyond the watchlist stage.

In addition, the oil-related Loonie likely received some fundamental support from Iran geopolitical tensions midweek on Trump’s tariffs threats, reviving supply fears for the energy commodity. These pulled USD/CAD to the target entry area around the 38.2% Fib, which did hold as support when safe-haven flows moved in favor of the dollar during the back half of the week to test its intraweek high.

The Verdict

The U.S. December CPI release delivered a softer-than-expected core reading (0.2% monthly versus 0.3% consensus), validating a bearish USD fundamental bias and triggering initial dollar weakness as traders repriced for more aggressive Fed rate cuts in 2026.

However, this dovish inflation surprise proved almost irrelevant to the week’s dominant price action, as geopolitical developments, Japan’s political crisis, and commodity market volatility completely overwhelmed the scheduled data narrative.

The softer core CPI reading validated our bearish USD fundamental bias but failed to produce sustained dollar weakness because counter-currency factors, particularly Japan’s snap election speculation and the resulting historic yen weakness, created such powerful cross-currents that traditional CPI reactions couldn’t take hold.

USD/JPY emerged as the week’s focus pair and the only setup to arguably move beyond the watchlist stage, though through a path more complex than our initial framework anticipated. The pair initially rallied to 159.45 despite the softer core CPI as Japan’s election uncertainty dominated, before Wednesday afternoon’s intervention warnings from Tokyo officials and escalating U.S.-Iran tensions drove sharp yen buying.

The bearish AUD/USD setup failed to materialize because the softer CPI triggered risk-on rather than risk-off flows, with better-than-expected Chinese data and de-escalating geopolitical tensions supporting the Aussie throughout most of the week.

Interestingly, the bullish USD setups that were invalidated by the CPI miss provided more valuable strategic insights than our technically-correct bearish bias. USD/JPY’s resilience above technical support despite dovish U.S. inflation demonstrated that counter-currency political crises can completely dominate scheduled economic data.

USD/CAD’s ability to hold its ascending trend line and reach 1.3918 despite the softer CPI showed that oil market volatility and Canadian data disappointments can validate technical structures even when the primary U.S. catalyst doesn’t cooperate.

Overall, we rate the watchlist discussion as “neutral-to-unlikely” supportive of a potential positive outcome. While we correctly identified the softer core CPI outcome and its dovish implications for Fed policy, the anticipated market reaction never fully materialized because we underestimated how completely counter-currency factors would dominate the week’s narrative. The bearish USD/JPY setup never reached trigger levels, and the bearish AUD/USD setup was invalidated by risk-on flows responding to the same data that should have supported our thesis.

The week delivered a critical lesson about the hierarchy of market drivers: when counter-currency political crises (Japan election), geopolitical commodity shocks (Iran-related oil volatility), or major cross-regional data surprises (Chinese trade, UK GDP) emerge during a scheduled event week, they can render even accurate data forecasts strategically irrelevant.

Traders who anchored exclusively to the CPI outcome missed that Japan’s snap election speculation, Trump’s shifting Iran rhetoric, and Wednesday-Thursday’s follow-up U.S. data (strong retail sales, surprise manufacturing surveys) would prove far more influential in determining dollar pair direction than Tuesday’s inflation print.

Key Takeaways:

Geopolitical and Political Developments Can Overwhelm Economic Data

December’s softer core CPI should have fueled dovish Fed repricing and dollar weakness, but political and geopolitical headlines took over. Japan’s snap election chatter, Powell’s DOJ drama, and Trump’s Iran rhetoric dominated attention, pushing inflation data into the background.

Currency-Specific Factors Create Asymmetric Opportunities

USD/JPY staying bid and reaching 159.45 despite softer CPI and intervention warnings showed how Japan’s political turmoil overwhelmed everything else. Yen weakness driven by election uncertainty and delayed BOJ normalization mattered far more than a 0.1% CPI miss.

Countercurrency Headlines Can Outweigh U.S. Event Outcomes

While CPI was the scheduled catalyst, Japan-focused headlines ultimately dictated USD/JPY direction all week. Broad yen weakness across crosses highlighted how counter currency developments can overpower U.S. data entirely.

Data Heavy Weeks Require Multiple Scenario Planning

Markets initially reacted to softer CPI, but stronger retail sales and manufacturing data later in the week shifted the narrative back toward economic resilience. In busy data weeks, price action reflects the full data mix, not just the first release.

Safe Haven Dynamics Are Not Uniform Across Currencies

Geopolitical risk supported the dollar but failed to lift the yen due to Japan’s domestic instability. Safe haven flows depend on local policy credibility and political clarity, not just global risk sentiment.

Disclaimer: The forex analysis content provided in Babypips.com is intended solely for informational purposes only. The technical and fundamental scenarios discussed are presented to highlight and educate on how to spot potential market opportunities that may warrant further independent research and due diligence. This content shows how we cover a portion of the full trading process, and does not constitute that we ever give specific investment or trading advice. The setups and analyses presented on Babypips.com are very likely not suitable for all portfolios or trading styles.

Trade and risk management are the sole responsibility of each individual trader. All trading decisions and their subsequent outcomes are the exclusive responsibility of the individual making them. Please trade responsibly.

Trading responsibly means knowing as much as you can about a market before you think about taking on risk, and if you think this kind of content can help you with that, check out our BabyPips Premium subscribe page to learn more!